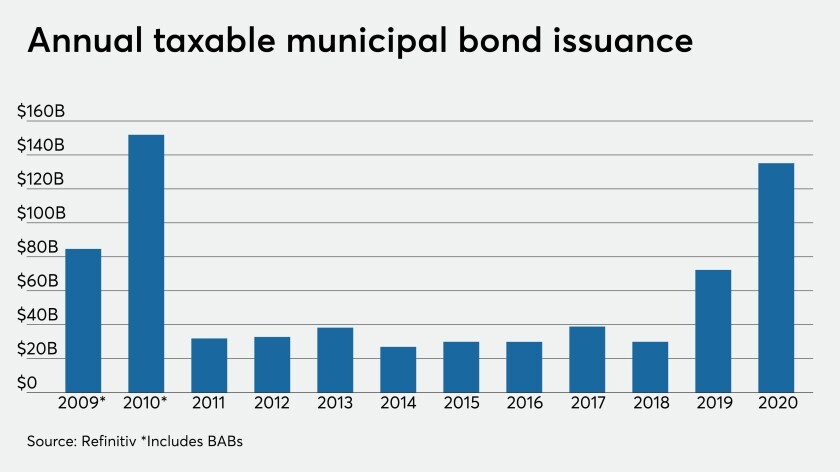

A record year of overall issuance, led by a boom in taxables, tells the story of a growing muni market with a broader, more diverse investor base.

The commission also approved converting a GO bond sale from competitive to negotiated.

The market is still in a negative technical period, said Chris Eustance, a portfolio manager at Morgan Stanley Investment Management.

Chicago's Regional Transportation Authority plans to return to market next Monday with $130 million of Series 2025A general obligation bonds.

Accusations are flying between the Republican state treasurer and attorney general, adding fuel to a battle that started last year.

Working in the public interest was "very satisfying," the longtime SEC lawyer said.

Federal Reserve Gov. Adriana Kugler said tighter monetary policy has proved to be less impactful on nonbank lenders during the post-pandemic era.