Municipal bond buyers had the pick of the litter as a variety of high-grade, high-yield and taxable deals hit the market on Tuesday. The new deals gave the municipal market a jump-start in the midst of a period of supply-demand imbalance.

“There is very strong demand,” said Dan Urbanowicz, senior portfolio manager at Ziegler Capital Management in New York. “The market feels somewhat overbought with the trade relation concerns and Brexit issues going on as well as the chance of a slowing economy, but in the face of that there is still very strong demand in the muni market.”

Primary market

Goldman Sachs priced the New York City Transitional Finance Authority’s (Aa1/AAA/AAA) $850 million of tax-exempt Fiscal 2019 Series C future tax-secured subordinate revenue bonds for NYC’s Department of Administrative Services for institutions. The bonds were offered to retail investors on Friday and Monday.

During the retail order period, the TFA said it received $294 million of orders for the tax-exempts, of which about $209 million was usable. During the institutional order period for the tax-exempt bonds, the TFA received $1.2 billion of priority orders, representing 1.9 times the bonds offered for sale to institutional investors.

At the repricing, TFA said yields were decreased one to two basis points for maturities in 2036 to 2038 and by one basis point in the 2042 maturity. Final stated yields ranged from 1.53% for the 2020 maturity to 3.16% for the 4% coupon bond maturing in 2042, 3.30% for the 3.25% coupon bond maturing in 2043 and 2.81% for the 5% coupon maturing in 2043.

Also Tuesday, the TFA competitively sold $600 million of taxable bonds in two sales.

JPMorgan Securities won the $300 million of Fiscal 2019 Series C Subseries C-2 future tax secured subordinate revenue bonds with a true interest cost of 2.8381%. There were nine bidders, the TFA said. RBC Capital Markets won the $300 million of Fiscal 2019 Series C Subseries C-3 future tax-secured subordinate revenue bonds with a TIC of 3.4399%. There were nine bidders for the bonds, according to the TFA.

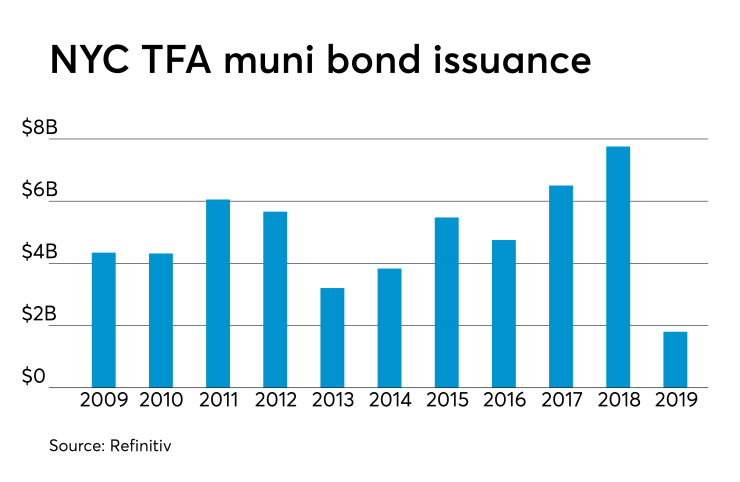

Since 2009, the TFA has sold about $53 billion of bonds, with the most issuance occurring in 2018 when it offered $7.76 billion. It sold the last amount in 2013, when it issued $3.2 billion of bonds.

Barclays Capital accelerated the pricing of Chicago’s (NAF/BBB+/BBB-/A) $727.87 million of Series 2019A GOs, originally slated to come on Wednesday. Sources said the underwriter received good reads from the accounts that would be submitting orders for the bonds and decided to push the deal forward.

Strong demand, along with fiscal strides by the city that resulted in one rating upgrade, helped offset market concern over the impending change in mayoral leadership in an April runoff. The city was able to slash spreads over triple-A yields , which had topped 300 basis points in its 2017 sale.

Chicago in its deal led by Barclays cut yields by five to seven basis points across maturities with the 10-year and 30-year both improved by five basis points. Based on preliminary pricing wire, the 10-year bond in the Chicago deal landed around a 174 basis point spread to the AAA and 96 to the BBB based on the scale set at the Monday market close. The 30 year bond landed at 175 basis point spread to the AAA, and 96 basis points to the BBB.

Illinois (Baa3/BBB-/BBB) sold about $440 million of GOs in two sales. BofA Securities won $300 million of taxable Series of April 2019A bonds with a TIC of 5.7409%. BofA also won $140.3 million of tax-exempt Series of April 2019B with a TIC of 3.33281%.

Illinois’ taxable tranche, which will fund pension buyouts, received nine bids. The winning bid came from BofA, which also won the tax-exempt refunding tranche as the lowest among 14 bidders. The refunding achieved a 7% net present value savings.

“We are very pleased with the strong response that the state received on today’s competitive bids and believe that recent positive statements by the Federal Reserve Board Chair and corresponding improvements in both the U.S. Treasury and tax-exempt municipal bond markets made this an opportune time for the state to come to market,” state capital markets director Kelly Hutchinson said in a statement.

The long nine-year bond in Illinois' tax-exempt tranche landed at about 178 basis points over the AAA scale and 100 basis points more than the BBB scale based on the scale at the market close Monday. The paper is rated in the low-to-mid BBB category. The state’s nine-year had been trading at 183 basis point spread and in a 2018 landed at a 176 basis point spread. The three-year bond landed at about 125 basis point spread over AAA and 64 over the BBB scale. It had been trading at a 145 basis point spread and the last deal landed at 161 basis point spread.

