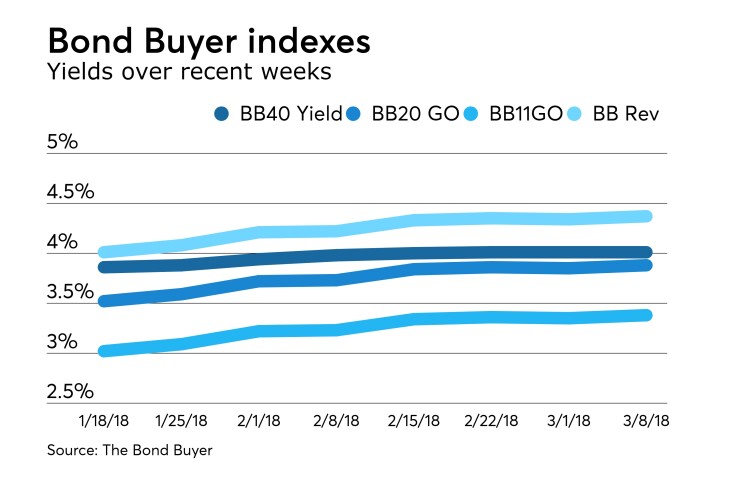

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was unchanged for the second week in a row at 4.01%.

The Bond Buyer's 20-Bond GO Index of 20-year general obligation yields was three basis points higher to 3.88% from 3.85% the previous week. It is at its highest level since March 23, 2017, when it was at 3.91%.

The 11-Bond GO Index of higher-grade 11-year GOs gained three basis points to 3.38% from 3.35% the prior week. It is at its highest level since 51 weeks ago, when it was at 3.42%.

The Bond Buyer's Revenue Bond Index increased three basis points to 4.37% from 4.34% last week. It is at its highest level since June 4, 2015, when it was at 4.55%.

The yield on the U.S. Treasury's 10-year note rose to 2.87% from 2.81% the previous week, while the yield on the Treasury's 30-year increased to 3.13% from 3.09% in the prior week.