Complimentary access to top ideas and insights — curated by our editors.

This article is part of The Bond Buyer’s multi-platform series on the future of infrastructure:

In this four-part series, The Bond Buyer looks at the changes this infrastructure moment could bring to landscapes and markets across the nation. It includes four longform feature stories running every other Tuesday for the remainder of 2021, beginning November 16th and concluding December 28th; a four-episode companion podcast series beginning November 30th; and a live video December 28th on our 'Leaders' channel, all hosted by the author.

Like many successful public works projects, the Interstate 40 bridge connecting Arkansas and Tennessee over the Mississippi River has become part of the everyday lives of nearby residents and businesses. Built for $57 million and opened 48 years ago, the bridge is officially named after Hernando de Soto, the Spaniard who explored the area around what is now Memphis and became the first European to see the Mississippi River.

Locals, though, call it the "M" because its arches are shaped like a double hump, and have contributed millions in private donations to light its distinctive curves and cables. By the spring of 2021, an average of 41,000 vehicles per day were crossing the six-lane bridge. Twenty-nine percent were commercial trucks, making the span into and out of FedEx's hometown the third-busiest freight corridor in the country.

But on May 11, inspectors conducting a routine check found a huge crack in a 900-foot horizontal beam supporting the bridge — presaging a potentially "catastrophic event," according to the head of the Arkansas Department of Transportation. Examiners called 911 to clear the de Soto, and officials shut it down completely.

Traffic along the river clogged immediately. Within a day, 16 tugboats pulling more than 220 barges idled at the bridge, part of a backup that stretched more than 18 miles to the north. Drivers crossing the river mostly tried diverting three miles south to the Memphis & Arkansas Bridge, a four-lane span along Interstate 55.

That has a local nickname, too: the "Old Bridge," because it was built more than 70 years ago. Before the closure, the Old Bridge was already conveying 46,000 vehicles a day, including about 14,000 trucks. It couldn't handle many more, and essentially dammed the new traffic. Commutes that normally took eight minutes suddenly lasted nearly an hour and a half, according to GPS data from the Arkansas DOT.

Engineers weren't sure why the beam split on the M. "The root cause of mechanical failure can be overload, shock, fatigue or stress," according to a Tennessee DOT statement. As with human bodies, it's often hard to pin down an exact cause for a bridge breaking down when the root problem is really old age.

"There is something called fatigue failure," Adel Abdelnaby, an engineering professor at the University of Memphis, told the local press. "It starts to crack with time."

As crews installed a series of 30-foot-long, three-ton repair plates on the de Soto Bridge, the costs of simply getting it back to its former operating condition began to pile up. Not just the materials and labor for the structural fix, but also the price of operating trucks slowed to a crawl (an average of $1.20 per minute), the reduced number of freight loads those trucks could carry, the time wasted by jammed commuters, the dangers of emergency vehicles stuck in traffic, the gasoline guzzled and greenhouse-gas-laden fumes belched by all of them.

The shutdown made big headlines for a couple of days, then receded from national attention. Local citizens made do for 10 long weeks, until the bridge reopened on Aug. 2.

"People around this area are used to lane closures," said DeWayne Rose, the director of emergency management in West Memphis, Arkansas. "They're used to construction, they're used to shutdowns."

There's no doubt about that — it's characteristic, not unique. If the de Soto Bridge crack hadn't been discovered in May, something disastrous could easily have happened — and likely will — at another place in Arkansas, where just 30% of roads are in good condition, according to the American Society of Civil Engineers (ASCE). Or Tennessee, where the proportion of bridges in good condition has dropped by 11 percentage points to 42% in just the past four years. Or, for that matter, in California, which is home to 11 structurally deficient bridges that carry more than 200,000 people every day, according to the American Road and Transportation Builders Association.

Of course, fatigue failure affects all kinds of physical connections, not just bridges. And it's exacerbated by natural disasters. This year has seen frozen and burst pipes leaving residents of Jackson, Mississippi, without water for a month, wildfires choking drivers and roiling traffic in Oregon and stormwater floods leading to at least 30 deaths in New York and New Jersey.

Crisis after crisis, across systems and around the country, adds to the heavy toll Americans have grown accustomed to paying as infrastructure springs chronic leaks. (Literally: Drinking water networks in the United States lose almost six billion gallons of treated water a day.)