California (Aa3/AA-/AA-) competitively sold $842 million of taxable GOs in two sales. Jefferies won the $422 million of Bid Group B various purpose GOs with a TIC of 2.5982%. Wells Fargo Securities won the $420.79 million of Bid Group A various purpose GOs with a TIC of 2.9139%.

The sale was highly popular with 10 broker-dealers that submitted bids for the two separate bid groups, California State Treasurer Fiona Ma said in a statement. “Today’s bonds will provide funding for 16 different bond acts approved from 2002-2018,” Ma said.

The bond acts that received the largest amount of bond proceeds include: Safe, Reliable High-Speed Passenger Train Bond Act for the 21st Century of 2008: $600 million; California Stem Cell Research and Cures Bond Act of 2004: $156.1 million; Housing and Emergency Shelter Trust Fund Act of 2006: $21 million; Veterans Housing and Homeless Prevention Bond Act of 2014: $18.7 million; and Water Quality, Supply, and Infrastructure Improvement Act of 2014: $17.1 million.

Maryland (Aaa/AAA/AAA) sold $489.6 million of state and local facilities loan of 2019 GOs in two sales. BofA Securities won the $265.04 million of Bidding Group 1 GOs with a TIC of 1.7789%. Citigroup won the $224.96 million of Bidding Group 2 GOs with a TIC of 2.7082%.

Miami-Dade County (NR/AA/AA) sold $221.39 million of Series 2019 transit system sales surtax revenue refunding bonds. BofA Securities won the bonds with a TIC of 2.90%.

Citigroup priced the Iowa Finance Authority (NR/B+/B-) $120 million of Midwestern Disaster Area revenue refunding bonds for the Iowa Fertilizer Co. project. Citi also priced the Pflugerville Independent School District, Texas (PSF: Aaa/AAA/AAA) $174.18 million of Series 2019A unlimited tax school building bonds and $49.43 million of Series 2019B variable-rate unlimited tax school building bonds.

Urbanowicz said that Tuesday was a tale of two GO credits: Illinois and Maryland.

“They are two obviously different credit profiles,” Urbanowicz said. The deals drew a strong following in maturities of five years and less because of “intense demand due to record inflows year-to-date.”

The Illinois deal consisted of $300 million of taxable new money to finance pension buyouts and a $152 million tax-exempt refunding series.

The new money portion of the deal has a final maturity in 2044 and the refunding in 2028. State GO paper in the 10-year range has been trading at a 183 basis point spread to the Municipal Market Data top-rated benchmark and 172 basis points on the long end.

The five-year paper came 155 basis points higher in yield than the generic triple-A scale, which is around 50 basis points tighter than where it had been a year or so ago, according to Urbanowicz.

He said demand for the Illinois bonds maturing in five years and less showed the supply-demand imbalance in the market.

The Maryland demand was also cleaned up in five years of the short series of bonds, while the longer series still had some balances as of 2 p.m. In contrast to the Illinois bonds, the higher-quality Maryland bonds were priced just three basis points above the triple-A scale in five years, he said.

Though the five-year part of the yield curve has flattened, Urbanoqicz said he is still able to find value in the 8-12 year area to pick up a little extra yield where the curve is the steepest.

“It seems like there’s very strong demand due to the inflows over the past few weeks,” he said. Although he did not participate in the Illinois or Maryland deals,- he is eyeing the $600 million tax-exempt portion of the Connecticut deal, which will be pricing for retail Wednesday and institutions on Thursday.

The deal he said should be attractive in the five-year area, which he said, “seems like a slight concession to where the bonds had been trading in the secondary market recently.”

Bond sales

Bond Buyer 30-day visible supply at $11.49B

The supply calendar rose $966.6 million to $11.49 billion on Tuesday; it’s composed of $6.04 billion of competitive sales and $5.44 billion of negotiated deals.

Secondary market

Municipals were mixed on the MBIS benchmark scale Tuesday, which showed yields falling three basis points in the 10-year maturity while rising less than a basis point in the 30-year maturity. High-grade munis were also mixed, with yields falling three basis points in the 10-year maturity and rising less than a basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO muni and the yield on the 30-year muni remained unchanged.

The 10-year muni-to-Treasury ratio was calculated at 79.0% while the 30-year muni-to-Treasury ratio stood at 92.3%, according to MMD.

Treasuries were stronger as stocks traded down.

Previous session's activity

The MSRB reported 33,779 trades Monday on volume of $8.32 billion. California, New York and Texas were most traded, with the Golden State taking 14.4% of the market, the Empire State taking 11.374% and the Lone Star State taking 11.364%. The most actively traded issue was the COFINA restructured Series 2018 capital appreciation zeros of 2051 which traded 121 times on volume of $24.01 million.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $50 billion of four-week discount bills Thursday. There are currently $35.004 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Treasury auctions bills, notes

The Treasury Department Tuesday auctioned $26 billion of 364-day bills at a 2.360% high yield, a price of 97.613778. The coupon equivalent was 2.443%. The bid-to-cover ratio was 3.69. Tenders at the high rate were allotted 18.24%. The median yield was 2.340%. The low yield was 2.310%.

Treasury also auctioned $40 billion of two-year notes with a 2 1/4% coupon at a 2.261% yield, a price of 99.978568. The bid-to-cover ratio was 2.60. Tenders at the high yield were allotted 39.90%. The median yield was 2.230%. The low yield was 1.888%.

Yvette Shields and Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.