With the South Carolina Legislature planning to decide the fate of Santee Cooper this year, Gov. Henry McMaster continues to be clear about what he sees as the future of the utility the state has owned for 86 years.

McMaster’s 162-page

McMaster told those interested in buying the utility that the state will not consider any proposal that “saddles” ratepayers or taxpayers with any of the debt Santee Cooper issued to build two nuclear reactors that were shelved before completion, the executive budget released Jan. 13 said.

“We must provide the state with the best solution possible, one which protects ratepayers while recognizing the valuable contributions of current and former employees of Santee Cooper, both now and in the future,” McMaster said.

The governor, who has supported selling the utility since shortly after the decision was made to stop construction on the reactors in 2017, admitted to meeting with utilities outside the formal process lawmakers instituted last year. In that process the Department of Administration was ordered to get bids and management proposals for the utility, known formally as the South Carolina Public Service Authority.

The authority has also submitted its own reform plan to allow Santee Cooper to remain a state-owned asset, but the report hasn’t been made public. The DOA was required to submit a report on the bidding and management proposals to lawmakers by Jan. 15, but has requested additional time to complete the analysis.

“The Department of Administration exercised their right to request up to a 60-day extension, so our reform plan is still confidential per Act 95,” said Santee Cooper spokeswoman Nicole Aiello. Act 95, signed into law by McMaster on May 22, 2019, is the joint resolution requiring the competitive bidding process for the sale of some or all of Santee Cooper.

The authority is providing up to $15 million to pay for the DOA’s consultants, which are Moelis & Co., the lead financial advisor; Gibson, Dunn and Crutcher LLP, the legal advisor; and Energy + Environmental Economics, or E3, the market advisor.

McMaster’s executive spending plan for fiscal 2021 proposes a general fund budget of $9.42 billion, and a total budget including federal funds of $14.1 billion.

South Carolina’s state budget supports 5.15 million residents, according to the July 2019 estimate of the U.S. Census Bureau. The Palmetto State has seen its population increase 11.3% since the last census in 2010.

The governor is proposing to spend $1.8 billion in surplus in the upcoming budget by giving a $250 million rebate to taxpayers and a 1% rate reduction over the next five years on all personal income tax brackets, a measure that would cost $160 million in the first year and $2.6 billion over five years.

McMaster is also proposing that military veterans and first responders be exempt from paying state taxes on their retirement income, a measure that will cost the state $18.5 million in the first year.

McMaster said the surplus will allow the state to put cash toward repairing aging campus buildings and infrastructure.

“I ask the General Assembly to join me in paying down the state’s deferred maintenance liability while we can now rather than borrowing it in the future through a bond bill,” he said.

The governor’s office did not respond to two requests from The Bond Buyer seeking information about whether the budget includes a transfer from Santee Cooper in 2021. Although the budget is searchable, it didn’t produce any line items related to the utility by name.

Santee Cooper transferred to the state general fund $17.5 million in 2019; $17.4 million in 2018; and $17.75 million in 2017.

From 1948 to 2019, the authority

In anticipation of remaining a state-owned utility, Santee Cooper approved a transfer of $17.5 million to the state in this year’s budget, an amount that represents 1% of projected operating revenues from the combined electric and water systems.

While part of McMaster’s focus is shedding obligations the state utility amassed to finance its 45% ownership share of two unfinished nuclear reactors in a partnership with investor-owned South Carolina Electric & Gas Co., Santee Cooper has aggressively defeased debt since the project was halted.

