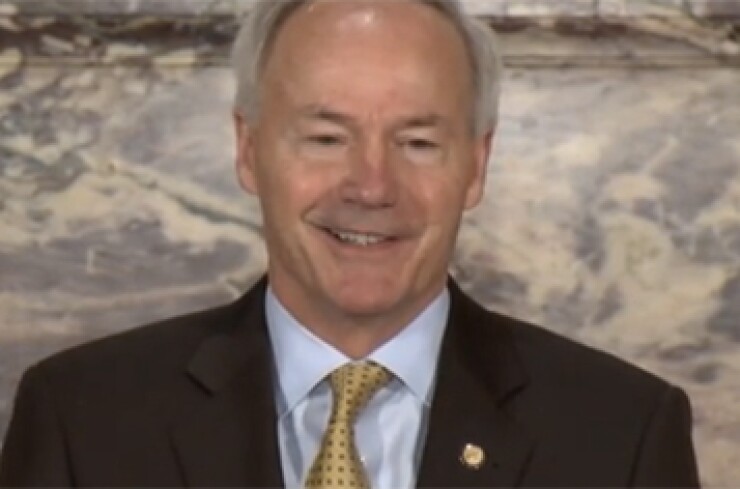

DALLAS – Arkansas Gov. Asa Hutchinson wants to boost state transportation funding by $750 million over 10 years with a no-new-tax proposal that would use general fund revenues for highway projects for the first time.

Arkansas would use the additional state funding as a match for $2 billion of federal highway aid that it would otherwise lose, Hutchinson said Tuesday as he outlined the four-part proposal.

"There is probably a greater urgent need for the immediate infusion of state funds into highway development than ever before," he said. "In addition to a state investment of more than three-quarters of a billion dollars over 10 years, this new program allows us to access billions of dollars in federal highway money – without raising taxes."

The five-year, $305 billion Fixing America's Surface Transportation Act (PL 114-95) provides Arkansas with at least $200 million per year of new federal funding for highway maintenance projects. The federal funds require a state match of $46.1 million by Sept. 30, the end of the federal fiscal year, and approximately $50 million per year through fiscal 2020, Hutchinson said.

"This means we are putting on the table $2 billion in federal funds over the same 10-year period," he said. "This is the first time in history we've made a meaningful contribution to highways from general revenue."

Arkansas received $499.7 million of federal highway funds in fiscal 2015, and will receive $525.2 million this year. It is in line for $2.7 billion of federal funding through 2020 with the FAST Act, an average of $548 million per year.

Hutchinson said his four-part plan would raise $64.1 million of additional state road funds in fiscal 2018, $71.1 million in 2019, $76.1 million in 2020 and $81.1 million in fiscal 2021.

His plan calls for the highway fund to receive 25% of the unallocated state surplus each year, estimated at $48 million, along with $5.4 million of state sales tax revenue and $4 million from diesel tax revenues that currently are dedicated to the general fund.

The governor's proposal is a promising start to adequate funding, said Scott Bennett, director of the Arkansas Highway and Transportation Department.

"The pressing need is making sure that we match those federal dollars," he said. "If we're not able to, that means $200 million of federal funds generated here in Arkansas would actually be distributed to other states for their highway use."

The highway department receives a little more than $400 million per year from the state's fuel taxes of 21.5 cents per gallon of gasoline and 22.5 cents per gallon for diesel, but the revenues peaked in 2004, Bennett said.

"The problem is pretty simple," he said. "Our revenue has been flat to declining. Even though people are driving more, they're buying less fuel."

Hutchinson's plan would raise the $46.9 million of matching funds for 2016 with $20 million from Arkansas's unobligated surplus, $20 million from the state's rainy day fund, $5.4 million from state central services, and would reallocate $1.5 million of revenue from the sales tax on new and used vehicles.

The $40 million of surplus funds would not be available "if we do not have access to the federal funds that are part of the Medicaid expansion" under the Affordable Care Act, Hutchinson said. Rather than opening up its Medicaid program, Arkansas received permission to purchase private health insurance for 200,000 low-income residents with the federal funds.

Hutchinson, a Republican, said he may call a special session of the General Assembly to consider the road proposals after the end of the short financial session that convenes in mid-April. Republicans hold 24 of the 35 state Senate seats and 64 seats in the 100-member House.