Brightline, Florida's privately owned passenger train system, has begun remarketing $950 million of nonrated, short-term, tax exempt private activity bonds into long-term debt.

The Florida Development Finance Corp. is the conduit issuer of the remarketing, which launched late Monday.

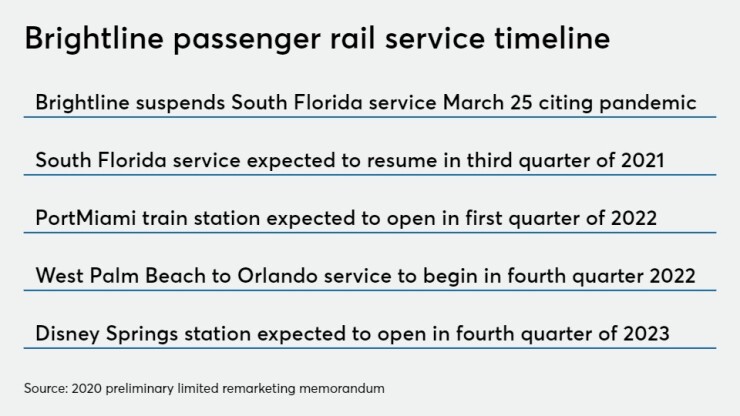

Brightline began operating trains on 75 miles from Miami to West Palm Beach in 2018, but shuttered service in March citing COVID-19 and hasn't carried a passenger since.

The bonds

The conversion of the short-term paper into long-term debt will release the escrowed securities for the company to use the net proceeds to finance and refinance costs of completing the project from Miami to Orlando, according to the preliminary limited remarketing memorandum.

The new unrated bonds, tax-exempt but subject to the alternative minimum tax, have a green designation and final maturity in 2049. They are only being sold to qualified institutional investors under Rule 144A and accredited investors under Rule 501(a) of the Securities Act. They will retain their designation as 2019B bonds.

A key assumption underpinning the company's current financial projections is that service between Miami and West Palm Beach will resume in the third quarter of 2021, with operations stabilizing in 2022, the remarketing memorandum said.

An extension of service from West Palm Beach to Orlando, construction of which is underway, is expected to begin operating in the fourth quarter of 2022. The company is also working on new revenue-generating projects.

Suspending service on the commuter-rail-length segment between West Palm Beach and Miami spared Brightline operating losses it was incurring before the pandemic. Its ultimate success or failure will hinge on whether it can compete for long-distance travel between Orlando and South Florida.

"We continue to build on the success of our Florida system including new stations and marked progress on our construction to Orlando," said Brightline spokesman Ben Porritt. "Investors and guests are excited about high speed rail in America and the environmental and economic benefits it provides."

Brightline's trains are expected to top out at 125 mph, short of the commonly accepted definition of high-speed rail but much faster than traditional U.S. passenger train service.

Brightline

“Like all businesses, we are operating in a period of uncertainty which may last several months," President Patrick Goddard said at the time. "Although a difficult decision, we have decided to temporarily suspend Brightline service in the best interest of the entire South Florida community as we all seek to flatten the curve."

Goddard, who was referring to containing the spike in COVID-19 cases, also said the company was taking proactive measures with its construction teams to keep people employed and continue construction between Orlando and West Palm Beach.

At the time train service ceased in March, the Florida Health Department reported that there were 1,289 positive cases of the virus, and 28 deaths. On Tuesday, the health department reported the grim news that more than 1 million people in Florida had been infected, and 18,916 had died.

Municipal bond analyst Joseph Krist, who has previously commented on investing in Brightline's Florida project, said without reviewing the current bond documents that the return to pre-pandemic travel levels is off in the distance for tourism especially.

"With every step the Florida Brightline is more clearly tourist-dependent," Krist said Tuesday. "The timeline for recovery will obviously reflect the state of vaccine availability, acceptance, and utilization and the state of the pandemic moving forward."

The next two weeks will reveal "how bad Thanksgiving was as a source of (COVID-19) spread," Krist said.

"If the worst fears are realized, travel will be down for a lot longer and all bets will be off," he said. "Having said that, this [Brightline] credit has always been about how long and at what level will the venture investors behind the deal continue to support it.

