Want unlimited access to top ideas and insights?

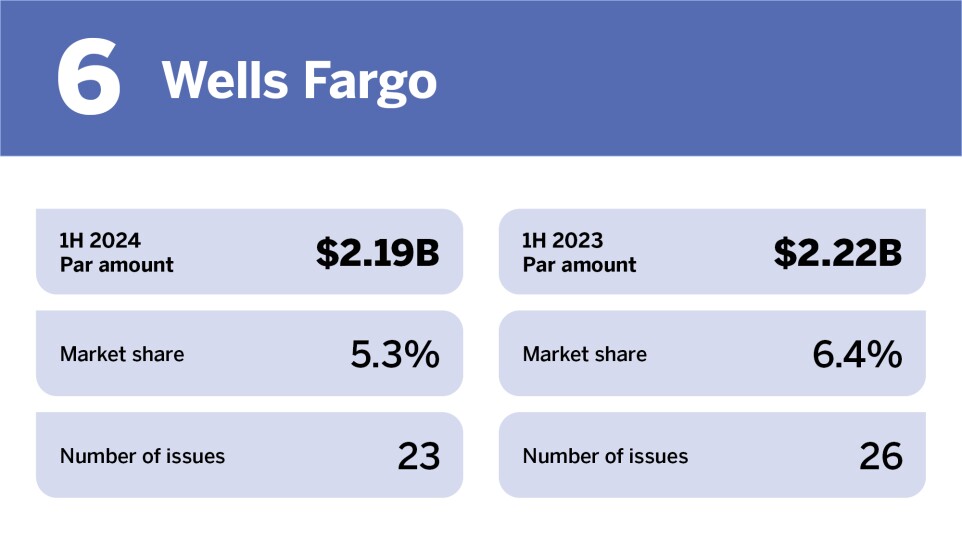

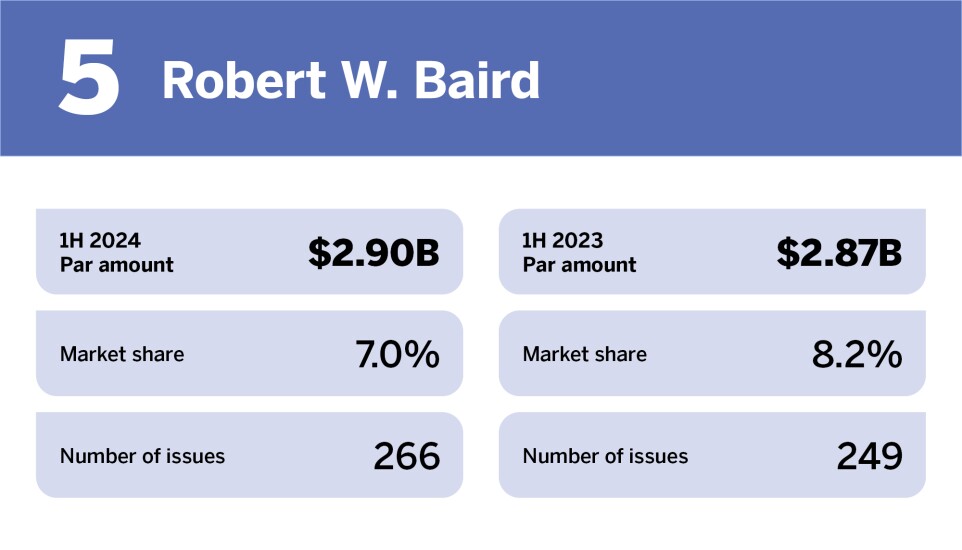

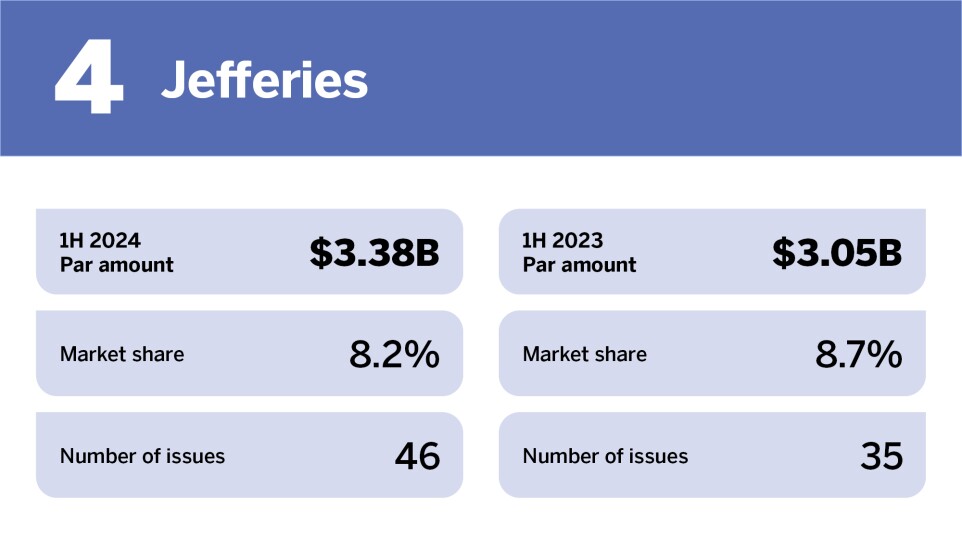

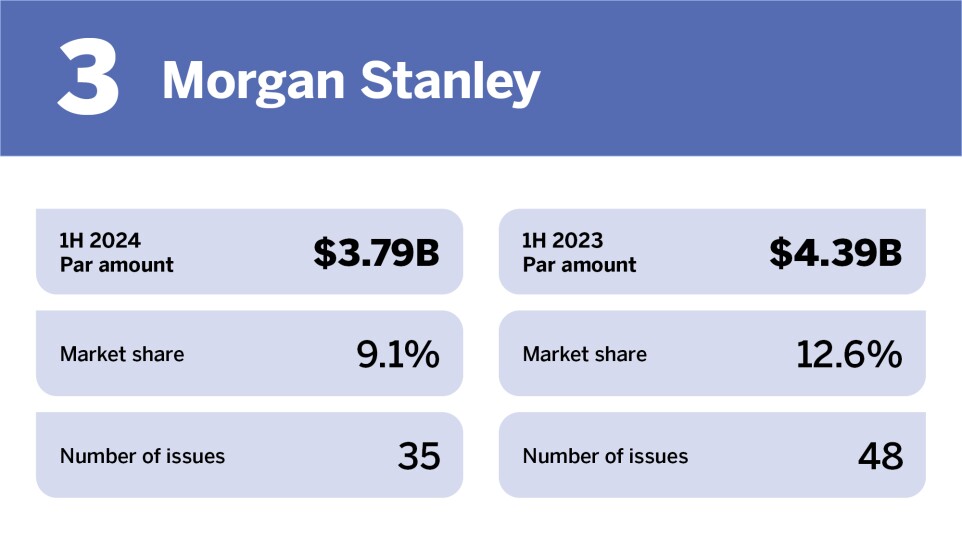

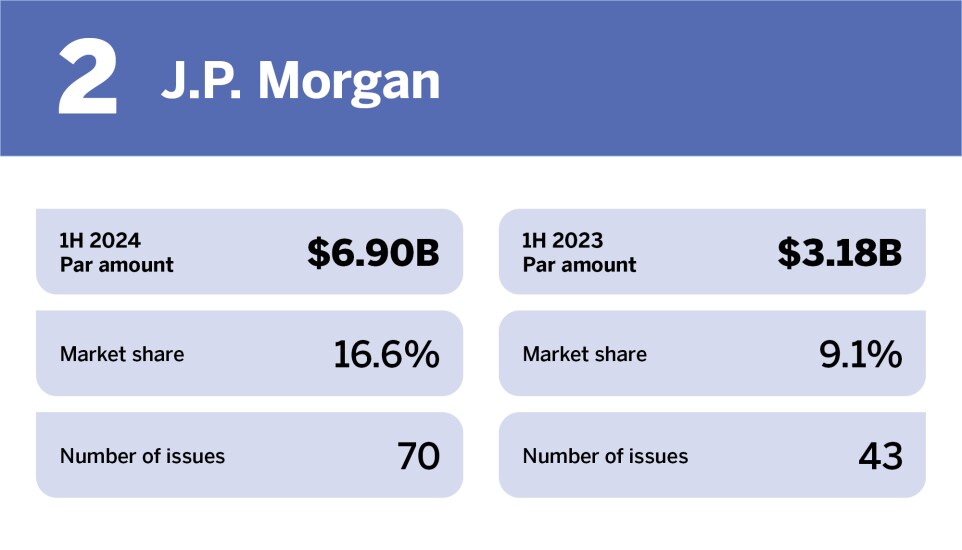

