In the middle of Lake Washington just across a bridge from Seattle sits a triple-A rated city that is sounding the alarm bells about its budget.

That municipality is Mercer Island, Wash., and it displays no signs of fiscal distress. Its economy hasn’t failed. Its jobs haven’t fled overseas. It’s a wealthy place — among the wealthiest in the nation with a median household income of more than $129,000 according to 2016 U.S. Census Bureau statistics. Yet the city has said it may have to slash services or terminate as much as 25% of its workforce. Public documents used the phrase “Houston, we have a problem.” Now the city of about 25,000 is in the midst of a public engagement effort and has convened a special committee to fix a looming structural imbalance.

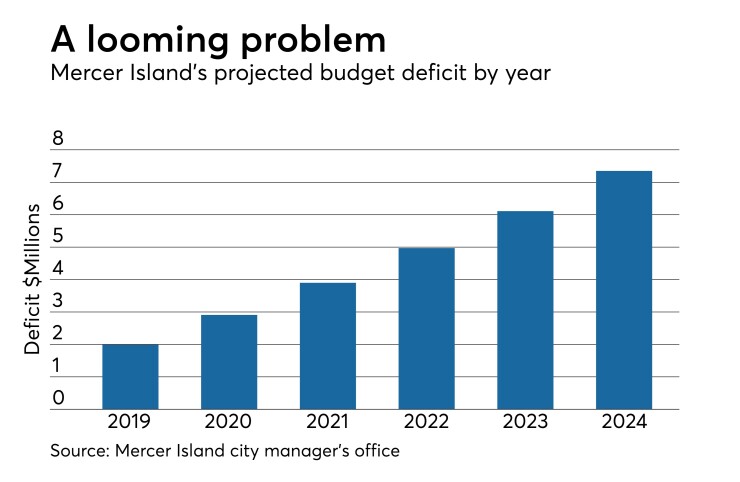

That imbalance, the city said in a series of “frequently asked questions” posted to its website, starts out moderately next year and then grows sharply over the next few years. Beginning in 2019, the city is projecting a nearly $2 million operating budget gap, which is expected to increase to $7.4 million by 2024. The city has reserves, but said it has only managed to balance its budget the last several years because of a variety of fortuitous factors and cost-savings efforts. A flurry of building led to a “significant spike” in construction-related sales tax, accounting for half of the city’s sales tax revenues, for example.

“Simply put, annual revenue growth is not keeping pace with annual expense growth,” the city said in its FAQs. “Why not? The answer is that property taxes, which are the city’s largest revenue source, are capped by state law at 1% growth per year plus an allowance for ‘new construction,’ which equates to another 1% per year on average. As a result, property tax revenue grows only about 2% annually.”

“Expenses, on the other hand, are projected to grow 4-5% annually,” the explanation goes on. The city warns that if the imbalance isn’t addressed, the island’s citizens will feel the effects pretty soon.

“To maintain current service levels, which 80-85% of Island residents believe is ‘about right’ according to prior biennial citizen surveys, a new, ongoing revenue source is needed,” the city said. “Otherwise, significant service level cuts will be required beginning in 2019.”

“Without additional revenue to maintain current city services, the city estimates that 25% of its workforce, or 52 employees, will need to be cut over a 6 year period (2019-2024) to balance the budget,” the city detailed. “Most of the cuts would impact ‘non-essential’ services provided by the Parks & Recreation and Youth & Family Services Departments. However, all city departments would likely be impacted, including police and fire, given the magnitude of the projected deficits in 2019-2024.”

Washington State uses a “levy” system for its property taxes, which means that as property values rise local governments don’t reap a revenue windfall because taxing districts can collect only a set levy capped at that 1% growth. Sharp property tax growth since the end of the Great Recession, the city said, actually resulted in residents paying less: $1.08 per $1,000 of assessed value compared with $1.44 in 2013.

Moody’s Investors Service, the agency that rates Mercer Island, lists the city as stable and affirmed its Aaa rating in July 2017 when Mercer Island was coming to market with a $6.3 million deal. The city had about $17 million in outstanding long-term debt at the end of 2016, according to disclosure documents filed on the Municipal Securities Rulemaking Board’s EMMA website.

Moody’s is aware of the city’s projections, and noted that city officials are confident that voters will improve a “levy lid lift” later this year. While Moody’s noted that the city’s reserve level of $8.1 million or 28.4% of revenues is “somewhat lower than the median for Aaa-rated cities nationally,” the agency believes that fact is “offset by the relative stability and structural balance of the city's finances.”

And indeed, a levy lid lift does appear to be on the table. A levy lid lift, according to the state Department of Revenue, is the means to exceed the 101% levy limit. A district may ask its voters to authorize an amount that exceeds the levy limit or "lift the levy lid."

The taxing district can request a single year lid lift or a multiple year lid lift of up to 6 years, and approval of the lid lift must occur within 12 months of when it will be imposed. The lift is temporary unless the ballot specifically states the resulting levy will be used for future levy limit calculations. According to Mercer Island, a six-year operating levy lid lift would cost the typical homeowner $360 in 2019, an amount that would grow 5% annually to $460 in 2024.

Mercer Island city manager Julie Underwood said the city’s rather somber rhetoric is designed as an alert to citizens who may not be aware that their affluent community faces a budget problem.

“From the surface of anyone looking at it, our lights are on,” Underwood said. “Everything is running pretty well.”

Underwood acknowledged the city’s heavy reliance on property taxes. Mercer Island is a “bedroom community,” she said, filled with commuters who work in neighboring Seattle and Bellevue and lacking enough retail activity to generate meaningful sales tax revenue.

The city has already made all the “invisible” cuts it can, Underwood said, and hasn’t actually even restored all the service cuts it made during the Recession. Residents will see any further service reductions and notice their absence.

“I’ve used all the tools in my toolbox,” said Chip Corder, Mercer Island finance director and assistant city manager. “At the end of the day, our residents have to decide: do we have a revenue problem or an expenditure growth problem?”

Corder said that neighboring Seattle and Bellevue face similar challenges, but have more diversified revenue streams because of the high level of business activities in those cities. As such, they may not have to take action as quickly as Mercer Island does.

The effort kicks off in earnest Jan. 6, when the Community Advisory Group meets to discuss a variety of options for budget balancing, including both different levy lid lift scenarios as well as a service reduction scenario.

Underwood said she will ultimately get a recommendation for the CAG, and she will then make a recommendation to the city council. If the recommendation is a property tax increase, the council would have to put it on the ballot and voters will need to approve it by a simple majority.