Hiring, firings, corruption, the new tax law and a volatile political climate shaped The Bond Buyer's list of most-read articles of 2018.

1: Chicago finds limits to its leverage on banks' gun policies

2. Trump administration raises `serious concern' about federal loan reliance

3. P3 attorney Devlin joins Nixon Peabody

4. Banks, broker-dealers accused of widespread fraud and collusion over VRDO rate resets

5. Two firms, 18 people charged by SEC in muni flipping scheme

6. Wells Fargo muni shop management in flux after ouster of Stratford Shields

7. Eight states may follow New York's workaround for SALT deduction limits

8. Wells Fargo cites market repositioning for muni banker departures

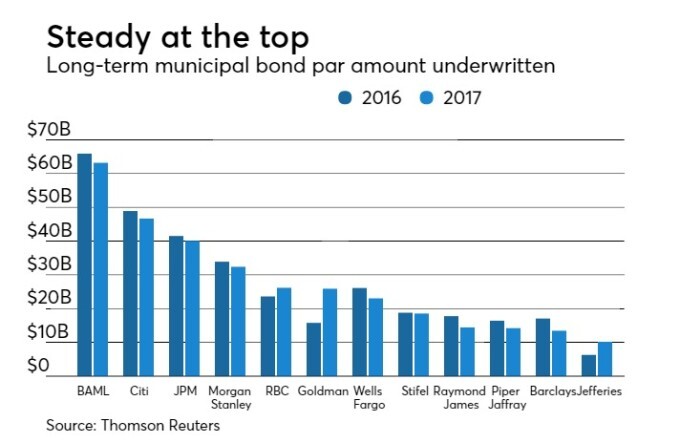

9. Three firms have banner years even as volume declines