*

But a new chapter in the story of U.S. infrastructure is at hand, because major shifts are coming to how it's financed and funded. After years where the phrase "infrastructure week" had become a punchline about federal inactivity, President Joe Biden made funding public projects a top priority of his 2020 campaign agenda. And in August, the U.S. Senate passed the bipartisan Infrastructure Investment and Jobs Act (IIJA), which promised a $550 billion infusion of new cash into the sector. And although tortuous negotiations dragged into November, the House of Representatives followed suit.

Infrastructure — finally — is having a once-in-a-generation moment. Capital spending in the United States will soon rise dramatically. The mix of funded projects will shift considerably. State and local governments, which build three-fourths of the nation’s infrastructure, may rev up municipal debt issuance, the key engine for leveraging federal money and accelerating long-term investment. Hilltop Securities, leading municipal advisory and broker-dealer firm, has even suggested a “golden age of public finance” is at hand.

We will dive into all of those subjects in The Bond Buyer series "Build What Better?" And to kick things off, here's a primer on the state of play in American infrastructure and the changes coming to landscapes and markets across the nation.

*

Keen observers have been worried for decades about this country's capital investments. Back in 1983, economist Pat Choate and planner Susan Walter wrote one of the earliest warnings, a book called America in Ruins: The Decaying Infrastructure. They were on to something that's even more true today: Many of America's most important public projects were created generations ago by designers who couldn't have imagined so many people using them so heavily for so long, and are wearing out faster than they're being replaced.

For instance, since construction of the Interstate Highway System started 65 years ago, the population of the United States has doubled, the number of vehicles in the U.S. has increased by 357% and vehicle-miles driven have quintupled, according to TRIP, a transportation research group. Roads that conveyed 626 billion miles of travel when they were first built are now handling more than 3.2 trillion miles of traffic. "The Interstate Highway System has a persistent and growing backlog of physical and operational deficiencies as a result of age, heavy use and deferred reinvestment," according to a 2019 report by the Transportation Review Board, a division of the National Academies of Sciences, Engineering and Medicine.

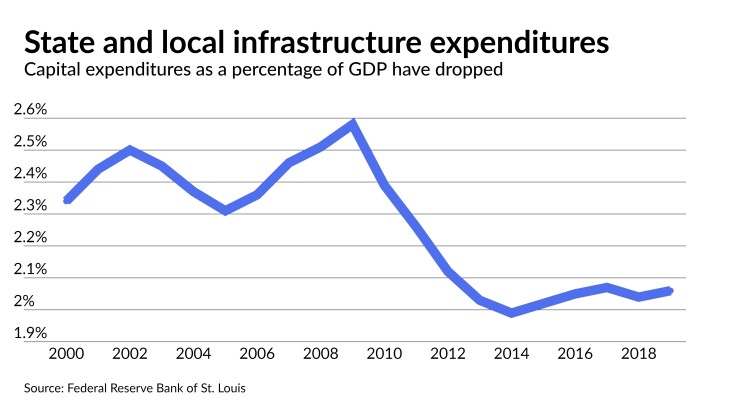

"Deferred reinvestment" is a polite term for cutting funding to infrastructure projects, which reached an inflection point about a dozen years ago. State and local governments account for about three-quarters of all infrastructure spending in the U.S. And from 1990 to 2008, their combined capital expenditures rose fairly steadily at an average of about 2.8% a year after adjusting for inflation, according to data from the Federal Reserve Bank of St. Louis. But as the country emerged from the Great Recession, public investment didn't keep up with the national economy. Instead, states and municipalities began slashing their infrastructure budgets. Capital spending plunged 15% in real terms by 2014, and even today hasn't recovered to its 2008 level.

This decline partly stems from harsh choices state and local governments started to face in the 2000s. From 2000 to 2010, their pension obligations nearly doubled, to about 7% of revenues, and the rising cost of employee health benefits put even more pressure on their operating budgets, which most municipalities have to balance every year. States didn't get the help they expected from gas taxes, either. Nationwide, after adjusting for inflation, collections actually declined in the 2000s — further eroded, ironically enough, by increasing fuel efficiency.

