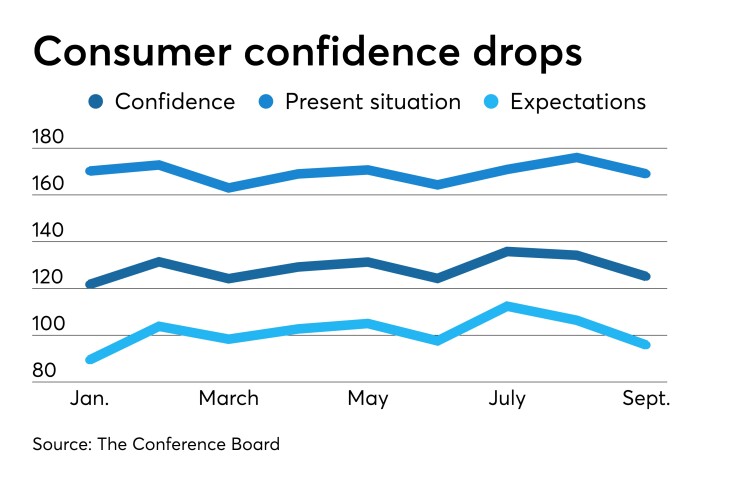

Consumer confidence plunged this month after a dip in August, as data released Tuesday showed a weakening economy.

Consumer spending has fueled economic expansion and a slowdown would dent prospects for gross domestic product growth.

The Conference Board’s consumer confidence index fell to 125.1 in September from 134.2 in August, while the present situation index fell to 169.0 from 176.0 and the expectations index dropped to 95.8 from 106.4.

Economists polled by IFR Markets expected a 134.0 reading for consumer confidence.

“The escalation in trade and tariff tensions in late August appears to have rattled consumers,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “However, this pattern of uncertainty and volatility has persisted for much of the year and it appears confidence is plateauing. While confidence could continue hovering around current levels for months to come, at some point this continued uncertainty will begin to diminish consumers’ confidence in the expansion.”

Only 37.3% of respondents said conditions are “good,” down from 40.9% a month earlier. Those saying jobs are “plentiful” slid to 44.8% from 50.3%

“Consumers remained optimistic about current business and employment conditions, but they lowered their income expectations and downgraded buying plans,” said Berenberg Capital Markets U.S. Economist Roiana Reid. “An elevated percentage of consumers expect lower interest rates within the next 12 months and fewer expect stock prices to increase.”

She added, “As long as consumer confidence remains within its recent elevated range, healthy consumption growth should continue. Persistent, sharp declines in confidence would suggest downside risk to this expectation.”

“Though they deny it, the Fed appears to have a bias toward cutting rates, all else being equal,” said Greg McBride, chief financial analyst for Bankrate.com. “Economic data that is more negative than positive only reinforces that stance.”

But with much data coming in before the next Federal Open Market Committee meeting, “saying the Fed is going to cut rates on October 30 at this point is a little like trying to call a no-hitter in the first inning,” he said.

The better bet is predicting action on repos. “The ongoing action by the Fed in overnight funding markets will put pressure on them to announce a revival of quantitative easing or a more permanent facility to sustain liquidity.” McBride said. “The next meeting won’t be all about whether or not the Fed cuts interest rates.”

Manufacturing

The Federal Reserve Bank of Richmond reported “manufacturing activity softened in September,” as its manufacturing index fell to negative 9 from positive 1 in August. The index was also negative in July, suggesting contraction.

Although shipments and new orders declined, employment rose. Firms “were optimistic that conditions would improve in the coming months,” the survey said.

Non-manufacturing

The Richmond Fed’s service sector survey suggested “moderate” activity in September, with the revenues and demand indexes holding steady.

The Federal Reserve Bank of Philadelphia reported expansion in the nonmanufacturing area, with the regional general business activity index gaining to 9.5 in September from 7.5 in August.

Home prices

The S&P CoreLogic Case-Shiller 20 city home price index rose 2% in July, the slowest growth since August 2012. In June, the index was up 2.2%.