Losing its 501(c)(3) status could cost Harvard $500 million annually.

-

MSRB appreciates "the robust stakeholder engagement and response" to its requests for feedback on both the rate card and a municipal fund securities concept release, Board Chair Bo Daniels said.

10h ago -

"Federal grants come with a clear obligation to adhere to federal laws," said Transportation Secretary Sean Duffy.

10h ago -

-

The city of Los Angeles and its Department of Water and Power face Palisades Fire-driven lawsuits from some 776 plaintiffs, according to the offering document.

April 25 -

"Easing tariffs, a slowing economy and an improved supply/demand outlook for munis in May and onward should drive muni market pricing going forward," BofA strategists said.

4h ago

Moody's Ratings cut the issuer rating for the District of Columbia to Aa1 with a negative outlook, which the city CFO blames on federal workforce reductions and weakness in the commercial real estate market.

The escalating dispute between the prestigious issuer and the White House is spooking some bond holders and creating opportunities for others.

As the municipal bond community rallies around protecting the tax-exempt status of munis, alternative viewpoints emerge for why it should be eliminated.

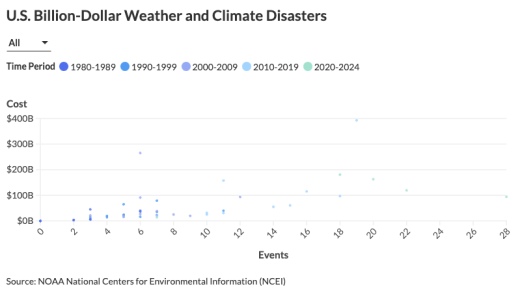

The steady demand for municipal bonds in high-risk areas underscores the complex relationship between climate change and financial markets.

Oppenheimer's Head of Public Finance Beth Coolidge and Columbus Auditor Megan Kilgore delve into the future of public finance and human infrastructure on a wide range of topics, from affordable housing and workforce development to public health, climate resiliency, and digital access.

As extreme weather events occur with more frequency across the country, Michael Gaughan, executive director of the Vermont Bond Bank, says municipal bond banks can help smaller communities deal with the effects of them. Gaughan speaks with The Bond Buyer's Lynne Funk on the effects of climate change and how the various levels of government can work together to address it.

The top 10 advisors accounted for $59.412 billion of par.

Siebert Williams Shank was the only new entrant into the top 10, knocking Piper Sandler out.

Photos from The Bond Buyer's Texas Public Finance conference.

Accusations are flying between the Republican state treasurer and attorney general, adding fuel to a battle that started last year.

A bill exempting local governments from a law prohibiting contracts with firms that "boycott" fossil fuels met a key milestone as did a pro-gun blacklist bill.

Glenn Hegar, the state comptroller since 2015, was chosen as the next chancellor for the Texas A&M University System by its board of regents.

-

S&P Global Ratings dropped Los Angeles' ratings and assigned a negative outlook, citing a "weakening financial position and an emerging structural imbalance."

2h ago -

Investors pulled $397.4 million from municipal bond mutual funds in the week ended Wednesday, following $1.258 billion of outflows the prior week.

April 24 -

The lawsuit contends that only Congress has the power to set tariffs that the president has unilaterally increased.

April 24 -

Muni advocates resist some of the arguments for eliminating the tax-exempt status of municipal bonds espoused in a new book by infamous Wall Street whistleblower Michael Lissack.

April 24 -

The state hopes bonds and associated incentives will help to address a state-wide housing shortage.

April 24