Of the $227.938 billion of par issued, municipal financial advisors saw $227.626 billion of business in 4,134 transactions in Q1-Q3 in 2023. This is down from the $249.137 billion in 4,820 deals over the same time period in 2022, out of a total of $249.168 billion.

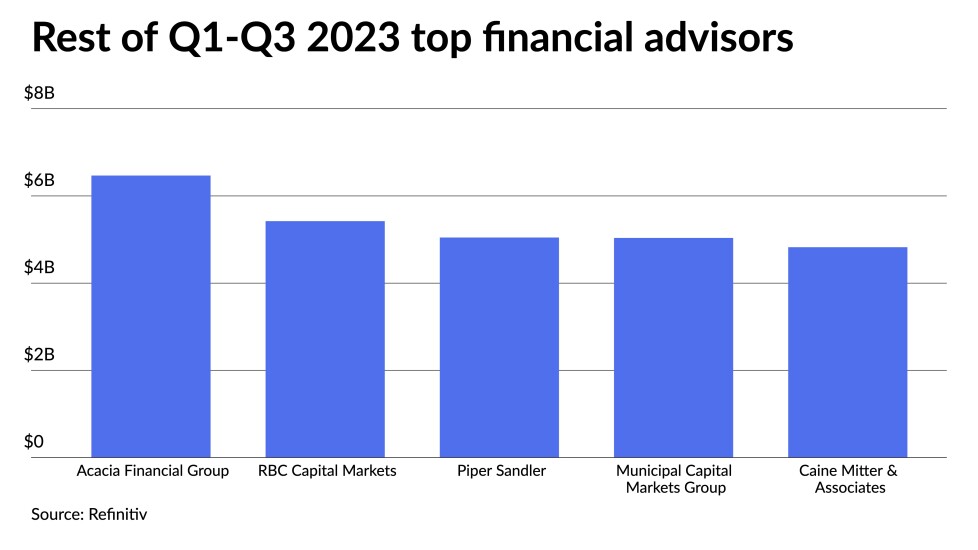

RBC Capital Markets and Caine Mitter & Associates moved into the top 10, while CSG Advisors and Kaufman Hall & Associates were bumped to the top 15.