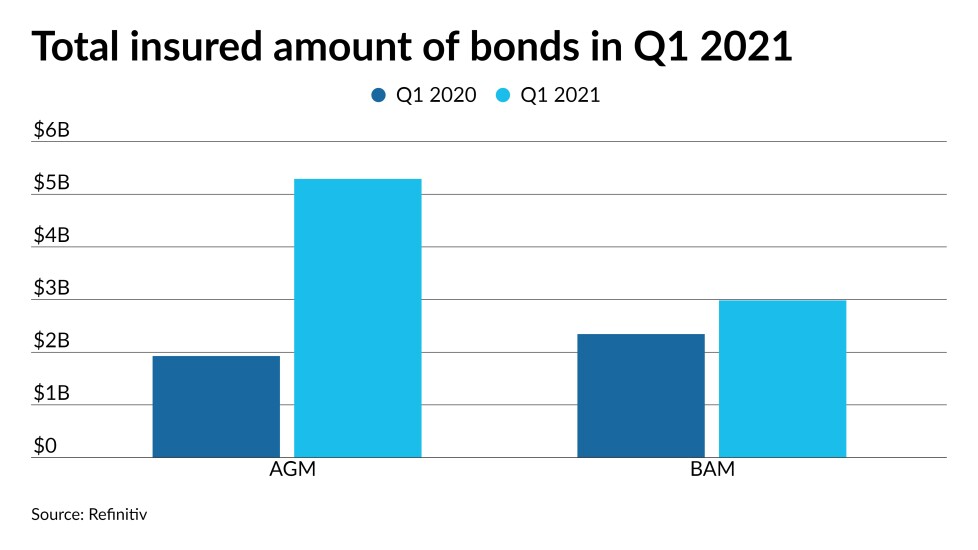

The total par amount insured industry wide was nearly double what it was in the first quarter of last year, as the amount of insured paper grew to $8.497 in 514 deals compared to $4.826 billion in 361 transactions in 2020.

The industry insurance wrap grew more to 7.8% in the first three months of 2021, up from 5.5% in Q1 of 2020 and also slightly higher than the 7.6% rate at the end of 2020. It is the highest it has been since 2009 when it was at 8.64%.