Want unlimited access to top ideas and insights?

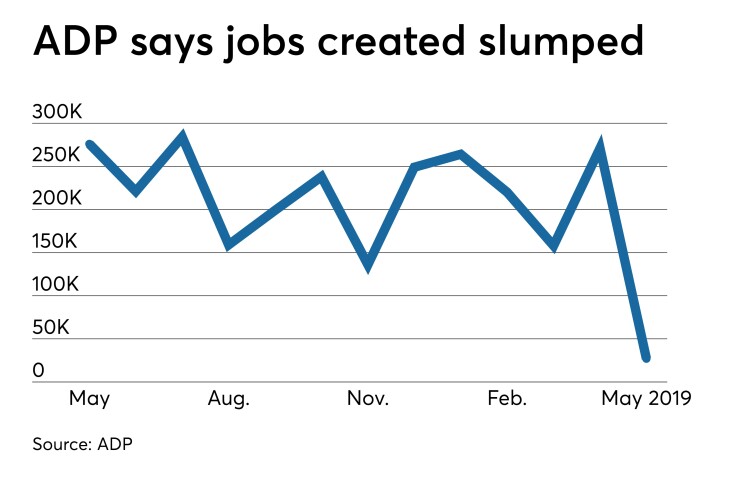

A disappointing read from the ADP employment report overshadowed a positive read on the service sector, fueling market expectations for rate cuts through next year.

“The data doesn’t support as aggressive an approach as the market expects,” Daniel Ahn, BNP Paribas chief U.S. economist and head of markets 360 North America, said at a press briefing Wednesday morning before the numbers were released. BNP expects “subpar growth” this year but no recession, as trade issues cause a “transitory” gain in inflation.

ADP reported a 27,000 rise in nonfarm jobs in May, the fewest since March 2010, after 271,000 were added in April. Economists polled by IFR Markets expected ADP would say 185,000 jobs were added last month.

“The usual caveats about volatile monthly economic data that are subject to revisions hold,” said Berenberg Capital Markets U.S. Economist Roiana Reid. “But amidst escalating trade tensions, additional tariffs, financial market volatility, gloomy business sentiment, the global industrial slump, and sluggish global growth and trade, we are hesitant to fully discount the soft ADP payrolls estimate.”

The Institute for Supply Management's non-manufacturing index rose to 56.9 in May from 55.5 in April, showing expansion has slowed from its pace the past two years.

Federal Reserve Bank of Dallas President Robert Kaplan said it’s too early to decide if a rate cut is needed. “I'd rather be patient and let events unfold a little bit more," he said in a televised interview.

Barry Topf, chief economist at Saga Foundation and former Bank of Israel monetary policy committee member, said “what we need to know is, do we now have a ‘Powell put’ underpinning the markets, with all that implies?”

Powell’s comment Tuesday on the dot plot — questioning whether “transparency adds up to effective communication” — “was a not-so-subtle hint to the market not to put too much weight on the dot plot, rather to regard it as, in his words, ‘the least unlikely outcome,’” Topf said.

At a global markets conference with 500 attendees, BNP polled the audience and found they were split about whether the Fed would cut rates this year, according to Mark Howard, BNP senior multi-asset specialist.

Attendees saw the Fed’s tightening last year and trade issues causing the slowdown in growth this year.

BNP’s Ahn said 3.1% GDP growth is “probably not sustainable” and they expect GDP to drop to a 1.2%-to-1.3% rise in the second quarter before rebounding in the final half of the year. But trade issues won’t lead to a U.S. recession, he said.

There is a 50% chance “of at least a truce” followed by further discussion between the U.S. and China in their ongoing trade war, after the G-20 meeting. But Ahn said a deal “almost doesn’t matter” since “irritants and frictions” in the two nations’ relations could lead to misunderstandings and a “break” in any deal.

There are risks to the U.S. that aren’t discussed but will arise later, Howard said. Some issues conference attendees see include: the possibility of a socialist president in the U.S.; the White House struggling to deal with unforeseen events as a result of recent employee departures; and “concern about the efficacy of monetary policy being able to stimulate growth so late in the cycle.”

The Beige Book

The Beige Book found “modest” economic growth, an upgrade from the “slight-to-moderate” gains in the prior report.

Nearly all districts saw “some growth, and a few saw moderate gains in activity. Manufacturing reports were generally positive, but some districts noted signs of slowing activity and a more uncertain outlook among contacts.”