Municipals were little changed on Tuesday along with U.S. Treasuries as financial markets took a breather after Monday’s positive health news and slight sell-off.

Bond buyers were treated to some new supply ahead of the Veterans Day holiday with deals from Louisiana, Florida and Oregon hitting the screens.

Yields on top-rated municipals were steady on the AAA scales, after rising by as much as five basis points on Monday on reports about a possible COVID-19 vaccine.

The news of a successful vaccine may open up a path to credit normalization, according to BNP Paribas’ Credit 360 team.

The cause of the economic downturn is a health crisis which can only be addressed with a medical solution such as a vaccine or treatment, Credit 360 said in a Tuesday report. They forecast sectors that have been virus-sensitive may now outperform other parts of the market.

“U.S. high-yield airlines and gaming will outperform,” the 360 Team said. “These sectors have priced in most lockdown-risk, have both gone through cost-cutting and rationalization, and would benefit from improved travel, conventions, tourism.”

Monday's medical news “showed front and center just how much of a safety/penalty bid has been built in with mass business closures and work-from-home scenarios, according to Kim Olsan, senior vice president at FHN Financial.

“The expectation always existed that this development would eventually occur, but the timing and strength of the announcement caught the market off guard,” she said.

She looked at the effects a vaccine may have on certain virus-impacted muni sectors, such as transportation, universities, hospitals, and airports.

Olsan said transportation-related bonds have been hit because there fewer people commuting to work via mass transit or who would be paying road, bridge or tunnel tolls.

“In a sign that a promising vaccine might be administered earlier than expected, active transit issues were quick to trade up. New York’s MTA 5s due 2029 (call 2028) traded +278/AAA vs. prints from late October around +335/AAA,” she said. “While muni transit wasn’t as reactive as the S&P Transportation ETF ‘XTN’ that gained over 8% on the vaccine announcement, the sector can be hopeful about reversing recent losses.”

She noted that after dropping almost 9% between March and April, the year-to-date transportation sector return is at 0.73%.

“Within the category, bonds supported by toll roads, fuel sales taxes and mass transit would see improving revenue models earlier in 2021 than projected,” she said.

Looking at universities, she said the virus has weakened the higher education sector, which has seen lower enrollments affecting revenue streams. She said healthcare bonds suffered revenue impacts from curtailed voluntary medical procedures and higher operating costs.

While the large university/teaching hospital model has been doubly affected, an effective vaccine could bring relief to the sector, she said.

“A block of Aa3/AA Pennsylvania Higher Education/University of Pennsylvania Health System 4s due 2034 (call 2027) were sold at 1.45%, or 22 basis points through the evaluated yield,” she said. “As a sector, healthcare is up 3.03% this year, slightly ahead of the broad market after having turned around following a combined 7.8% loss in March and April.”

Looking at airports, she said that airport bonds have been hit as lockdowns halted much air travel.

“An issue of Baa3 New York Transportation for Delta Airlines/LaGuardia Airport 5s due 2040 traded +240/AAA, in from +276/AAA a month ago (the original syndicate spread from late August was +311/AAA),” she said. “The sector can be expected to benefit from an earlier and possibly larger rebound in air travel, as TSA reported over 1 million screened daily travelers in mid-October. Returns were hit during the early stages of lockdown, but since August have only trailed the broad market by 0.30%.”

Primary market

Wells Fargo Securities remarketed Louisiana’s (Aa3/NR/AA-/NR) $424.375 million of gasoline and fuels tax second lien revenue refunding bonds in a conversion from interest-rate mode.

The $200 million of Series 2017A bonds were priced at par to yield 0.60% in 2043 with a mandatory put date of 2023. The $103.125 million of Series 2017D-1 bonds were priced at par to yield 0.60% in 2043 with a mandatory put date of 2023.

Morgan Stanley priced the Contra Costa Community College District, Calif.’s (Aa1/AA+/NR/NR) $145.395 million of tax-exempt and taxable Series 2020C Election of 2014 GOs and $35.395 million of taxable refunding GOs.

The $104.385 million of exempt GOs were priced to yield from 0.24% with a 4% coupon in 2023 to 2.20% with a 2% coupon in 2039. The $5.615 million of taxables were priced at par to yield 0.20% in 2021. The $35.395 million of taxable refunding GOs were priced at par to yield from 0.35% in 2021 to 2.25% in 2032.

