Puerto Rico officials clashed with investors Wednesday as the government enacted a moratorium on paying the territory's $70 billion of public debt and rejected an offer of more credit to help meet a July 1 payment.

Gov. Alejandro García Padilla signed the bill into law Wednesday afternoon, giving him the authority to suspend payments on debt backed by the government, the island's Government Development Bank and other public agencies through January 2017.

Stephen Spencer, a financial advisor to Puerto Rico bondholders, said the moratorium threatened to upend efforts to solve the island's debt crisis, including an agreement hammered out between bondholders and the Puerto Rico Electric Power Authority.

"Lawmakers have acted precipitously by allowing the governor to unilaterally impose debt payment moratoriums, a step that could have unintended consequences and could ultimately prove harmful to the commonwealth's citizens as well as bondholders," Spencer said. "Additionally, imposing a moratorium on payments would likely close the door to anyone extending new credit to Puerto Rico, seriously impeding its ability to meet citizens' needs."

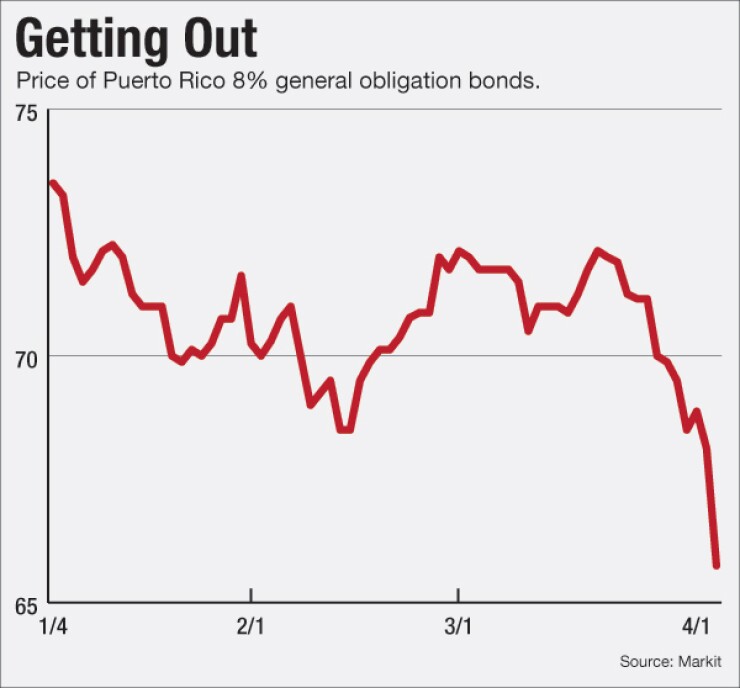

Puerto Rico general obligation bonds have plunged as the U.S. Congress debated bills to help the territory and the debt moratorium bill moved through the legislature in San Juan. Since April 1 yields on Puerto Rico 8% GOs have jumped 60 basis points on the secondary market to 12.834% as of April 5.

The new proposal for a debt exchange came from a group of investors holding $5 billion of $17 billion GO and guaranteed bonds outstanding. They proposed to defer principal repayments until July 2020 and offered to lend $750 million immediately at a 7% interest rate. This money could be used to avoid a July 1 default on Puerto Rico's GO payment. There would be level GO and guaranteed debt service for 25 years following July 1, 2025.

"This consensual process avoids a July 1 default, which would irreparably harm Puerto Rico's economy, hurt millions of American citizens who live on the island, and impair Puerto Rico's access to markets and its ability to finance essential services," the group said in a statement.

Melba Acosta Febo, president of the Government Development Bank for Puerto Rico, said the proposal "fails to solve the severe and real challenges that the commonwealth is now facing. Incurring additional debt at a higher cost is not the answer to the commonwealth's fiscal issues—indeed it is exactly the type of 'Wall Street' solution that led us to the precipice we are now looking over."

She denied assertions that Puerto Rico had rebuffed offers from the bondholders, saying: "We have serious matters to solve and instead of keep kicking the can down the road, we need to get serious about solving these matters now."

Acosta Febo said the proposal amounted to a "scoop and toss" to pay interest on the GOs "at the expense of holders of all of the other credits of the commonwealth, many of whom are residents of Puerto Rico. The commonwealth has been clear from the beginning—we need a comprehensive restructuring that, while recognizing priorities among creditors, does not place the burden of the restructuring entirely on any single group of stakeholders."

Not everyone among the bondholders was critical of Puerto Rico's debt payment moratorium. Susheel Kirpalani, an attorney for Quinn Emmanuel representing senior bondholders of the Puerto Rico Sales Tax Finance Corp. (COFINA), said in an email: "With entrenched private institutions obstructing the legislative process in Washington, it is understandable that Puerto Rican leaders are taking steps to equip the island with the tools it needs. COFINA Senior Bondholders hope our fellow creditors acknowledge this dire reality and finally stop holding legislation hostage."

The Puerto Rico House of Representatives voted to approve the debt payment moratorium and GDB reform bill by a vote of 26 to 21. In the vote at 1 a.m. Wednesday, 26 members of the governor's Popular Democratic Party voted in favor and one, Ángel Matos Garcia, voted against. All 23 opposition New Progressive Party participating legislators voted against it. In addition one PDP member and three NPP members were absent from the vote.