Want unlimited access to top ideas and insights?

The municipal market was imploding in real time as it sold off by at least half a percentage point across the curve and Lipper reported more than $12 billion of outflows — simply more sellers amid a chaotic reaction to the COVID-19 virus.

The municipal market also completely decoupled from U.S. Treasuries in a major sell off that had the one-year muni yielding well over 2% on Thursday as the rest of the curve was up by more than 50 basis points across AAA benchmarks.

One-year munis currently yield more than 30-year U.S. Treasuries, which landed at 1.77%.

This sell off is fund outflow-driven and there were massive bid lists out on Thursday morning and the relative ratios of municipals to corporates and Treasuries are historic.

Lipper reported a whopping $12.214 billion of outflows from municipal bond funds. Out of that huge number, $5.3 billion of outflows were from high-yield bond funds. The $12 billion figure of outflows in one week equates to about 3% of annual municipal volume.

“The outflows from high-yield is equivalent to roughly $50 billion of high-yield corporates,” said Eric Kazatsky, municipal

strategist at Bloomberg Intelligence.

Municipal exchange traded funds are unloading.

The highest weekly SIFMA reset rate since the financial crisis was 7.96% on Sept. 24, 2008. This week it was set at 5.20%.

There is essentially no primary municipal market at this point.

“The muni short end is caught up in a market-wide liquidity shortfall. The colossal outflows make sense why there’s so much pressure. I don’t know if that’s the biggest ever, but does that matter?” said Matt Fabian, Partner at Municipal Market Analytics. “Investors worried about a recession or depression want to convert their holdings to cash, creating uncertainty over what cash alternative securities, like VRDOs, are worth. But because this is mostly an issue about the market at large, the government’s programs to supply incremental liquidity should have a more beneficial impact on munis than normal. And if you can buy one-year high-quality paper for 4% tax free, you probably should.”

Participants said the panic around the world was disrupting the global markets to an extent not seen since 2008 — or perhaps ever — because of this pandemic. New York City may convert empty hotels into hospitals, a growing number of commentators were urging the Federal Reserve to include municipals in their purchases,

“The muni market is seeing a lot of liquidation to raise cash in other areas of business which is resulting in large customer bid-wanted lists and forced selling,” said Greg Saulnier, managing analyst at Refinitiv. “Meanwhile, most muni participants do not currently have the capital to try and combat this type of pressure, and those few that might are also sellers right now. Unfortunately, munis seem to be the odd man out when it comes to cash needs in the current environment and thus rates are being driven higher in a search for a buyer of last resort.”

Significant pressure in the U.S. municipal VRDO market

The highest weekly SIFMA reset rate since the financial crisis was 7.96% on Sept. 24, 2008. This week it was set at 5.20%.

In recent days, the U.S. Federal Reserve announced extensive programs to help support capital markets functioning and facilitate the availability of credit. We have seen quantitative easing measures, a Primary Dealer Credit Facility (PDCF), and a Commercial Paper Funding Facility (CPFF) all come out of Washington, D.C. However, the PDCF does not support non-primary dealers and the CPFF does not cover the U.S. municipal variable rate demand obligation/note/bond market, according to Tom Kozlik, head of municipal strategy & credit at Hilltop Securities.

“This is important because we have recently seen significant pressure in the U.S. municipal short-term market, which has flowed through and pressured the VRDO market specifically,” Kozlik said. “We are not seeing or expecting near term relief as a result of the Federal Reserve’s recent actions. Fund selling has been and continues to be too extensive.”

Kozlik added that Hilltop’s observation is that there is generally not much liquidity from funds in the municipal market, nor in the short-term municipal market. Specifically, credit is not flowing as smoothly as it may appear in other markets.

“Traditionally, the buyers of VRDOs include money market funds, high net worth retail investors, and some corporate investors. Funds have been one of the largest holders of VRDOs because they are among their most liquid assets,” he said.

He noted that it is possible that the funds exercise that put option and tender back bonds they may have otherwise kept, but are required to liquidate because of the selling pressure they are facing.

“It is also possible cross-over or non-traditional buyers recognize the opportunity in time. This type of activity would go a long way in finalizing successful remarketing(s) going forward,” Kozlik said. “A typical element of VRDOs, and two of the reasons that money market funds have found them appealing, is they are traditionally considered of strong credit quality and are seen as being highly liquid relative to other securities.”

Daily rates this week have also been high, as an example New York City was set at 7.60% and there were abundance more priced at 10% dallies that were saw strong interest, according to sources.

“Watching dailies go from around 1% last Monday, all the way up to 10% a week and a half later is a clear sign of an antiquated market structure and also shows dealers fears of owning bonds — it appears to be a defensive move,” said one industry executive. “The dynamics of the markets are clearly signaling a high level of fear similar to the financial crisis in 2007/2008 and the sentiment and psychology displayed by the buy and sell side is highly reflective of 2008’s sentiment and psychology. The base reasons are clearly different but the fear rippling through the markets has been happening at a much faster pace than the finical crisis.”

ETFs continue their dislocation

“There is a significant and troubling after effect of the disorderly coronavirus driven markets — several bond ETFs share prices have dislocated significantly from their net asset values,” said JR Rieger of the Rieger report. He pointed to ETFs where share prices were significantly lower than their NAVs, including iShares National Muni Bond 7% lower. SPDR Nuveen Bloomberg Barclays High-Yield Municipal, 18% lower. VanEck Vector’s High-Yield Municipal — 23% lower.

