-

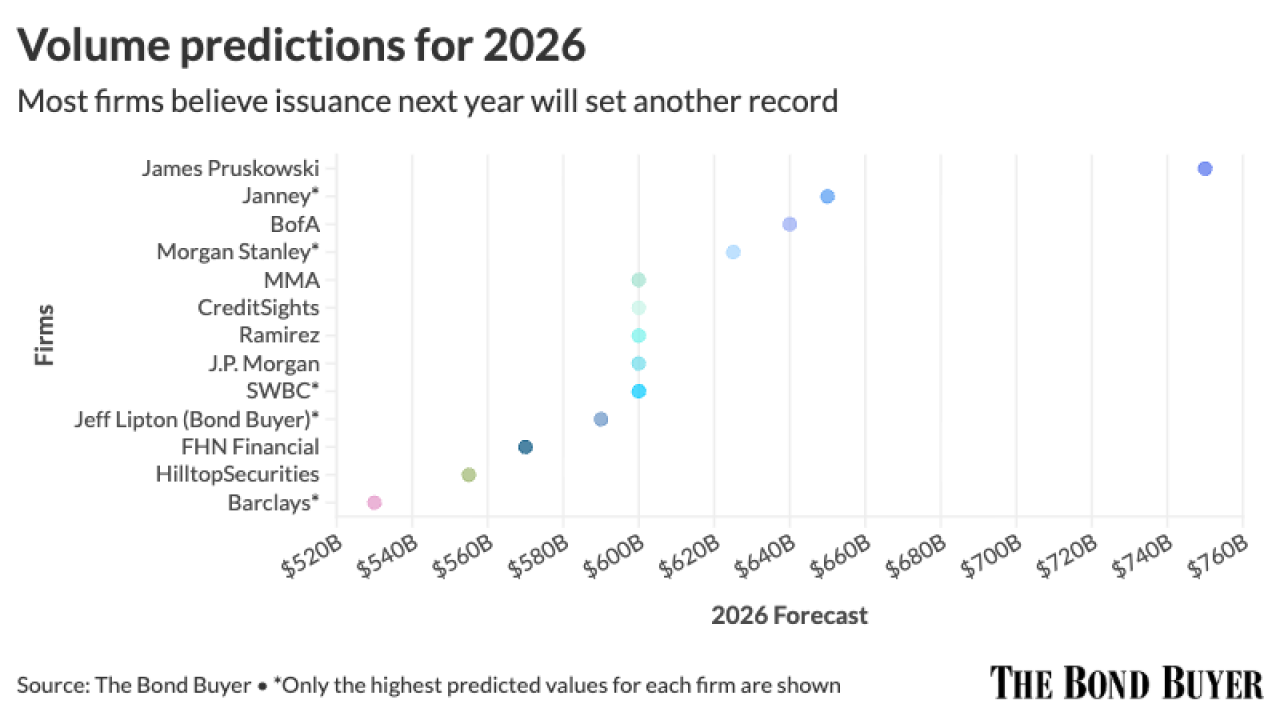

Municipal bond supply projections for next year range from a high of $750-plus billion to a low of $520 billion, with most firms expecting issuance to hover around $600 billion, easily surpassing 2025's record.

December 10 -

Omaha Public Power District will go to market the week of Jan. 5 with about $164 million of Series 2026A separate electric system revenue refunding bonds.

December 9 -

While muni returns moved lower last week, year-to-date returns still hover around 4%, said Jason Wong, vice president of municipals at AmeriVet Securities.

December 9 -

Concerns about Brightline have dragged down performance in the high yield sector this year.

December 9 -

Issuers mostly avoided pricing deals in the previous weeks the Fed met this year, but that's not the case this week, said Pat Luby, head of municipal strategy at CreditSights, and Wilson Lees, an analyst at the firm.

December 8 -

States face broadening credit challenges, and while local governments have shown resilience, school districts are more at risk, S&P Global Ratings said.

December 8 -

This is the first upgrade of bonds supported by assets currently or formerly in the Puerto Rico government's hands since the passage of PROMESA in 2016.

December 8 -

Investors are about to get a chance to buy bitcoin-backed municipal bonds. It won't be the last, according to the team behind the New Hampshire-based deal.

December 8 -

The tax-exempt muni market has performed "exceptionally well" so far this week, outperforming USTs, said J.P. Morgan strategists led by Peter DeGroot.

December 5 -

The Regents of the University of California will sell $2 billion of bonds next week after yanking a $1.5 billion summer deal amid Trump administration threats.

December 5