Municipals were stronger Friday as Treasuries weakened following the strong December jobs report which showed non-farm payroll employment rose 312,000, far more than the 180,000 gain predicted by some economists.

Primary market

Massachusetts got an early start to the upcoming week as Bank of America Merrill Lynch priced the Bay State’s $918.49 million of tax-exempt general obligation bonds for retail investors on Friday.

The deal will have a second retail order period on Monday before being priced for institutions on Tuesday.

The bonds are rated Aa1 by Moody’s Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings.

Decent demand for the first day of the retail order period the Massachusetts GOs offered an optimistic view of the swell of volume in the week ahead, a New York trader said.

"The calendar is growing," he noted.

Ipreo forecasts weekly bond volume will rise to $7.77 billion next week from a revised total of $43.9 million this week, according to updated data from Thomson Reuters. The calendar is composed of $5.81 billion of negotiated deals and $1.96 billion of competitive sales.

JPMorgan Securities expected to price the San Francisco Airport Commission’s $1.78 billion of tax-exempt and taxable revenue and revenue refunding bonds on Thursday.

The deal, which consists of bonds subject to the alternative minimum tax and non-AMT bonds, is rated A1 by Moody’s and A-plus by S&P and Fitch.

Also next week, Wells Fargo Securities is expected to price the New Jersey Transportation Trust Fund Authority’s $500 million of transportation program bonds on Wednesday.

In the competitive arena, New York’s Empire State Development is selling about $1.56 billion of Urban Development Corp. state personal income tax revenue bonds in six sales on Tuesday.

Friday’s bond sale

Bond Buyer 30-day visible supply at $10.27B

The Bond Buyer's 30-day visible supply calendar increased $5.04 billion to $10.27 billion for Friday. The total is comprised of $3.73 billion of competitive sales and $6.54 billion of negotiated deals.

Secondary market

"It's a crazy day with the jobs report so much stronger than expected," the New York trader said. The unemployment rate rose to 3.9%, with job gains occurring the health care, food services and drinking places, construction, manufacturing, and retail trade sectors.

Municipal bonds were stronger on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the three- to 30-year maturities while falling seven basis points in the one-year maturity and dropping four basis points in the two-year maturity.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale falling as much as three basis points in the two- to 30-year maturities and dropping six basis points in the one-year maturity.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining steady while the 30-year muni maturity rose as much as two basis points.

Treasury bonds were weaker amid continuing stock market volatility. The Treasury 30-year was yielding 2.975%, the 10-year yield stood at 2.651%, the five-year was at 2.486%, the two-year was at 2.488% while the Treasury three-month bill stood at 2.422%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 86.0% while the 30-year muni-to-Treasury ratio stood at 100.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Jan. 4 were from New Jersey, Texas and Puerto Rico issuers, according to

In the GO bond sector, the Jersey City 3.25s of 2020 traded 22 times. In the revenue bond sector, the Texas 4s of 2019 traded 20 times. And in the taxable bond sector, the Puerto Rico Government Development Bank Recovery Authority 7.5s of 2040 traded 27 times.

Week's actively quoted issues

Puerto Rico, New York and California names were among the most actively quoted bonds in the week ended Jan. 4, according to Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5.25s of 2041 were quoted by 62 unique dealers. On the ask side, the NYC taxable 5.206s of 2031 were quoted by 85 dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 23 dealers.

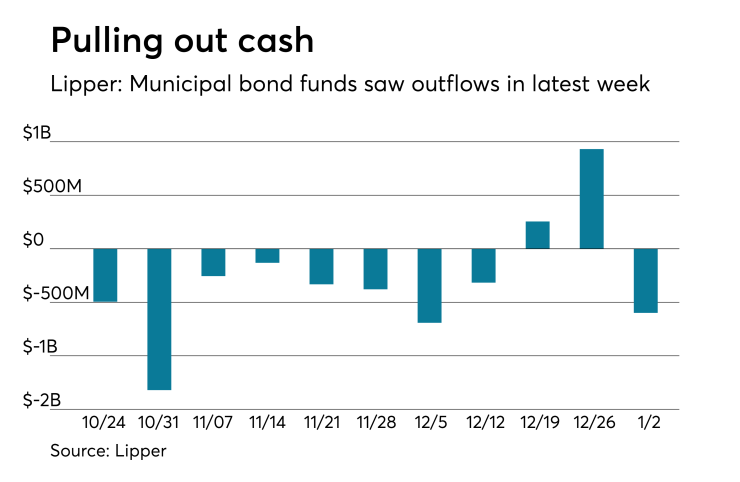

Lipper: Muni bond funds saw outflows

Investors in municipal bond funds pulled their cash out of them in the latest week, according to Lipper data released on Thursday.

The weekly reporters saw $599.184 million of outflows in the week ended Jan. 2 after inflows of $931.424 million in the previous week.

Exchange traded funds reported inflows of $107.278 million, after inflows of $549.913 million in the previous week. Ex-ETFs, muni funds saw outflows of $706.472 million after inflows of $381.511 million in the previous week.

The four-week moving average remained positive at $67.686 million, after being in the green at $44.474 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $542.820 million in the latest week after inflows of $694.069 million in the previous week. Intermediate-term funds had outflows of $550.066 million after outflows of $255.794 million in the prior week.

National funds had outflows of $16.142 million after inflows of $936.236 million in the previous week. High-yield muni funds reported outflows of $8.143 million in the latest week, after inflows of $395.844 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.