“There is an exasperated and varying degree of secondary market liquidity for individual bonds,” Rieger said. “The current fast & furious bond markets have changed how investors, dealers and ETF market makers behave in regard to risk taking.

Secondary market

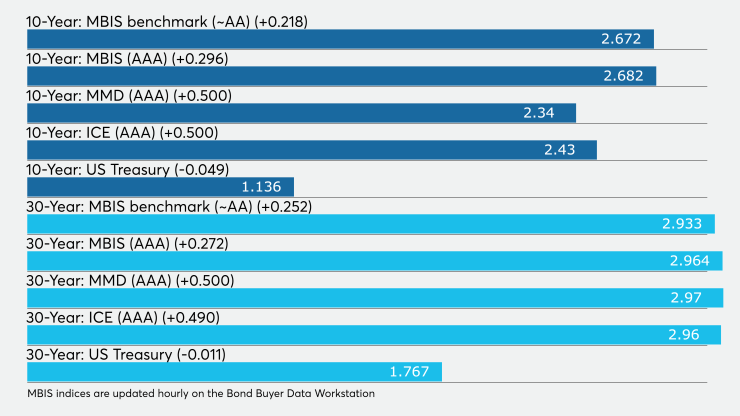

Munis were weaker on Thursday on the MBIS benchmark scale, with yields rising 21 basis points in the 10-year and by 25 basis points in the 30-year maturity. High-grades were also weaker, with yields on MBIS' AAA scale increasing by 29 basis points in the 10-year maturity and by 27 basis points in the 30-year maturity.

Munis were weaker on Refinitiv Municipal Market Data’s AAA benchmark scale, as the yield on both the 10-year muni and 30 year muni GO were 50 basis points higher to 2.34% and 2.97%, respectively.

BVAL saw the one-year cut by 56 basis points as of publication, 51 basis points cut in 10-year 50 basis point cut in the 30-year.

The 10-year muni-to-Treasury ratio was calculated at 202.2% while the 30-year muni-to-Treasury ratio stood at 162.0%, according to MMD.

Stocks were back up on Thursday, as Treasury yields were mostly lower.

The Dow Jones Industrial Average was up about 1.08%, the S&P 500 index was higher by 1.23% and the Nasdaq gained roughly 3.54% late in the session on Thursday.

The three-month Treasury was yielding 0.051%, the Treasury two-year was yielding 0.427%, the five-year was yielding 0.657%, the 10-year was yielding 1.136% and the 30-year was yielding 1.767%.

ICE Data Services saw a muni market in disarray on Thursday.

“The ICE muni yield curve is now inverted out to around the 10-year area; the one-year yield is currently 2.21%. Short rates are now higher than they were one year ago,” ICE said in a market comment. “Volumes remain above average, however, as liquidations continue. The muni percentage of Treasury yield is at historical levels, which is the same comment as yesterday.”

High-yield prices were accelerating their declines on Thursday. ICE cited trades on Ohio’s Buckeye Tobacco Settlement Authority bonds.

The Buckeye $3.38 billion of 5s of 2055 [CUSIP: 118217CZ] came to market on Feb. 25 priced at 109.43 cents on the dollar, a yield of 3.875%, was 10 to 15 times oversubscribed; the bonds have traded as high as 116.00. On Thursday morning, a customer bought 4 million of the 5s at 74.00, a 6.996% yield.

By late in the day according to EMMA, the 5s were trading at a low price of 71.94, a high yield of 7.203%, in 51 trades totaling $47 million.

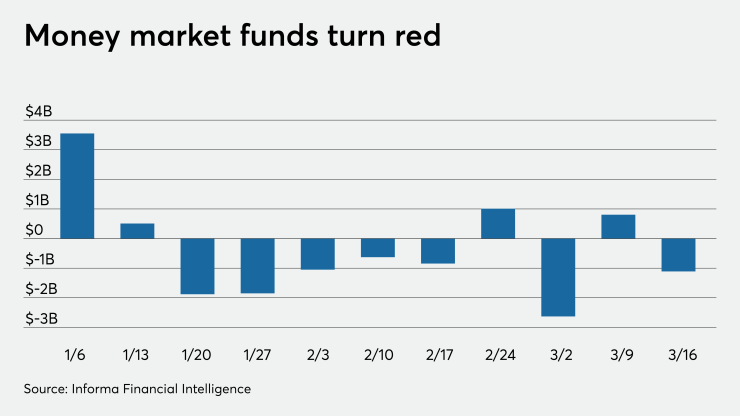

Muni money market funds see big outflows

Tax-exempt municipal money market fund assets decreased by $1.11 billion, lowering their total net assets to $132.99 billion in the week ended March 16, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds increased to 0.86% from 0.80% in the previous week.

Taxable money-fund assets were up $139.78 billion in the week ended March 17, bringing total net assets to $3.715 trillion. The average, seven-day simple yield for the 797 taxable reporting funds was decreased to 0.81% from 1.00% the prior week.

Overall, the combined total net assets of the 984 reporting money funds grew by $138.67 billion to $3.848 trillion in the week ended March 17.

“Right now, this market is looking for the buyer of last resort, risk players. Even though I think there is an overreaction right now — depression talk — but it’s also creating a buying opportunity. If I were a financial advisor, I’d be telling clients to get in,” a New York analyst said.

“This is completely fund outflow-driven,” a New York trader said. “The real question is, ‘who is buying?’”

Written by Lynne Funk, Aaron Weitzman and Chip Barnett.