Just in time for its $1.4 billion bond sale, California received a holiday present from Moody’s Investors Service. The rating agency late Monday raised the rating on the state’s general obligation bonds to Aa2 from Aa3 and assigned a stable outlook to the GOs.

It was the

The state continues to hold a AA-minus rating with a stable outlook from S&P Global Ratings, which last upgraded the bonds in July 2015.

The new rating reflects a continued upward climb over the past decade since S&P cut California to A-minus in 2010 after the bonds had fallen to Baa1 from Moody’s and BBB from Fitch in 2009.

The upgrade is positive for both the state and investors, municipal sources said.

“We agree with the upgrade and we think it was overdue given California’s economic strength, their accumulation of reserves, and improved governance,” John P. Ceffalio, municipal credit analyst at AliianceBernstein, said on Tuesday.

However, he doesn’t expect the upgrade to impact the new deal this week and said he is monitoring the state’s financial and credit characteristics going forward.

“Key credit factors we are watching are the state’s volatile revenues, unfunded pension liabilities, fiscal policies, and the impact of climate and demographic changes on the state’s economy,” Ceffalio said.

The market reacted mostly favorably, although some analysts said the state’s GOs had already been trading up due to the high demand for bonds from this high-tax state after the 2017 tax reform laws cut the federal deduction on state and local taxes. In late trading, the state’s GO were mixed in active trading, according to data from the Municipal Securities Rulemaking Board’s EMMA website.

The Series 2010 5.25% various purpose GOs of 2030 [13063BEQ1; originally priced at 98.178] were trading at a high price of 101.7 cents on the dollar in 12 trades totaling $850,000. This compared to a high of 101.547 cents in one trade totaling $2.31 million on Friday.

The Series 2019 3% various purpose GOs of 2049 [13063DPX0; originally priced at 102.444] were trading at a high price of 104.967 cents on the dollar in 22 trades totaling $4.24 million. This compared to a high of 105.411 cents in eight trades totaling $520,000 on Friday.

Others say the upgrade is largely helpful to the state, but there are challenges.

“In the short-term, the benefit of the upgrade in terms of potentially lower interest rates is somewhat offset by the headline risk of the purposeful power outages implemented by PG&E,” Alan Schankel, managing director and municipal strategist at Janney Capital Markets said Tuesday afternoon.

If the state’s upcoming deal was tax-free, the impact would be minimal given the continuing strong inflows to municipal mutual funds supporting municipal yield-chasing, Schankel noted.

But the taxable deal will command a different market reaction, he said. “The taxable investor universe will require a wider spread than the 52 basis point, 10-year spread to Treasuries of the March 2019 California taxable offering.”

Moody’s said its upgrade “incorporates continued expansion of the state's massive, diverse and dynamic economy and corresponding growth in revenue.”

California State Treasurer Fiona Ma said the upgrade would help the state see lower borrowing costs in a low interest-rate environment.

On Wednesday, the state will competitively sell $1.14 billion of taxable GOs in two offerings.

The deals consist of $680.59 million of Bid Group A various purpose construction GOs and $459.975 million of Bid Group B various purpose GO refunding bonds.

Proceeds will be used to finance capital improvements and to refund certain outstanding GO commercial paper notes.

Public Resources Advisory Group is the financial advisor and Orrick Herrington is the bond counsel.

Primary market

On Tuesday, the Cupertino Union School District, Calif., sold $121.66 million of taxable GO refunding bonds. Citigroup won the issue with a true interest cost of 2.6588%. Proceeds will be used to advance refund certain outstanding debt. Piper Jaffray was the financial advisor; Stradling Yocca was the bond counsel.

Siebert Cisneros Shank priced Atlanta, Georgia’s (Aa3/AA-/AA-) $257.86 million of Series 2019E airport general revenue refunding bonds not subject to the alternative minimum tax and Series 2019F airport passenger facility charge and subordinate lien general revenue refunding non-AMT bonds.

Meanwhile, in an updated pricing note from Siebert on the Atlanta deal, the underwriter said that earlier this month the SEC's Division of Enforcement issued a non-public letter to the City advising it of a preliminary "fact-finding inquiry" into certain matters related to the Atlanta Airport as part of an investigation to determine if there have been any violations of the federal securities laws. "The letter from the SEC expressly indicates that the investigation does not mean that the SEC has concluded that anyone violated the law," Siebert said. "The City intends to cooperate with the fact finding inquiry."

