As summer sizzles, this week’s hottest deals are in the municipal bond market, as New York City (Aa1/AA/AA) comes to market with over $1 billion of general obligation bonds.

Primary market

On Monday, Ramirez & Co. priced for retail

Also Wednesday, the city will competitively sell $600 million of taxable fixed-rate bonds in two offerings. Most proceeds will be used to fund capital projects, while $538 million will be used to convert existing bonds.

The city is one of the largest issuers of municipal debt in the United States. As of March 31, the city had about $38 billion of GO debt outstanding. That's not counting the various city authorities which issue debt.

The NYC Transitional Finance Authority has about $37 billion of debt outstanding while the NYC Municipal Water Finance Authority has around $30 billion of debt outstanding. The TFA’s debt consists of future tax secured senior bonds (Aaa/AAA/AAA), future tax-secured subordinate bonds (Aa1/AAA/AAA) and building aid revenue bonds (Aa2/AA/AA). The MWFA’s debt consists of general resolution bonds (A1/AAA/AA+) and second general resolution bonds (Aa1/AA+/AA+).

In March,

“Exceptionally strong budget monitoring and controls have been in place since the city's fiscal crisis in the 1970s. Positive economic prospects also contribute to sound overall credit quality and Fitch Ratings' expectation that the liability burden will not increase notably,” Fitch said Monday in affirming the city’s debt. “However, the long-term liability burden remains large relative to other highly rated local governments and pressure to increase capital spending is an ongoing concern. Changes to pension benefits for newer employees should over time moderate the pension liability if actuarial assumptions are met. Fitch anticipates debt levels to be controlled by the city's longstanding policy cap on debt service as a percentage of tax revenues.”

While some sectors lagged, others surged ahead, Fitch said.

“The city's tourism sector is performing exceptionally well, attracting a reported record 65.2 million visitors in 2018. Various metrics rank New York City as the leading American city for both domestic and international tourism,” Fitch said. “Financial activities employment has shown some growth over the last four years and is now slightly above the pre-recession high.”

But the rating agency injected a cautious note for the future.

“The city remains an economic force but expansion may be approaching a cyclical peak. Unsurprisingly after more than a decade of national economic expansion, growth in New York City appears to be slowing,” Fitch said. “The U.S. census-estimated population for 2018 is 8.4 million, up 2.7% since 2010 which is about half the rate of national population growth. This remains well ahead of the less than 1% growth for the state. Labor market gains are plateauing with the labor force essentially flat since 2014 and employment growth trending slightly lower for three consecutive years.”

Monday’s bond sale

Last week's actively traded issues

Revenue bonds made up 49.98% of total new issuance in the week ended July 19, up from 48.61% in the prior week, according to

Some of the most actively traded munis by type in the week were from Guam, California and Illinois issuers.

In the GO bond sector, the Guam 5s of 2031 traded 24 times. In the revenue bond sector, the Foothill/Eastern Transportation Corridor Agency, California, 5s of 2053 traded 38 times. In the taxable bond sector, the Illinois 5.1s of 2033 traded 45 times.

Secondary market

Munis will enjoy another busy week, before things slow way down next week with the Federal Open Market Committee meeting where a decision will be made and announced on interest rates. The biggest question is will the Fed cut 25 basis points or 50? And there is also a possibility of holding rates where they are for now.

"I think they have now been dragged into doing at least a total of 50 BPs this second half," Jim Grabovac, senior portfolio manager at McDonnell Investment Management said. "Do they do it all in one to get ahead or do they space it out? We will find out but I feel as though the economy is not in a position where a series of cuts are needed."

He added that Fed is following the market and not leading it and they are not basing choices on economics.

"Prior to this year, investors have enjoyed the time where the Fed has not been politicized," he said. "Now with push back against the Fed this year, they need to engineer what they have to do at this point, and manage expectations going forward."

Dawn Mangerson, senior portfolio manager at McDonnell said munis still remain in a level of low yields, making the buying environment spotty.

"In the new-issue market, things have been really spotty on the deals," she said. "While most deals are way oversubscribed and allocations are tiny, there is at least one deal a week where we get our whole allotment."

