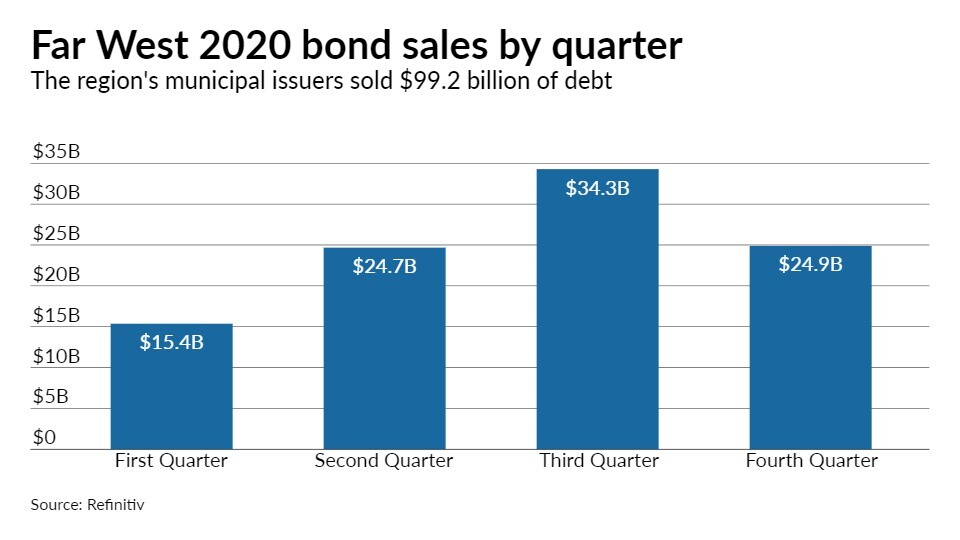

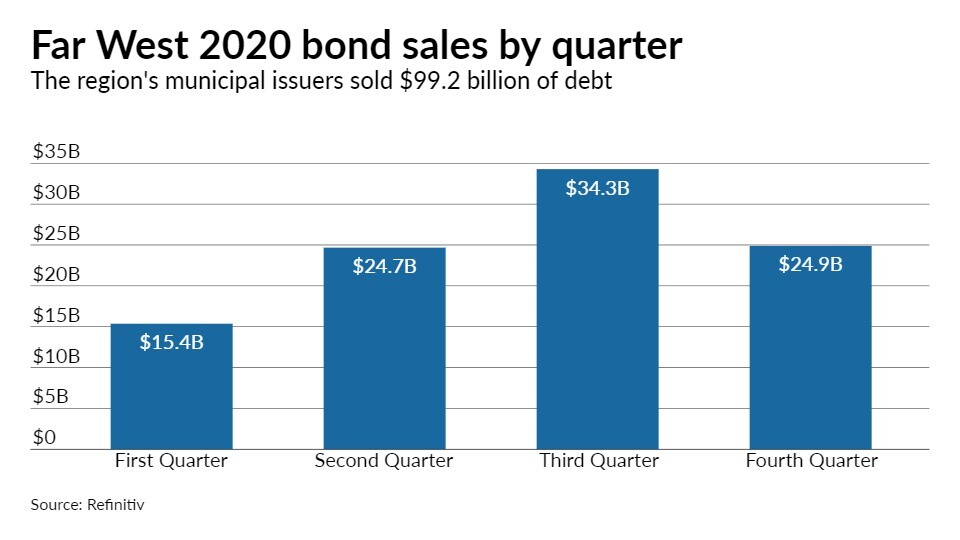

A big year in the Far West

Low rates, in the end, outweighed pandemic uncertainty

Issuers may have run through many of their refunding candidates

It was a big year for taxable debt

BofA heads the regional league table

The new-issue calendar is led by Washington with $1.3 billion of GOs selling by competitive bid in three series.

A trio of current and former Alaska lawmakers presented views differing from the governor's on how to solve the state's budget red ink.

Kutak Rock warns tax attorneys about the Internal Revenue Service doing compliance checks as opposed to formal audits on certain multifamily bond issues as tax season is expected to add more stress to an understaffed agency.

The rating agency cited weak operating results and high leverage.

Piper Sandler will price $100 million of electric revenue bonds for Iowa public utility Muscatine Power and Water on Wednesday.

Longer-term bonds could ease financial pressure for Sound Transit's $54 billion long-range plans.