State houses and city halls came under further assault by the financial collapses of 2008. And though a popular Obama-era initiative called Build America Bonds (BABs) paid municipalities directly to issue taxable bonds to fund infrastructure, that program ended in 2010. For all of these reasons, state and local governments pulled back from borrowing to pay for big projects. The aggregate annual issuance of new state and local bonds, which used to average around 2% of U.S. GDP, dropped by half in 2011. And even as interest rates have fallen to historic lows, it hasn't hit 2% again, despite record sales in nominal terms of muni bonds over the past couple of years.

Politics, of course, has played an important role in keeping infrastructure spending down. The United States has always had its anti-tax activists, but 2009 marked the rise of the Tea Party movement, which organized with particular ferocity. Over the following three national election cycles, Republicans gained 13 seats in the U.S. Senate, 69 in the House of Representatives and a whopping 913 in state legislatures, giving them control of Congress and full control of 23 states. GOP officeholders have put forward various infrastructure plans in recent years. But there's no getting around the fact that the 2010s brought to power many elected representatives who passionately opposed paying for any Democratic-flavored initiatives, such as climate-change mitigation, light rail or mass transit — and who often saw debt financing as just another tax. As just one example, under a Democratic governor in 2012, Maryland began requiring its 10 biggest jurisdictions to charge fees to fund stormwater management programs. Opponents branded the concept a "rain tax," and fought it for three years until the fees were made voluntary under a newly elected Republican.

All of these factors have combined to build a cumulative gap of nearly $1 trillion between where infrastructure investment is today and where it would have been had the earlier trend line continued after 2009, according to an August report by Breckinridge Capital Advisors. And that has accelerated the need for better funding. ASCE, which regularly analyzes American infrastructure across 17 categories, estimated in March that to get it all into good repair would take almost $2.6 trillion over the next 10 years, up from $2.1 trillion in 2017.

It's fair to look critically at those enormous numbers, since they're derived from and published by sources that would benefit from more infrastructure planning. (The more construction, the better for engineers and builders.) And there's some underappreciated good news beneath the staggering top lines. One example: water utilities, possibly spurred by the disastrous contamination of Flint, Michigan, planned to replace more than 12,000 miles of pipes last year, and are increasing their use of advanced technology, including sensors and machine learning, to identify problems inside their systems.

Moreover, highway and traffic agencies have paid sustained attention to bridge safety ever since the US-51 Bridge in Tennessee collapsed in 1989, killing eight people and compelling the federal government to mandate regular inspections, and their long-term work has paid off. The number of structurally deficient highway bridges in the United States declined steadily from about 112,000 in 1992 to about 52,000 (or 8.5% of all such bridges) in 2019, according to an analysis of federal data by the Antiplanner blog. And while 97,000 highway bridges were functionally obsolete in 1992 — meaning aspects of their design, such as clearances or entry or exit angles, no longer met contemporary requirements — that number dropped, too, to 84,000 (13.6%) in 2019.

Overall, though, these efforts are just not enough to keep up with wear and tear. Here's how we can tell objectively: Since 1999, state and local governments have had to issue annual reports that include details about their capital assets. Examining these reports reveals the average age of an entity's property, plant and equipment (PPE), a measure analysts also call its capital plant ratio. Of course, municipalities around the U.S. maintain widely varying mixes of public projects. But as a July report by Merritt Research Services puts it: "Calculating the capital plant ratio, which largely incorporates infrastructure, provides a useful signal that indicates whether fixed assets are depreciating at a faster pace than new funds are helping restore or upgrade the value of the asset." Simply put, if the capital plant ratio increases, infrastructure is getting older and necessary repairs and replacements aren't keeping up.

Which is exactly what's happening. Merritt tracks audits around the country, and the average age of PPE has increased in every sector of infrastructure. Airports were an average of 4.4 years older in 2020 than they were just 10 years earlier, for example, and water and sewer systems were 2.3 years older. Over the same 10-year span, average age also advanced by 3 to 3.6 years at every level of government — in states, cities, counties and school districts. This very broad measure shows it's right to worry that decay is advancing systemically throughout American infrastructure.