She noted that the U.S. is about 15 months away from another election but thus far in the process, there has been no talk of infrastructure among the slew of candidates.

"The topic of infrastructure has turned political and although they both agree that it is a need of this country, they can't get a bipartisan agreement on spending, as spending a ton of money is not politically appealing to either side," Mangerson said. "Unfunded infrastructure is similar to unfunded pensions; the problem is only going to get worse and the longer you wait, the more money you are going to have to put into it."

Munis were little changed in late trade on the

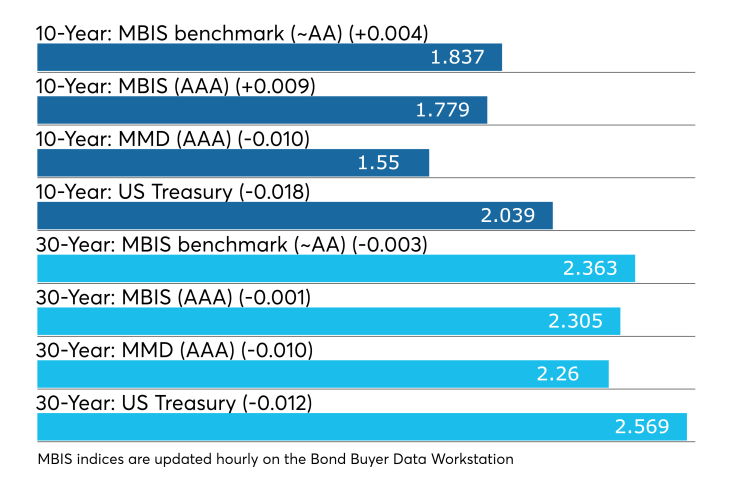

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GOs dropped one basis point to 1.55% and 2.26%, respectively.

“The ICE muni yield curve is about one basis point lower in sympathy with Treasuries,” ICE Data Service said in a Monday market comment. “High-yield and tobaccos are one basis point lower as well.”

Political turmoil in Puerto Rico didn’t moved the island’s bonds on Monday. “Amidst calls for the governor to resign due to a leaked private chat group scandal, Ricardo Rosselo has stated that he will finish his term but will not seek re-election,” ICE said.

The 10-year muni-to-Treasury ratio was calculated at 75.8% while the 30-year muni-to-Treasury ratio stood at 87.9%, according to MMD.

Treasuries were stronger as stocks traded mixed. The Treasury three-month was yielding 2.089%, the two-year was yielding 1.819%, the five-year was yielding 1.793%, the 10-year was yielding 2.039% and the 30-year was yielding 2.569%.

Previous session's activity

The MSRB reported 26,510 trades Friday on volume of $11.16 billion. The 30-day average trade summary showed on a par amount basis of $5.89 million that customers bought $3.33 million, customers sold $3.45 million and interdealer trades totaled $1.94 million.

California, Texas and New York were most traded, with the Golden State taking 12.45% of the market, the Lone Star State taking 11.142% and the Empire State taking 10.648%.

The most actively traded security on Friday was the Brookhaven Development Authority, Georgia, Series 2019A revenue 3s of 2046, which traded 92 times on volume of $41.71 million. On Monday, the 3s of 2046 traded in large blocks with a high of 3.06% and a low of 3.03%. The original yield was 3.14%. The 10-year with a 5% coupon traded at 1.78% on Friday versus an original yield of 1.83%. The 30-year 4s traded at 2.89% on 7/18 versus 2.94% original.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the $36 billion of three-months incurred a 2.040% high rate, down from 2.115% the prior week, and the $36 billion of six-months incurred a 2.010% high rate, unchanged from 2.010% the week before. Coupon equivalents were 2.085% and 2.064%, respectively. The price for the 91s was 99.484333 and that for the 182s was 98.983833.

The median bid on the 91s was 2.010%. The low bid was 1.980%. Tenders at the high rate were allotted 17.88%. The bid-to-cover ratio was 2.96.

The median bid for the 182s was 1.960%. The low bid was 1.930%. Tenders at the high rate were allotted 38.88%. The bid-to-cover ratio was 2.69.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.