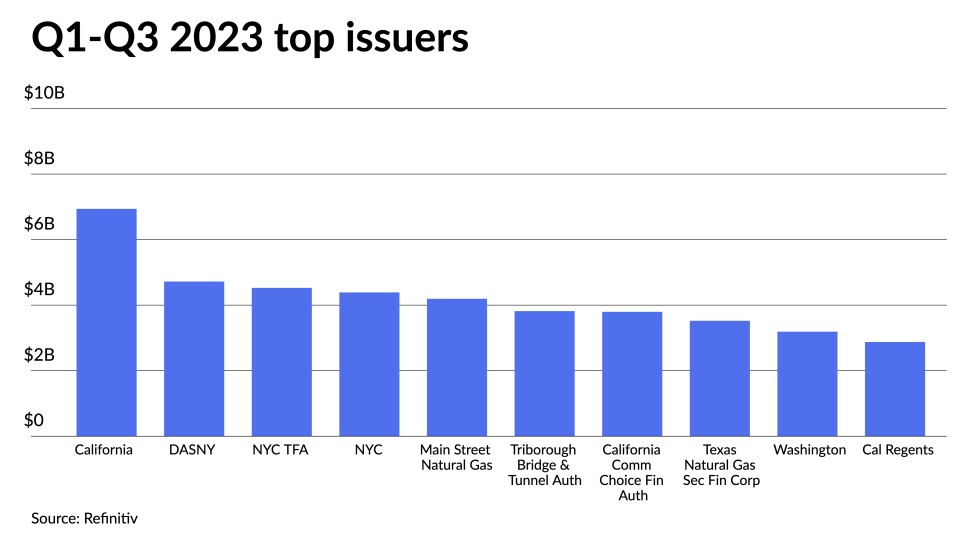

California headlined the top 10 issuers in the first three quarters of 2023.

Three new issuers entered the top 10 — Main Street Natural Gas, the California Community Choice Finance Authority and the Texas Natural Gas Securitization Finance Corp. — as Massachusetts, the Louisiana Local Government Environmental Facilities and Community Development Authority and the New York State Thruway Authority were bumped out of the top 10.

Still, the top 10 issuers are mostly from just two states, with four from New York and three from California.