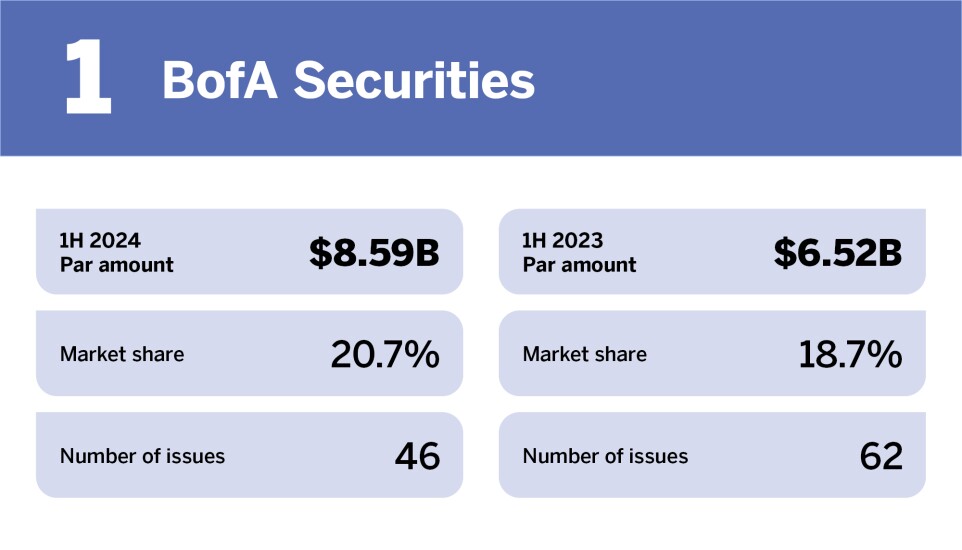

Competitive underwriting rose in 1H, increasing to $41.467 billion in 1,668 deals from $34.945 billion in 1,569 deals, according to LSEG data.

The market share of competitive underwriting also grew to 17.5% from 14.7%.