BofA Securities priced the Missouri State Environmental Improvement and Energy Resources Authority’s (Aaa/AAA/NR/NR) $100.805 million of Series 2020B taxable water pollution control and drinking water refunding revenue bonds. The bonds were priced at par to yield from 0.211% and 0.261% in a split 2021 maturity to 1.905% in 2030.

BofA also priced Gardena, Calif’s (NR/AA-/NR/NR) $100.59 million of Series 2020 taxable pension obligation bonds. The bonds were priced at par to yield from 1.081% in 2021 to 3.363% in 2035 and 3.854% in 2039.

RBC Capital Markets priced the Bush Foundation of Minnesota's (Aaa/NR/NR/NR) $100 million of taxable corporate CUSIP social bond issue. The bonds were priced at par to yield 1.754%, or 100 basis points above the comparable Treasury security, on Oct. 1, 2050. Co-managers are Loop Capital Markets and Siebert Williams Shank.

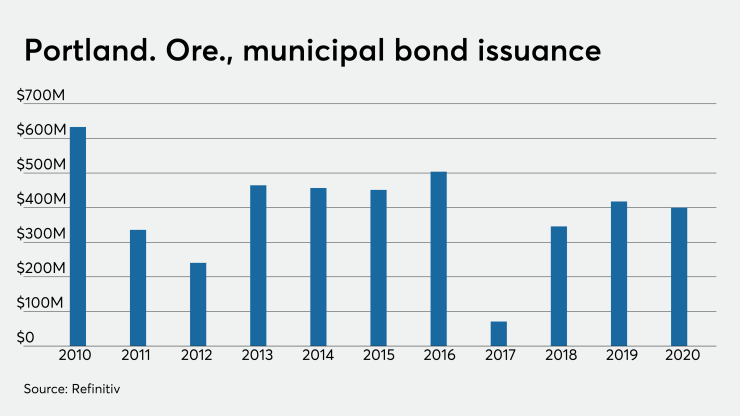

In the competitive arena, Portland, Ore., (Aa2/AA/NR/NR) sold $239.59 million of Series 2020A second lien sewer system revenue bonds.

Citigroup won the deal with a true interest cost of 2.0913%. The bonds were priced to yield from 0.30% with a 5% coupon in 2024 to 2.22% with a 3% coupon in 2046.

Co-managers were Roosevelt & Cross, Ramirez & Co., Siebert Williams Shank, Drexel Hamilton, Bancroft Capital, Amuni Financial, Stern Brothers & Co WMBE, Intercoastal Capital Markets, Stifel, AmeriVet Securities, Loop Capital Markets, Rice Financial Products Co., Oppenheimer & Co., and Mischler Financial Group. PFM Financial Advisors is the financial advisor; Hawkins Delafield is the bond counsel.

Since 2020, the city has sold about $4.3 billion of bonds, with the most issuance occurring in 2010 when it sold $633 million.

The Florida Department of Transportation (Aaa/AAA/AAA/) sold $187.55 million of right-of-way acquisition and bridge construction GO bonds.

BofA Securities won the deal with a TIC of 1.9297%. The bonds were priced to yield from 0.20% with a 5% coupon in 2021 to 2.03% with a 2% coupon in 2044 and as 2.125s to yield 2.24% in 2050. The state Division of Bond Finance acted as the financial advisor; Greenberg Traurig was the bond counsel.

Markets are closed Wednesday for Veterans Day.

On Thursday, Citi is expected to price the California Earthquake Authority’s (NR/NR/A/AA-) $300 million of Series 202B taxable revenue bonds.

Pent up demand for 3% and 4% coupon bonds was driving demand among institutions on the buy side on Tuesday, as the pricing of a Aa3/AA-rated $72 million Manchester, N.H. deal displayed up and down the yield curve, according to a New York trader.

“The taxables were more subscribed for than tax-exempts,” he said, noting that the best execution of bonds was for the 3% and 4% coupons up and down the yield curve.

The deal exemplified the tone of the market amid a recent supply shortage, and uncertainty and volatility following the election and Treasury weakness.

