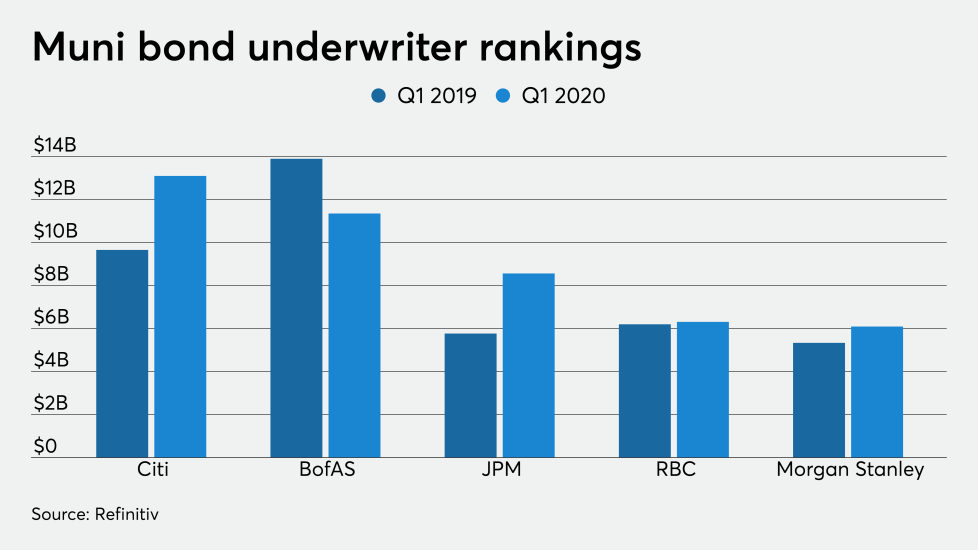

Municipal bond underwriters did the majority of business during the first two months of the year, before COVID-19 swept the country with sickness and severe spreading. The top underwriters accounted for $87.84 billion of bonds throughout 2,119 transactions, compared to $75.84 billion in 1,809 deals in first quarter of 2019.

Citi sits at the top

Bank of America dethroned

BofAS wrote $11.35 billion or a 12.9% market share, compared to $13.89 billion and 18.3% share of the market.

JPM moves up

RBC slides one spot

The firm was responsible for $6.31 billion over 127 transactions — the most of all firms in the top ten — and a 7.2% market share. Those numbers are compared to $6.17 billion and 8.1% share of the market.