Tuesday’s bond sales

Secondary market

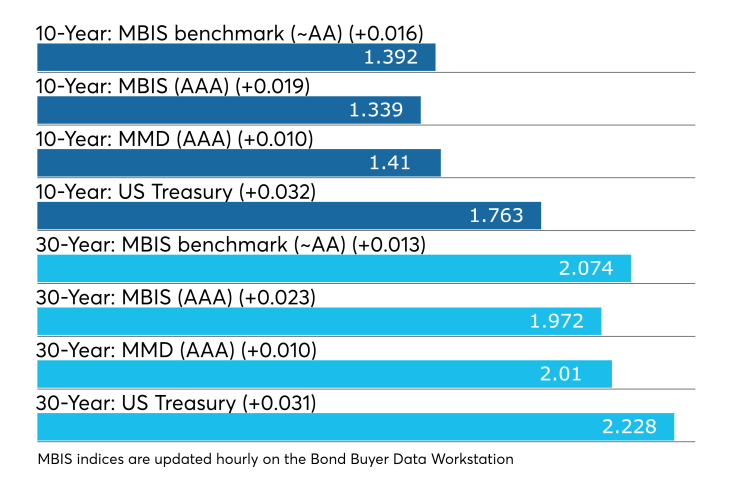

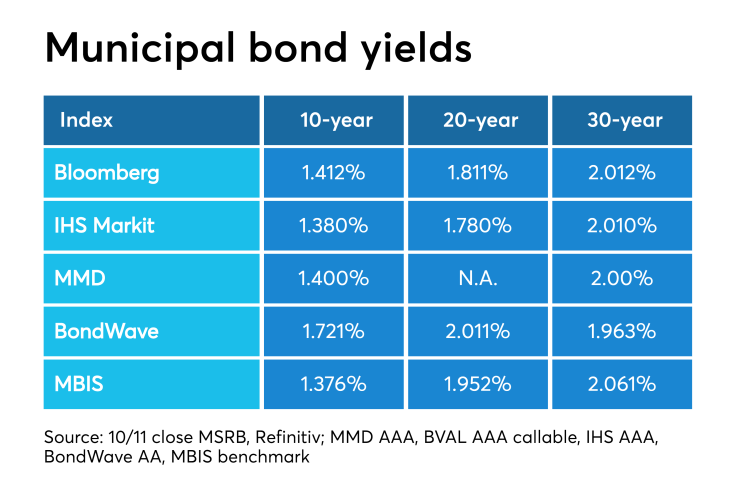

Munis were weaker on the MBIS benchmark scale, with yields rising by one basis point in the 10- and 30-year maturities. High-grades were also weaker, with yields on MBIS AAA scale rising by one basis point in the 10-year maturity and by two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GOs rose one basis point to 1.41% and 2.01%, respectively.

“The ICE muni yield curve is up two to three basis points,” ICE Data Services said in a market comment. “Tobaccos are unchanged, while high yield is up one basis point. Taxables are mixed. Puerto Rico is unchanged while the 8% bellwether GO bonds are up 3/8 point.”

The 10-year muni-to-Treasury ratio was calculated at 79.4x% while the 30-year muni-to-Treasury ratio stood at 89.7%, according to MMD.

Stocks were higher as Treasuries were weaker. The Treasury three-month was yielding 1.674%, the two-year was yielding 1.622%, the five-year was yielding 1.595%, the 10-year was yielding 1.763% and the 30-year was yielding 2.228%.

“Chinese officials threw cold water on the optimism about Donald Trump’s first phase trade agreement, as they said to be willing to discuss more before signing a deal,” Ipek Ozkardeskaya, Senior Market Analyst at London Capital Group, wrote in a Tuesday market comment. “This is of course just a game of power. The latest trade metrics in China suggest that the emerging market giant also has growing interest in strengthening its trade ties with the U.S.”

Previous session's activity

The MSRB reported 25,280 trades Friday on volume of $8.86 billion. The 30-day average trade summary showed on a par amount basis of $11.16 million that customers bought $6.03 million, customers sold $3.24 million and interdealer trades totaled $1.89 million.

New York, California and Texas were most traded, with the Empire State taking 14.745% of the market, Golden State taking 12.461% and the Lone Star State taking 10.531%.

The most actively traded securities were the New York Metropolitan Transportation Authority Series 2019E BAN 4s of 2020, which traded 78 times on volume of $66.32 million.

Last week's activate traded issues

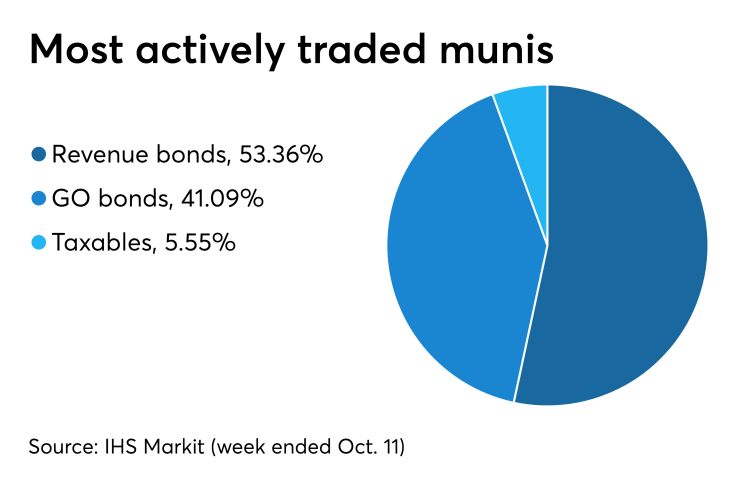

Revenue bonds made up 53.36% of total new issuance in the week ended Oct. 11, down from 53.66% in the prior week, according to

Some of the most actively traded munis by type in the week were from New York, Ohio and District of Columbia issuers.

In the GO bond sector, the New York City 4s of 2044 traded 42 times. In the revenue bond sector, the Hamilton County Hospital Facilities Authority, Ohio, 5s of 2049 traded 33 times. In the taxable bond sector, the District of Columbia Water and Sewer Authority 3.207s of 2048 traded 43 times.

Last week's actively quoted issues

California bonds were among the most actively quoted in the week ended Oct. 11, according to IHS Markit.

On the bid side, the California taxable 7.55s of 2039 were quoted by 19 unique dealers. On the ask side, the Los Angeles Metropolitan Transportation Authority revenue 5s of 2044 were quoted by 125 dealers. Among two-sided quotes, the California taxable 7.5s of 2034 were quoted by 11 dealers.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.