"It wouldn't be the first high-yield credit to be unable as an enterprise to support its debt that ultimately relied on a sponsor and/or equity owner to be willing to subsidize debt service," he said. "That's what an investor ultimately has to get comfortable with."

The remarketing memorandum says the company is continuing to assess and update its business continuity plan in the context of the pandemic, including when it believes is the best time to resume service.

While service has been suspended, Brightline officials have continued developing additional stations in Aventura, Boca Raton and PortMiami in South Florida; entered a shared commuter rail corridor agreement with Miami-Dade County; and advanced work on a station at Walt Disney World, according to a

The report said the new projects are expected to be "highly accretive to our ridership and revenue, generating an estimated 3 million incremental passengers annually at stabilization, an approximate 45% increase over our estimated ridership prior to these initiatives, and generating stabilized revenue and incremental operating cash flows in excess of $125 million annually."

For the commuter rail agreement, Brightline expects to securitize its 30-year access fee agreements with Miami-Dade and Broward counties for $625 million, according to the internet "roadshow" presentation for the deal.

This week's remarketing is Brightline's first issuance of green bonds, which may attract investors interested in sustainable developments. The passenger train's Siemens-built diesel locomotives meet the Environmental Protection Agencies Tier 4 emissions standard, the highest standard for non-road engines, according to the roadshow presentation.

The train is estimated to result in a 75% reduction of CO2 emissions per passenger kilometer compared to travel by car, the presentation says. The bonds received a pre-issuance review and second-party opinion from Sustainalytics; its review is included in the remarketing memorandum.

Concurrent with this week's remarketing, Brightline Holdings released

The tender offers expire at 11:59 p.m. on Dec. 11, unless extended or terminated earlier by the company.

The 2024 tranche last traded at 87.5 cents on the dollar on Sept. 28, while the 2029 tranche traded at 85 cents on the dollar on Nov. 13, according to the Municipal Securities Rulemaking Board’s EMMA repository on Tuesday.

The 2019A tender offer

Financing for the western project

The failed financing "is just another setback in a long-lived project which has seen its share" of difficulties, Krist said in a commentary Nov. 23.

"It is hard to assess exactly how much of the inability to find buyers for the bonds was a function of rates, specific credit concerns, [or] a limited and unclear operating history for the Brightline in Florida. Likely it is a bit of all three," Krist wrote.

While the Brightline project has many supporters, it also has opponents, including residents and elected officials in Indian River County.

In October, the U.S. Supreme Court

The county had asked justices to overturn a December 2019 appellate court decision that supported the U.S. Department of Transportation's decision to approve private-activity bond financing for Brightline

The Indian River County Commission, which has spent nearly $4 million on litigation over some six years, fought the train project over safety issues due to the fact that 32 daily passenger trains will run at speeds up to 110 mph through many small downtowns where tracks are close to local roads and stores.

While it lost the federal case, Indian River County is continuing to press a lawsuit in the Circuit Court for Duval County where Florida East Coast Railway is located. FECR operates 351 miles of railroad from Jacksonville to Miami, along the state's east coast.

Brightline shares the rail line with FECR through an easement FECR gave to the passenger train company.

The lawsuit will determine if the train’s private owners can benefit from the county’s 31 at-grade highway crossing agreements with FECR. The county said in its filing that it hasn’t agreed to make any changes in its crossing agreements that would allow Brightline to use the tracks.

The lawsuit, filed in January 2019, is moving slowly through the court system, said Indian River County Attorney Dylan Reingold.

“The court system in general in Florida has slowed down due to the pandemic,” Reingold said Wednesday. “In our case, we submitted a proposed trial schedule and are waiting for an order from the court. We had proposed a trial date in July.”

In this week's remarketing, the new long-term bonds will be registered as Florida Development Finance Corp. surface transportation facility revenue bonds, the Brightline Florida passenger rail project.

The 2019 bonds were initially registered as the Virgin Trains USA passenger rail project, but in August Brightline Holdings announced

Larson Consulting Services LLC is the company's municipal advisor.

Morgan Stanley & Co. is the lead manager. Co-managers are Barclays, BofA Securities, Deutsche Bank Securities Inc., Jefferies, Piper Jaffray & Co., UBS, Academy Securities, and Oppenheimer & Co.

Greenberg Traurig PA is bond counsel.