The top municipal underwriters accounted for $456.44 billion in 11,808 transactions for 2021 compared to $451.24 billion in 11,849 deals in 2020.

BofA Securities led with $62.01 billion of deals. Out of the top five, only BofA Securities and Morgan Stanley increased market share year-over-year.

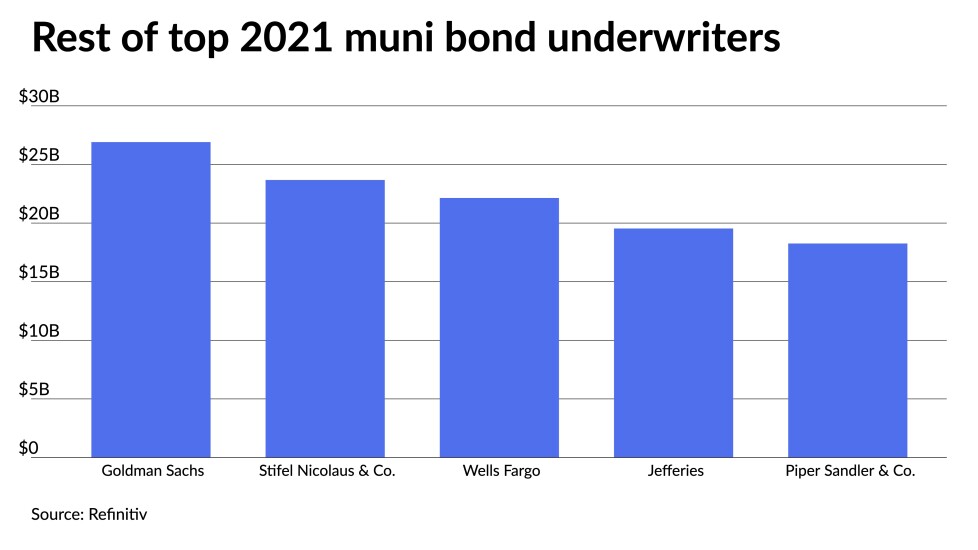

Stifel Nicolas & Co. moved into the top 10, while Raymond James & Associates fell to 11th.