As Florida lawmakers prepare to vote on the state's record $93.2 billion budget, losses because of the novel coronavirus have already begun mounting for industries that support the state’s economy.

The Legislature returns to the capital Thursday for a final vote on the fiscal 2021 spending plan as new cases of the COVID-19 virus are announced daily in the state and around the country.

Well before the vote, some retail businesses in the Sunshine state voluntarily closed their doors to slow the spread of the novel coronavirus. In the state's iconic tourism sector, visitors who contribute to the sales taxes that support the state budget found favorite haunts closed, including all theme parks.

Some beaches are now closed while others are limited to groups of 10. Bars and nightclubs are shuttered for the next 30 days, while restaurant seating has been cut in half and others have shifted to delivery or pickup only of food. Curfews are being imposed in many areas.

When The Bond Buyer asked Tuesday if state lawmakers requested projections of potential economic losses due to COVID-19, and the impact it could have on state revenues, a spokeswoman for Senate President Bill Galvano, R-Bradenton, said the impacts won't be known with certainty for some time.

"We are just now starting to see the widespread closures across the state. Some of those impacts will be apparent when the March sales tax receipts are available in May, April in June etc.," the spokeswoman said.

"However, we certainly recognize that the coronavirus presents a challenge for the sales tax forecast, especially regarding taxes collected from tourists, and our estimators are working very diligently as new impacts are developing on a daily basis,” she added.

The first few cases of novel coronavirus were detected by Florida health officials between mid-January and mid-February. The next month negotiations began on the budget, and through the week the annual session was scheduled to end on March 13. By then there were 155 cases of the novel coronavirus confirmed by testing.

By Thursday, there were 314 confirmed positive cases and six deaths, according to

With limited availability of testing, the number of actual cases is likely far higher. As testing ramps up with the help of private labs, the number of cases rises exponentially each day.

As Florida lawmakers vote on the fiscal 2021 budget, they will do so without an updated revenue forecast and there are signs of deterioration in major industries that support the state's economy.

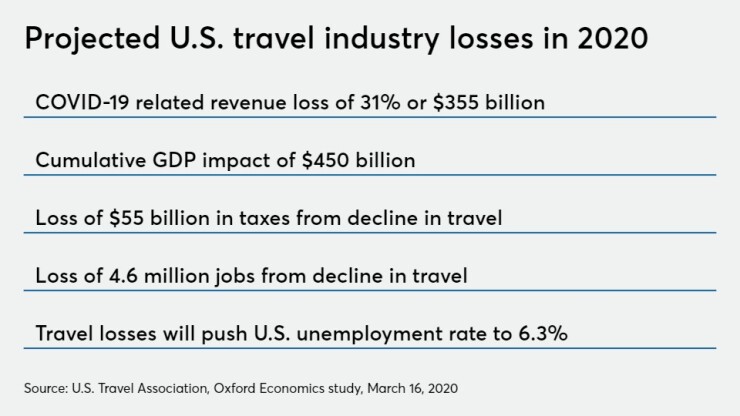

On Tuesday, the U.S. Travel Association projected that "decreased travel due to coronavirus will inflict an $809 billion total hit on the U.S. economy and eliminate 4.6 million travel-related American jobs this year."

Total spending on travel for transportation, lodging, retail, attractions and restaurants is projected to plunge by $355 billion for the year, or 31%, according to a USTA-commissioned

The potential losses, the USTA said, could be more than six times the impact on the travel industry after the Sept. 11, 2001 terrorist attacks, and could be severe enough to push the U.S. into a protracted recession expected to last at least three quarters.

"The health crisis has rightly occupied the public's and government's attention, but a resulting catastrophe for employers and employees is already here and going to get worse," said USTA President and Chief Executive Officer Roger Dow, who presented the industry projections at a White House meeting to discuss financial relief for the sector. "This situation is completely without precedent."

Dow has asked the Trump administration to consider $150 billion in relief for the broader travel sector.

The funds, he said, will help establish a travel workforce stabilization fund, provide an emergency liquidity facility for travel businesses, and modify federal Small Business Administration loan programs for businesses and their employees.

There were 1.27 million people employed in Florida’s leisure and hospitality industry as of January, according to preliminary data from the U.S. Bureau of Labor Statistics

Other states have already begun projecting potential losses of revenues supporting their budgets.

In Colorado Monday, chief economist Kate Watkins

“We’re now, based on the reduction in revenue, expecting you to have $27.3 million for next year,” Watkins said.

Budget analysts told the committee that they are hopeful that the negative economic impact will last months, not years, in Colorado, but they acknowledged that there's significant uncertainty and risk and “potential for a more protracted recession," the Post reported.

On Tuesday, the District of Columbia reported that it may miss out on up to 50% of its hotel and restaurant tax revenue due to the impact of COVID-19, a potentially significant hit to the sales tax collections that usually account for about 10% of the city's revenue, according to a

DeWitt said tourism, which includes hotel and restaurant revenue, is typically about 30% of D.C.'s sales tax revenue.

On Monday, UCLA Anderson Forecast

The downturn ends an expansion that began in July 2009.

“After a solid start to 2020, the escalating impacts of the coronavirus pandemic in March have reduced the first-quarter 2020 forecast of GDP growth to 0.4%,” according to the Anderson Forecast. “GDP growth for the second quarter of the year is now forecast to be at a negative 6.5% growth rate, and at negative 1.9% for the third quarter.”

On Tuesday, Moody's Investors Service placed the ratings of Delta Air Lines, American Airlines, United Airlines, JetBlue Airways, Southwest, Hawaiian Airlines and Allegiant Travel Co. on review for downgrade.

Southwest's senior unsecured debt ratings were also downgraded to Baa1 from A3, while its equipment trust certificate financings were downgraded as low as Baa2.

S&P Global Ratings started taking action on airlines Monday, cutting Spirit Airlines' rating to B-plus from BB-minus, and on Tuesday downgrading Allegiant's rating to B-plus from BB-minus. S&P placed Spirit, Allegiant, United, Delta, American and Hawaiian Holdings all on CreditWatch negative due to the reduction in air travel because of the new coronavirus.

"The rapid and widening spread of the coronavirus outbreak, the deteriorating global economic outlook, falling oil prices and asset price declines are creating a severe and extensive credit shock across many sectors, regions and markets," Moody's analysts said about the airlines. "The combined credit effects of these developments are unprecedented.

"The passenger airline sector has been one of the sectors most significantly affected by the shock given its exposure to travel restrictions and sensitivity to consumer demand and sentiment."

Airlines are seeking a $50 billion relief package from the federal government due to what executives have called an “unprecedented collapse” in travel demand as the spreading COVID-19 virus prompts Americans to stay home.

In the U.S., at least 5,881 people had tested positive for coronavirus as of Wednesday morning and COVID-19 had killed at least 107 patients, according to a

Florida's 2021 budget contemplates $35.2 billion in general revenues, the major source of funding for which is the state sales tax, and $58 billion in federal funds and revenues in designated trust funds.

Reserves will total $3.9 billion, and are composed of $1.3 billion in working capital funds, $1.7 billion in the budget stabilization fund, and $858 million available, as needed, in the Lawton Chiles Endowment Fund for affordable housing.

The budget, which exceeds the current spending plan by $2.2 billion, includes about $25.1 million to address the COVID-19 outbreak. An additional $300 million was placed in reserves if needed.

Lawmakers are taking special precautions when they return to the state capital, limiting interaction with each other and the amount of time spent there.