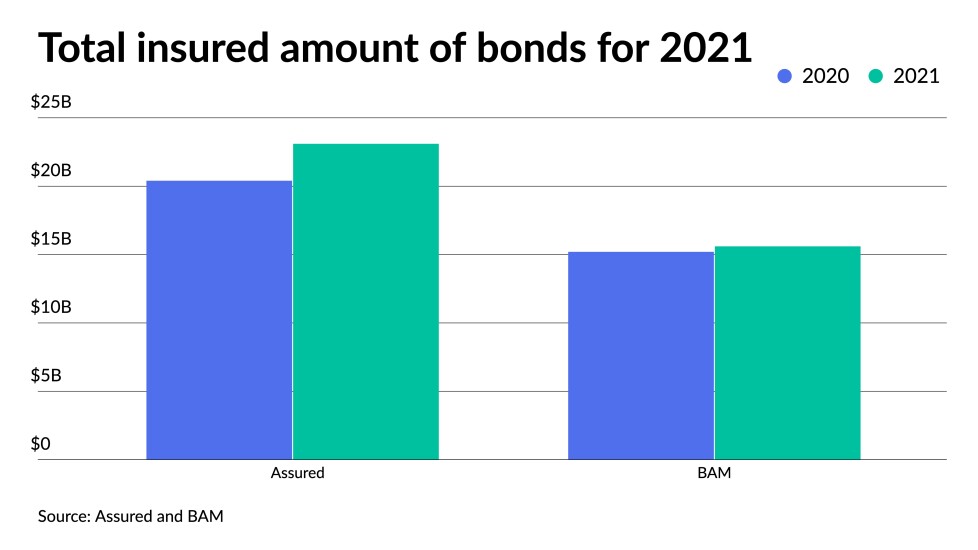

The two active municipal bond insurers wrapped $38.7 billion in 2021, an 8.7% increase from the $35.6 billion of deals done in 2020. It marks the highest level since 2009.

The industry par amount was achieved in 2,151 deals, fewer than the 2,270 in 2020.

Market demand for bond insurance increased steeply during the past two years, initially due to credit concerns caused by the pandemic.