Municipal bonds were mostly stronger on Wednesday along with Treasuries as continued volatility in the stock market promoted a better safe than sorry attitude among investors.

The tale of the muni market in 2018 was one of reduced issuance and shifting demand, according to Janney analysts.

“Following a January selloff, tax-free yields occupied a tight 15-basis-point trading range (2.41%-2.56%) for much of the year (February-August),” Janney said in a Wednesday market comment. “A post Labor Day selloff was reversed following the midterm election, pulling muni performance for the year into positive territory. Based on Bloomberg/Barclays Index data, the muni sector finished 2018 with a 1.28% return, the highest among major fixed income sectors.”

Janney noted a shift in demand for tax-free bonds among banks, since under the 2017 tax legislation the exemption offers less value at the lower 21% corporate tax rate. “After decades of steady increases, bank holdings of tax free bonds fell by 6.9% during the first three quarters of 2018, with insurance companies and mutual funds absorbing some of the slack (+2.3% and +2.0%, respectively),” Janney said.

Secondary market

Municipal bonds were stronger on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS' AAA scale falling as much as eight basis points in the one- to five-year maturities and dropping as much as one basis point in the six- to 26-year maturities and rising less than a basis point in the 27- to 30-year maturities.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the 30-year muni maturity falling between two and four basis points.

Treasury bonds were stronger amid continuing stock market volatility. The Treasury 30-year was yielding 2.997%, the 10-year yield stood at 2.668%, the five-year was at 2.503%, the two-year was at 2.492% while the Treasury three-month bill stood at 2.451%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 85.1% while the 30-year muni-to-Treasury ratio stood at 100.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Primary market

This week’s calendar is mostly empty, with only about $18 million of deals going up for sale. The calendar is composed of $6.4 million of negotiated deals and $11.3 million of competitive sales.

The biggest deal of the week is a note sale, with Jersey City selling $83.4 million bond anticipation notes on Thursday.

Next week’s slate is building, with Bank of America Merrill Lynch set to priced Massachusetts' $967 million of tax-exempt and taxable general obligation and GO refunding bonds in the negotiated sector.

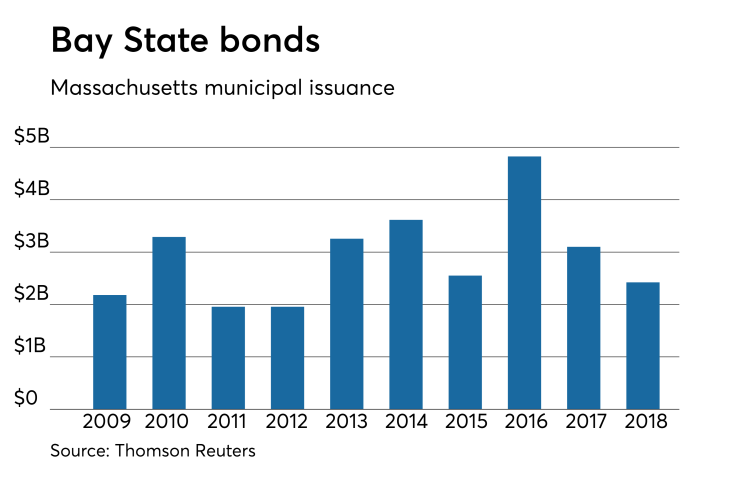

Since 2009, Massachusetts has sold over $29 billion of bonds, with the most issuance occurring in 2016 when it offered $4.83 billion of securities. It sold the least amount in 2011 and 2012 when it issued $1.96 billion of bonds in each of those years.

Wells Fargo Securities is expected to price the New Jersey Transportation Trust Fund Authority’s $500 million of transportation program bonds and the state of Mississippi’s $279 million of gaming tax revenue bonds.

Morgan Stanley is set to price Texas A&M University’s $220 million of tax-exempt and taxable revenue financing system bonds.

Bond Buyer 30-day visible supply at $5.09B

The Bond Buyer's 30-day visible supply calendar increased $69.5 million to $5.09 billion for Wednesday. The total is comprised of $1.98 billion of competitive sales and $3.11 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.