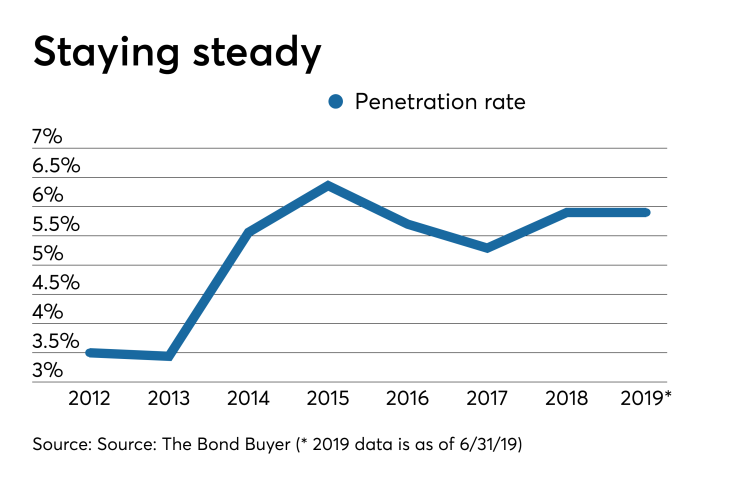

The municipal bond insurance industry has seen an uptick in overall par amount insured and a steady industry saturation rate for the first half of 2019.

The two active bond insurers — Assured Guaranty and Build America Mutual — have a total of $9.69 billion of combined par amount insured in 798 deals in the first half of the year, up 7.1% from the $9.06 billion in 625 issues in the first six months of 2018, according to data from Refinitiv. Bond insurance industry saturation finished the first half at 5.74%. The percentage of bonds insured hit a low point back in 2017 at just 5.29% but it has been slowly climbing since then, as it finished 2018 at 5.90%.

Assured Guaranty is the top municipal bond insurer at the halfway point of 2019. Assured insured a total of $5.67 billion in 423 deals for a 58.4% market share, versus $5.12 billion in 283 transactions or 56.5% market share during the first half of 2018. The figures include Assured's subsidiary Municipal Assurance Corp.

“The first half of the year is off to a good start, with municipal bond issuance and the insured market both making volume gains compared with the previous year,” Robert Tucker, head of investor relations and communications at Assured said. “During the first half of 2019, the par volume of insured new issues increased by 7.7% from its level in last year’s first half, outpacing the 5.8% increase in overall municipal bond issuance.”

For the first quarter of 2019, Assured Guaranty insured 56% of insured new-issue par and 56% of the transactions sold in the quarter and insured about $2.4 billion in aggregate in the primary and secondary market with a total transaction/policy count of 261.

For the second quarter of 2019 alone, Assured led the market, capturing 60% in terms of par insured and 51% in transaction count of the insured market. Compared with the second quarter of the previous year, Assured Guaranty’s insured par was up 27% to $3.7 billion, surpassing the 13% increase in the insured market, and up 58% to 260 new issues in transaction count.

“Assured Guaranty led the bond insurance market in terms of both par insured and transaction count for the first half,” Tucker said. “Our par insured in the primary market increased 11.3% to $5.7 billion and represented 59% of insured par, and its transaction count of 423 insured transactions was up more than 49% and represented 53% of the insured deals.”

He added that additionally, Assured Guaranty’s 175 secondary-market policies generated $665 million of insured par, more than twice the secondary-market par it produced in the first half of 2018.

“In aggregate, including both primary and secondary market business, Assured Guaranty’s total par insured was $6.4 billion, up 17% from the total in the first half 2018,” he said.

During the half, Assured Guaranty insured 25 transactions with AA underlying credit quality, for a total of $770 million in insured par. Assured Guaranty also continued to benefit from its ability to assist the larger transactions that typically interest institutional investors, guaranteeing par amounts exceeding $100 million on seven different transactions, according to Tucker. Among these was the largest insured Green Bond on record, $179 million of bonds issued by New York’s Metropolitan Transit Authority.

“Rating agencies continued to recognize Assured Guaranty’s financial strength,” Tucker said. “So far this year, S&P Global Ratings affirmed Assured Guaranty’s ratings, including its AA financial strength ratings, with stable outlook, on AGM, MAC and AGC; Kroll Bond Rating Agency affirmed its AA+ ratings for MAC, also with a stable outlook. AGM was affirmed by KBRA at the end of 2018 also with a AA+ stable outlook.”

Build America Mutual accounted for $4.03 billion of insured volume spanning 375 transactions or 41.6% market share in the first six months of 2019, compared with $3.94 billion in 343 deals and 43.5% market share.

“Credit considerations have remained core to most municipal investors’ approach to the market this year, and even as rates and spreads fell, bond insurance often offered compelling relative value,” Grant Dewey, BAM’s head of Municipal Capital Markets said. “That’s why we’ve seen an increase in primary-market penetration for the year so far. We’re seeing solid demand across all of the sectors where BAM is active, and we’re constantly monitoring the market alongside our counterparties to identify opportunities where our guaranty creates values.”

Dewey added that for the larger universe of uninsured bonds in the secondary market, insurance is a valuable tool that gives institutional investors an opportunity to manage the credit profile of their portfolio without having to sell or swap long-term holdings and potentially trigger a tax liability — and that value is magnified in an environment of net negative supply.

BAM's AA rating with S&P was affrimed in June and assigned with a stable rating.

"Build America Mutual Assurance Co. has a strong competitive position arising from investor acceptance of its financial guarantees and stable market share, as well as its very strong capital adequacy," S&P said in its report. "As a result, we are affirming our ratings on BAM. The stable outlook reflects our view that BAM will maintain its strong competitive position along with its market share."

S&P continued to say that BAM has gained strong market acceptance since its inception in 2012 and, in 2018, it experienced strong demand in the secondary market for its financial guarantees. Also boosting its long-term profitability is BAM's completion of its first assumed reinsurance transaction assuming about $2.2 billion in par of principally noncallable bonds from Ambac and roughly $20 million in premiums.

"The $20 million in premiums will earn out in future years," said the report. "BAM's capital adequacy is very strong, with a capital adequacy ratio above 1.0 times."