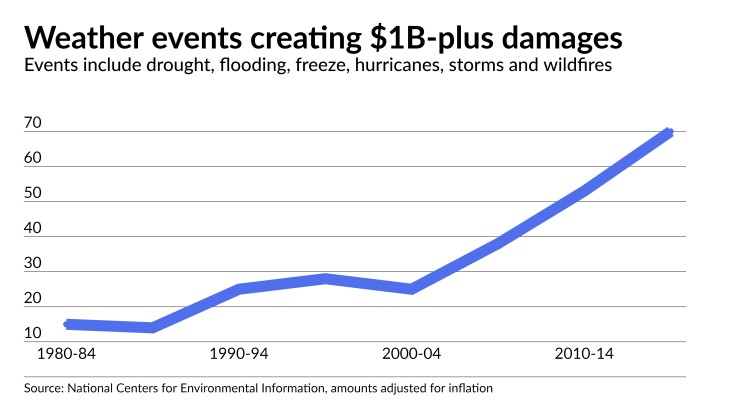

But wait, as infomercials will tell you, there's more. For many infrastructure systems, past maintenance needs no longer serve as reliable guideposts to future requirements, because climate change is making weathering effects more severe. Over the past five years, the United States has been hit by 81 weather- or climate-related disasters causing at least $1 billion in damages, almost as many as the country sustained during the entire period from 1980 to 1999 (even after adjusting for inflation), according to the National Centers for Environmental Information. 2020 topped them all, with 13 severe storms, seven cyclones, a wildfire and a drought.

Consider just one hidden but scary chain of events: As air warms, it holds more water, leading to heavier rain, which not only threatens coastal and urban areas but leads to more river flooding, and rushing water carries sand and soil away from the foundations of bridges. This is called "scour," and it already causes about half of all bridge collapses. And as long as temperatures keep rising, the need to detect and fight scour will, too. As Peter Orszag, former director of the federal Office of Management and Budget, has written, "So while it's true that the share of bridges in poor condition has fallen, maintaining current quality scores and avoiding unnecessary bridge collapses will require more spending in the future."

The mismatch between America's infrastructure bills and its payments has become so severe that it's impossible to ignore. "The current state of our nation's infrastructure has become a matter of national security," says Jeffrey Lipton, head of Municipal Credit and Market Strategy at Oppenheimer & Co. "We are seeing the effects of a wakeup call. Something bold and broad-based needs to be done. And there needs to be more in the way of a federal contribution to our infrastructure deficit."

*

"There's a new bargain," President Biden said while pitching his economic program this spring. "Everyone is going to be in on the deal this time." Harking back to the days when the federal government connected millions of Americans to electricity under Franklin Roosevelt and highways under Dwight Eisenhower, Biden made clear that infrastructure is central to his we're-all-in-this-together vision. "We've neglected that kind of public investment for much too long," he said.

Senate negotiators whittled down the administration's original spending plans over the summer. Still, the White House is correct to claim the IIJA marks a vastly bigger commitment to infrastructure than the federal government has made in decades: $550 billion of new spending over the next five years. That includes the largest investments in bridges since the creation of the Interstate Highway System in 1956 and in passenger rail since the Amtrak launched in 1971, and the largest ever in public transit and drinking water systems, among many other provisions.

Throughout this series, we will explore just what that money will buy. First, though, it's also important to understand what the new law doesn't contain: much in the way of dedicated future revenues to infrastructure. It covers its new costs with one-shots, like redeploying unused pandemic assistance, and accounting legerdemain, such as allowing corporations to smooth the interest rates they use to calculate contributions to their pension funds. It also transfers $118 billion for the Treasury to bail out the Highway Trust Fund, which pays for most federal surface transportation spending and was on track to run out of money by the end of this year. But it leaves the federal tax on gasoline at 18 cents a gallon, where it has sat since 1993.

So the IIJA will go a long way toward closing the nation's annual infrastructure funding gap while it's in force. But without additional guaranteed revenues, Washington will fight all over again in 2026 about whether and how to keep the elements of the IIJA alive. That will leave many projects highly vulnerable to mid-stream cutoffs. After all, what good is an electric-vehicle charging network that's only partially connected after five years, or a one-sided bridge? "This is a good bill in terms of capital expenditures," says Adam Stern, co-head of research at Breckinridge. "A lot of projects that have been on a back burner are going to get accelerated because of this money. But I don't know what happens after five years to change the equation. Americans just don't like to pay for infrastructure."

Over the long haul, the IIJA's impact is going to hinge on how much it can spur further, sustainable investment, specifically state and local capital spending and debt issuance. The IIJA will change the course of American infrastructure to the extent it can shift conditions, financial as well as political, so that appropriators leverage more federal aid, investors participate in bigger, broader municipal market and the legislation becomes a new baseline rather than a moonshot.

