Want unlimited access to top ideas and insights?

A smaller decline in business investment and continued consumer spending suggest the economy will continue to grow at a moderate pace.

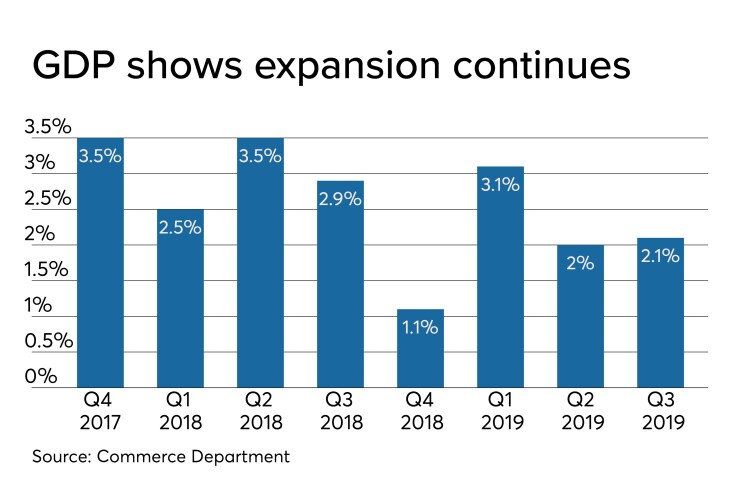

Gross domestic product was stronger than expected in the third quarter as the preliminary read was 2.1% growth, better than the 1.9% read in the advance estimate.

Economists polled by IFR Markets expected the growth rate to remain at 1.9%.

The 2.1% pace of growth tops the second quarter’s 2.0% gain.

The Commerce Department said business investment was off 2.7% in the period, compared with the earlier estimate of a 3.0% decline. Inventories were also revised higher, which helped boost GDP.

Separately, Commerce said, personal income was unchanged in October after posting a 0.3% gain in September, while spending grew 0.3% after a 0.2% rise a month earlier.

Economists expected income and spending to each rise 0.3% in the month.

Inflation remained in check, according to the report with personal consumption expenditures up 0.2% in the month, after holding steady in September, and up 1.3% year-over-year in October, the same pace as in September.

Core PCE, the Federal Reserve’s preferred inflation measure, was up 0.1% in the month and 1.6% year-over-year. In September, core PCE was flat and up 1.7% year-over-year. Economists expected core PCE to grow 0.1% in the month and 1.7% year-over-year.

In another report, Commerce said orders for durable goods rose 0.6% in October after a 1.4% drop in September. Excluding transportation, orders increased 0.6% in the month after a 0.4% decline in September.

Orders for non-defense capital goods excluding aircraft, a proxy for business investment, gained 1.2% in the month, the biggest increase in the category since January, suggesting business spending may start to increase.

Economists expected durable goods orders to fall 0.7% and rise 0.2% excluding transportation orders.

The report “was broadly stronger than expected, with rising core orders and shipments, despite the GM strike that weighed on activity,” Mickey Levy, Berenberg Capital Markets' chief economist for the U.S. Americas and Asia, and U.S. Economist Roiana Reid, write in a note. “This suggests that investment in business equipment started Q4 with solid momentum, a welcomed change from the prior three quarters.”

While the better-than-expected report is “encouraging,” they said, “sustained improvement in coming months is needed to confirm a recovery in manufacturing activity.”

The Labor Department reported initial jobless claims fell 15,000 in the week ended Nov. 23 to 213,000 while continued claims dropped to 1.64 million in the week ended Nov. 16 from 1.697 million a week earlier.

Economists expected 219,000 initial claims in the week.

The Chicago Business Barometer climbed to 46.3 in November from 43.2 a month earlier, its third consecutive contractionary reading.

The new orders and order backlogs indexes improved the most in November, while supplier deliveries posted the largest decline from the prior month.

Pending home sales slipped 1.7% in October to a 106.7 index reading, but gained 4.4% year-over-year, according to the National Association of Realtors.

A small uptick in interest rates and a shortage of supply contributed to the decline, said NAR chief economist Lawrence Yun.