“It seems like the market has reached a point of equilibrium here,” the trader explained. “Based on what we’re seeing, there is still pretty good demand out there,” he continued.

The New York trader said it remains to be seen how the calendar will shape up next week — however he said a $1.4 billion Massachusetts general obligation deal announced Tuesday should cause a buying opportunity for investors — in between market breaks for the two upcoming holidays.

“There’s volatility in the risk markets so we are seeing a little bit of safe haven buying on the side of institutional buyers,” the trader said. “There was nothing last week, so the market is getting back up to speed after a pretty quiet period,” he said.

The Massachusetts deal consists of $917 million of tax-exempt GOs, both new-money and refunding bonds, as well as $440 million of taxable refunding bonds.

“I think there’s plenty of demand for that right now,” he said of the deal. “There is pent-up demand and cash looking to be put to work, and the timing will help as well."

Secondary market

Some notable trades Tuesday:

Prince Georges County, Maryland GO 5s of 2023 traded at 0.23%. NYC TFA subs 5s of 2027 at 0.82%.Charlotte NC 5s of 2028 at 0.69%-0.68%. Maryland GOs, 5s of 2028, traded at 0.68%-0.67%.

Baltimore County, Maryland GOs, 5s of 2030 at 0.87%-0.86%. Monday at 0.90%. Maryland GOs in 10 years traded at 0.90% Tuesday and Monday. Humble County, Texas ISD 3s of 2033, traded at 1.18%-1.17%. Monday at 1.20%. Washington GOs, 5s of 2036 at 1.33%.

NYC TFA subs 4s of 2041 traded at 2.11%-2.00%. On Monday, 2.12%. Humble County, Texas ISD 2.25s of 2049 at 2.33%-2.34%. Alexandria, Virginia 3s of 2050 traded at 2.02%-2.01%.

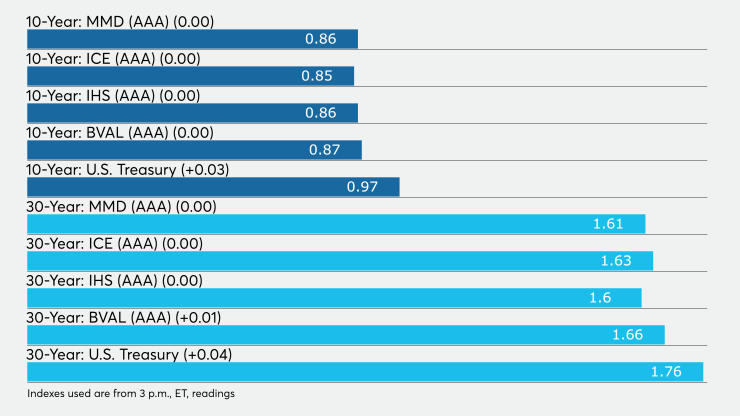

High-grade municipals were steady, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields in 2021 and 2022 were unchanged at 0.18% and 0.20%, respectively. The yield on the 10-year muni was unchanged at 0.86% while the yield on the 30-year was flat at 1.61%. The 10-year muni-to-Treasury ratio was calculated at 88.8% while the 30-year muni-to-Treasury ratio stood at 91.7%, according to MMD

The ICE AAA municipal yield curve showed short maturities unchanged at 0.18% in 2021 and 0.20% in 2022. The 10-year maturity was flat at 0.85% and the 30-year yield was steady at 1.63%. The 10-year muni-to-Treasury ratio was calculated at 87% while the 30-year muni-to-Treasury ratio stood at 93%, according to ICE.

The IHS Markit municipal analytics AAA curve showed yields steady across the curve, at 0.19% and 0.20% in 2021 and 2022, respectively, and the 10-year at 0.86% with the 30-year yield at 1.60%.

The BVAL AAA curve showed the yields on the 2021 and 2022 maturities unchanged at 0.15% and 0.17%, respectively, while the 10-year was flat at 0.87% while the 30-year increased one basis point to 1.66%.

Treasuries were weaker as stock prices traded mixed.

The three-month Treasury note was yielding 0.10%, the 10-year Treasury was yielding 0.97% and the 30-year Treasury was yielding 1.76%. The Dow rose 0.86%, the S&P 500 decreased 0.08% and the Nasdaq fell 1.18%.