The new revenue streams it will provide, gushing as they are compared with current levels, don't actually offer much hope for that. The IIJA directs $73 billion to the power grid, $66 billion to passenger and freight rail and $50 billion toward resilience, or making infrastructure more resistant to climate change and cyberattacks. Combined, that totals more than one-third of the IIJA's $550 billion in new federal spending. And private utilities, (for the most part) Amtrak and the Army Corps of Engineers don’t issue tax-exempt bonds.

That leaves about $360 billion that the IIJA will send to state agencies and programs, including $110 billion in additional funding for roads, bridges and highway projects; $65 billion for broadband; $55 billion for drinking and waste water systems; $39 billion for public transit; $25 billion for airports, $17 billion for ports; and $15 billion for EVs. This is money state and local governments could use or borrow against to augment their capital investment.

But if history is any guide, they will probably do so fairly conservatively. For one thing, when federal dollars arrive, municipalities gain flexibility and tend to shift priorities. CBO research indicates that for every extra $100 of federal spending on infrastructure, total spending rises by just $85; state and local governments use the rest to plug other needs.

Further, in places where priorities, habits or culture resist adding debt, it can be hard even for nine-digit grants to spark more borrowing. As an extreme example, Pennsylvania's Clean Water and Drinking Rater Revolving Funds received nearly $100 million of federal capital assistance in 2020 but issued no municipal bonds, according to a July report by the journal Water Finance and Management. In contrast, nearby Ohio leveraged $117 million of water aid into $945 million of bonds.

"It's going to depend, state to state," says Kenneth Bentsen, president of the Securities Industry and Financial Markets Association. "Many states have infrastructure concerns. But if some of the federal money can backfill projects they otherwise would have had to use either general revenues or bonding on, they could redirect their state or local money to pension obligations, or health care issues."

Some provisions of the IIJA probably will boost capital markets on a smaller scale. The new law expands the Transportation Infrastructure and Innovation Act (TIFIA), which provides federal loans, guarantees and lines of credit, to airport projects, expands its analogue WIFIA (for water) and creates a new CIFIA (for carbon-capture). Lending programs such as these typically don't cause the kind of offsets by state and local governments that outright grants seem to trigger.

But two moves that would have directly stimulated the municipal-bond market are off the table entirely. Muni issuers wanted the Biden administration to restore the ability of issuers to use tax-exempt bonds to advance refund outstanding tax-exempt debt,, a bond refinancing tactic outlawed by the Trump tax cut package in 2017. And many infrastructure advocates were hoping for a new version of BABs. The former would have freed up bonding capacity; the latter would have encouraged broader investment in taxable bonds. But they never made it into the IIJA. And they've been stripped from the spending framework Biden announced in October (details of which the House of Representatives is still negotiating), apparently to save the federal government about $3.7 billion a year.

Overall, there's little chance that by itself, the new legislation will return enough clout to municipal bonds to build back America. Instead, it is sure to play a massive near-term role in what has become an ongoing nationwide tug of war over infrastructure, where increasing demand for refurbishment, repairs and new projects keeps struggling to pull new issuance into supply. Morgan Stanley strategists led by Michael Zezas wrote three years ago about "a gravitational pull toward a public policy-driven upward shift in infrastructure spending in the coming years." The need is even greater and interest rates are even lower today. But it's still very much an open question whether proponents of investment have actually turned a corner against the forces of austerity — and the answer will be driven in large part by the performance of projects funded by the IIJA.

In March, Sen. Pat Toomey, R-Pennsylvania, announced he was adamantly opposed to reviving Build America Bonds or any similar funding for infrastructure. "I do not support misallocating billions of dollars to incentivize potentially unworthy projects," he told CNBC, "and to encourage insolvent or irresponsible state and local governments to take on even more debt."

On the other hand, 46 billion-dollar storms, 18 hurricanes and seven floods have struck the United States over the past five years, killing 3,677 Americans and causing a total of $587 billion in damage, and in the time it has taken you to read this story, half a dozen water mains around the country have ruptured.

A new vision of infrastructure will truly arrive in America if and when "bailing out" carries a new primary meaning for voters, lawmakers and investors.

*

Coming November 30: Part Two of our “Build What Better?” series explores 10 significant projects around the U.S. that the new infrastructure bill could fund or finance.