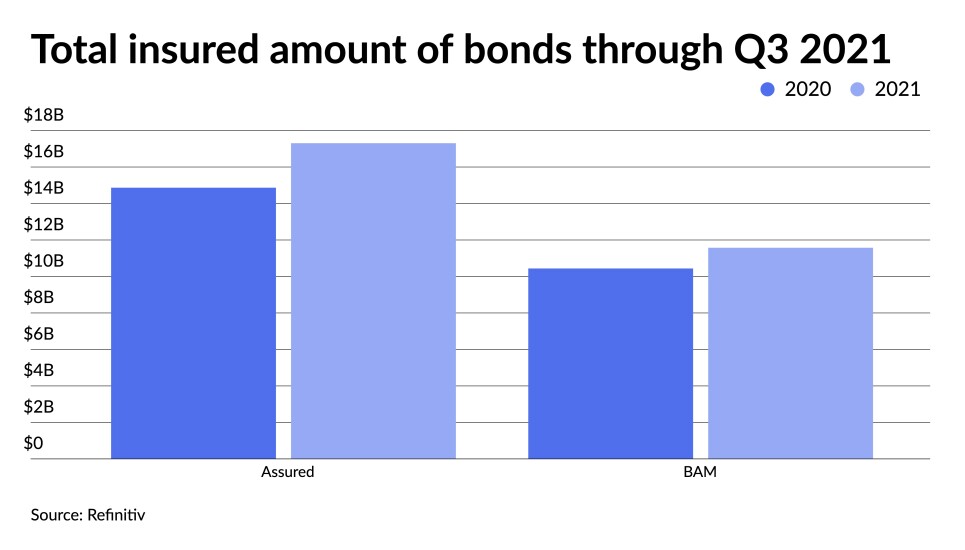

The two active municipal bond insurers wrapped $29.02 billion in the first three quarters of 2021, a 13.8% increase from the $25.49 billion of deals done in the first nine months of 2020.

The industry par amount was achieved in 1,704 deals, up from the 1,611 the same time in the year before.