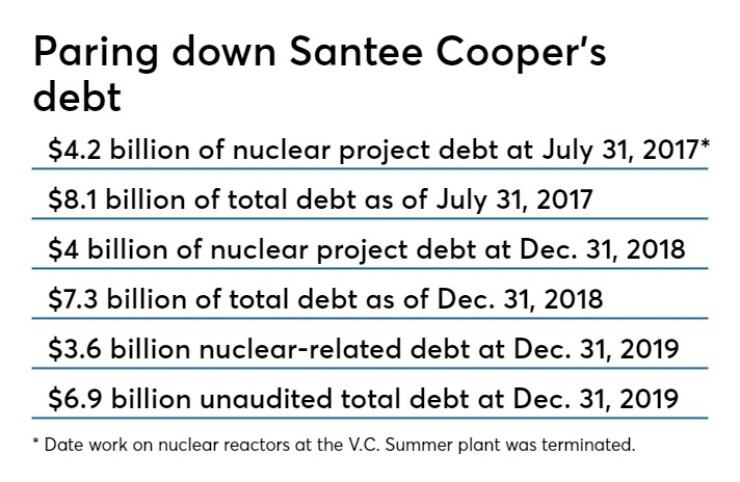

The authority said it had issued $4.2 billion of debt to finance its share of the reactors that were being built at the V.C. Summer Nuclear Station, before the board of directors voted to suspend construction on July 31, 2017.

The board said it made the decision after an assessment found it would cost another $7 billion to complete the delayed project, an assessment that was triggered by the Chapter 11 bankruptcy of the project’s main contractor, Westinghouse Electric Co., on March 29, 2017.

SCANA Corp.’s SCE&G, a 55% owner in the failed nuclear project, also decided to stop work on the reactors. On Jan. 2, 2019, SCANA became a wholly owned subsidiary of Richmond, Virginia-based Dominion Energy, also an investor-owned utility.

A similar twin reactor project at Georgia’s Plant Vogtle is still under construction.

When Santee Cooper’s board of directors pulled the plug on the V.C. Summer project, the authority’s debt for its water and electric divisions, including revenue obligations, commercial paper and revolving credit agreements, totaled $8.1 billion.

As of Dec. 31, 2019, about $3.6 billion related to the nuclear reactor project remained outstanding, while its total debt was $6.9 billion, according to unaudited year-end figures provided to The Bond Buyer by Santee Cooper.

Santee Cooper is headquartered in Moncks Corner, a town in Berkeley County. The utility was created by the state in 1934 to provide electric power and wholesale water in South Carolina. It also has an economic development program that offers loans and develops industrial commerce parks.

About 2 million South Carolinians receive power from Santee Cooper, the largest power producer in the state.

The failed nuclear reactor project has triggered a number of lawsuits. Those lawsuits factored into two S&P Global Ratings downgrades of Santee Cooper.

Shortly after the project was terminated S&P lowered its rating to A-plus from AA-minus. In June 2019, S&P again downgraded Santee Cooper’s outstanding senior-lien debt to A from A-plus, and maintained a negative outlook saying that it was the result of ongoing judicial and political challenges stemming from its investment in the abandoned nuclear project.

The downgrade also reflected the utility’s strong enterprise risk profile as well as a “vulnerable operational management assessment” because there is no longer an asset to support the associated debt, S&P said.

Fitch Ratings downgraded the utility’s bonds to A-minus from A-plus in November 2018. Moody's Investors Service lowered its rating to A2 from A1 in August 2018. Both have negative outlooks.

In September, Santee Cooper made future plans as if it will remain owned by the state, plans that include new measures to accelerate debt reduction related to the canceled reactor project.

The board of directors unanimously approved a

The forecast calls for using $925 million in the next two years to pay down debt related to the nuclear reactor project to “achieve ongoing savings that further accelerate debt payoff without additional rate increases,” according to the forecast. A presentation to the directors says that nuclear-related debt is projected to be paid off by 2053.

Santee Cooper also plans to increase solar-generated capacity by 500%; develop large-scale battery storage; close four coal-fired generating units; increase natural gas generation; maintain the current workforce at 1,675 employees; and to continue implementing economic development projects.

“We are evaluating the potential benefits of issuing securitized debt, a financing mechanism that can yield savings, to refinance nuclear debt,” the board presentation said.

The state Department of Administration also used the 2019 business forecast as a base case that was provided to prospective bidders, according to Santee Cooper.

With the analysis of bids and management proposals delayed to an unknown date, lawmakers don’t have a timeline to determine Santee Cooper’s fate. The annual legislative session convened Jan. 14.