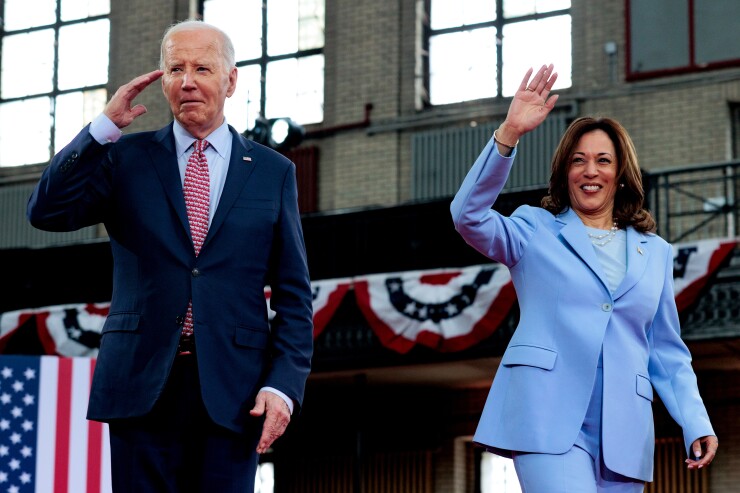

The day after President Joe Biden's abrupt decision to drop out of the 2024 presidential election, municipal market participants' attention turned to concerns over market volatility, whether a final Democratic ballot would include bond-friendly candidates, and the impact on high-stakes House races that will prove crucial next year to priorities like preserving the municipal bond tax exemption.

With just 105 days until the election, Vice President Kamala Harris was working Monday to shore up support for her bid as nominee. If she's successful, a key question will be her running mate. Potential candidates floated Monday included Kentucky Gov. Andy Beshear, Pennsylvania Gov. Josh Shapiro, Gov. Roy Cooper of North Carolina, and Illinois Gov. JB Pritzker. Arizona Sen. Mark Kelly was the only non-gubernatorial candidate.

"All of the names that have risen to the top seem to be governors, and interestingly enough, governors have a very close relationship with the concept of bonds and what bonds do in our country," said Emily Brock, federal liaison for the Government Finance Officers Association.

Meanwhile, the GFOA and other muni lobbyists will continue to advocate to the IRS and Treasury that

While all eyes are on the presidential election, the next Congress will play a major role shaping tax policy

"I am looking toward House races and what kind of impact a change at the top of the ticket will have," said Brett Bolton, vice president of Bond Dealers of America. "It's fair to say the presidential race was trending heavily towards former President Trump, and in turn I think the House was trending red, which would open up the likely outcome of a Republican sweep and a clear path to extend the TJCA fully through the budget reconciliation process, eliminating the need for Democratic support," Bolton said.

The next few weeks will be pivotal to see whether Democrats "get a foothold back into the race and stem the tide and potentially find a path to flip the House blue," he said.

The TJCA lowered the top corporate tax rate to 21% from 35%, and Trump in recent weeks has said he wants to lower rate even lower, to 15%.

"Team Trump in recent weeks has been pressing for Congressional leaders to lower the corporate rate even further to 15%, while House Ways and Means Chair [Jason] Smith has remained somewhat steady in saying the rate may be too low as is," Bolton said. "This has caught my attention fully. This debate, with a Republican sweep, would be a critical one for munis as many thought that the raising of the rate would provide some pay-for cover as Congress looks to extend TJCA."

All 435 House seats are up in November. Republicans will defend their narrow five-member majority.

The path to a Republican sweep of Congress and the White House "remains more straightforward than a Democratic sweep," said Wells Fargo Monday in a special election commentary. Democrats are defending 23 Senate seats compared to the Republican's 11 seats, the firm said, citing online prediction market Polymarket at putting odds of a Republican sweep at 40% compared to just 18% for a Democratic sweep.

Market participants will need to defend against the threat to the tax exemption regardless of the election outcome, participants said.

"A Republican victory could mean that tax-exempt bonds in general and private activity bonds in particular will be under challenge but a Democratic victory is not necessarily all upside," said Charles Samuels, attorney at Mintz who is counsel to the National Association of Health & Educational Facilities Finance Authorities.

"Democrats have a history in recent decades of ignoring traditional municipal finance and emphasizing new toys like BABS and infrastructure banks, as well as promoting unnecessary legislation and regulation like FDTA," Samuels said. "Lobbyists have to be prepared for any eventuality."

Harris, if named, is expected to maintain many of Biden's policies, including a focus on infrastructure and new energy, both of which rely on state and local government financing tools like muni bonds and tax credits. JPMorgan, in a Monday commentary, urged investors to "focus on what stays the same," and noted that "investing in the resulting infrastructure build is one of our highest conviction ideas."

As of midday Monday, munis were little changed despite the political drama. U.S. Treasury yields rose by three to four basis points by early afternoon and new-issue supply remained at a healthy $9.673 billion for the week.

Biden's departure from the presidential race introduces uncertainty into the market, especially because Harris has yet to be named as the new Democratic nominee, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

The initial reaction was a little bit a flight-to-quality trade in rates, which is supportive of USTs and munis as safe-haven assets do well during times of uncertainty, Brigati said.

There has been a bit of a reversal of the "Trump Trade," a sentiment among investors that former President Donald Trump's reelection would benefit the market, he said, noting it's unclear if that will persist throughout this week.

"We need time see how the market digests this all," Brigati said.

Jessica Lerner contributed to this report.