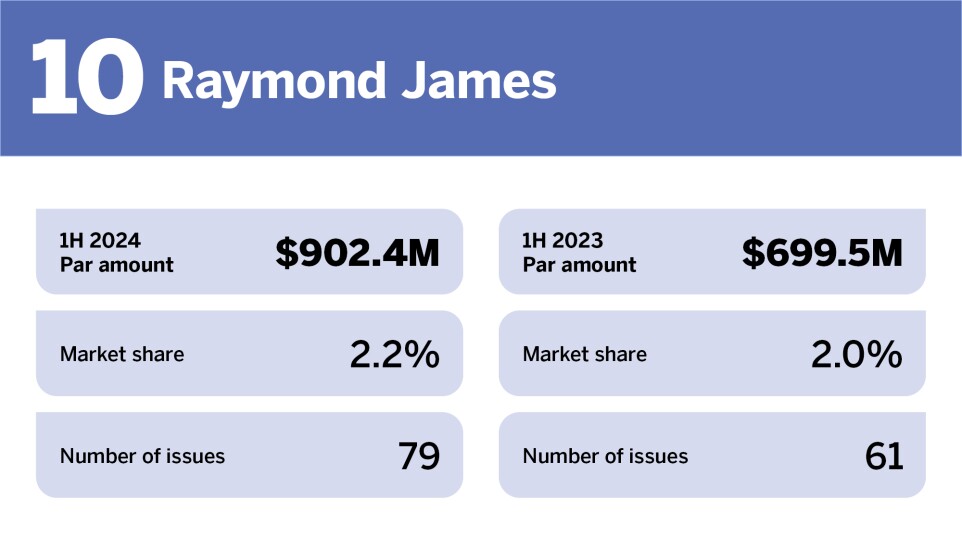

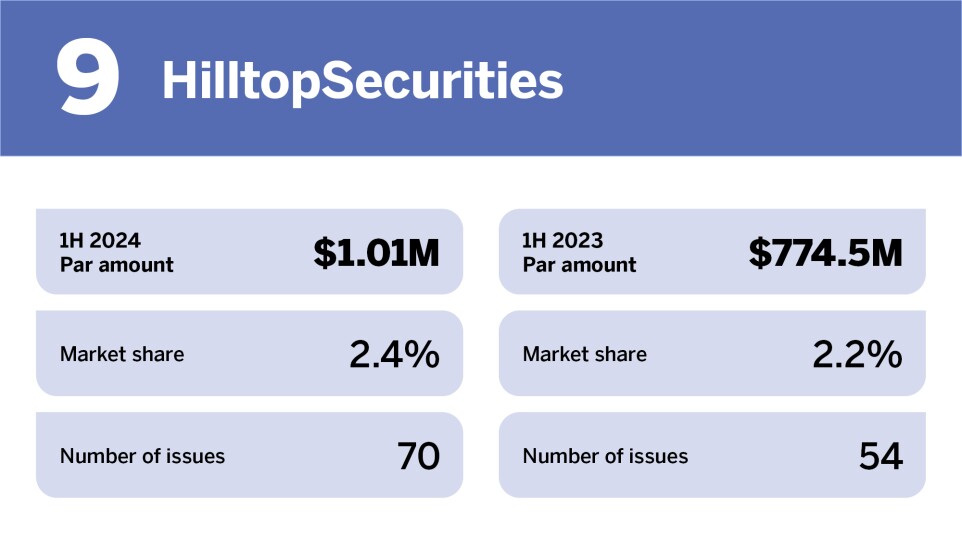

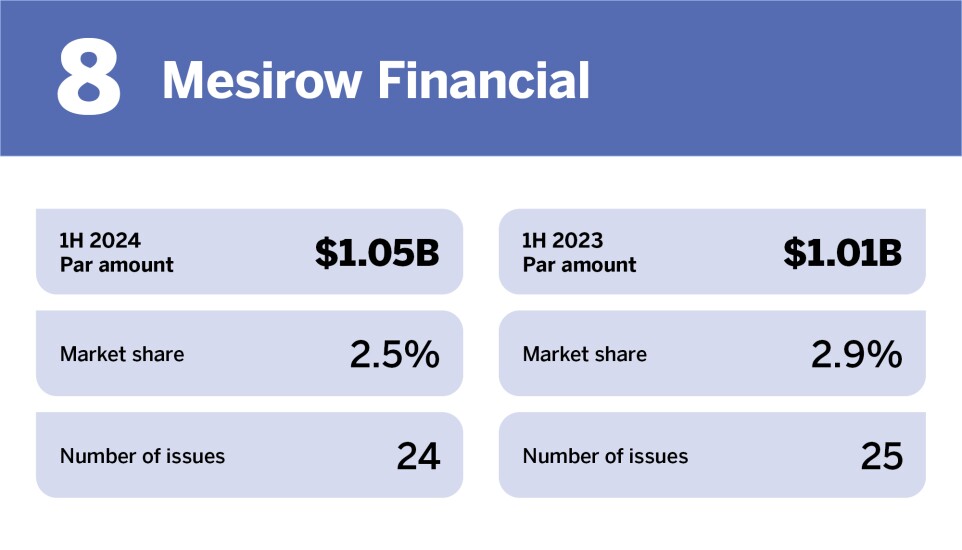

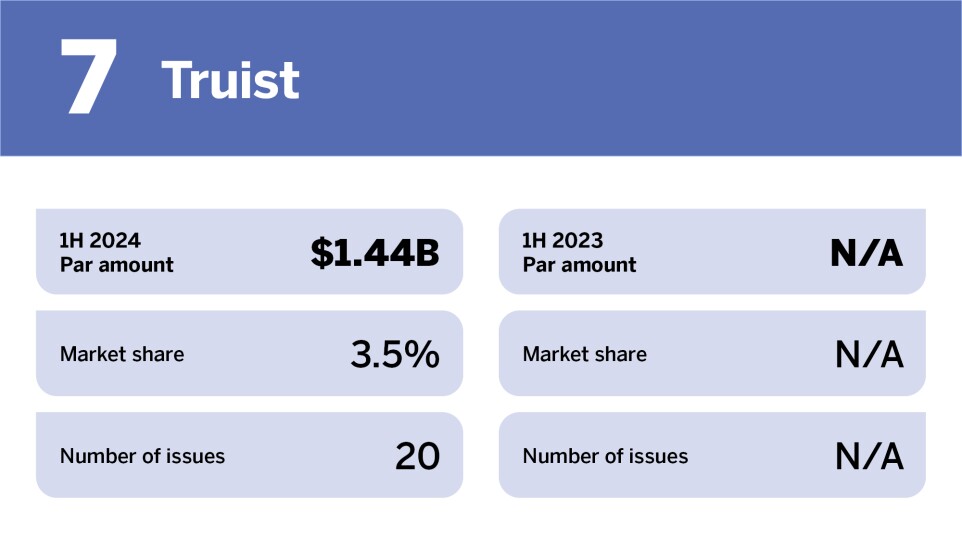

The top 5 competitive underwriters remained in the same rankings as in 1H 2023, while there was some shuffling with the remaining Top 10.

Truist and Raymond James entered the Top 10, bumping RBC Capital Markets and Citi, which announced its exit from the muni market at the end of 2023.

Source: LSEG