New York's Metropolitan Transportation Authority's debt could push $50 billion by the end of its coming five-year capital program, its chief financial officer said.

Net debt, now $42.9 billion for the MTA's core credits, could rise by up to $7 billion, Robert Foran told members of the MTA board's finance committee on Tuesday.

The MTA, one of the largest municipal bond issuers, received approval from the state Capital Program Review Board three weeks ago for its five-year capital program.

"The total amount of debt that we're going to sell for the $51 billion capital program really will be sold between this coming year and probably 2026, 2027, so it will be stretched out over time," Foran said. "We're paying off about a billion one, a billion two of debt every year, so really the number I think will be probably about net $6 billion higher by 2025 [or], $7 billion."

The capital program assumes new revenue streams from a planned congestion pricing mechanism for parts of Manhattan — scheduled to take effect next year — and a variety of taxes. Whether the dedicated revenue or the higher debt would hold more sway in the capital markets remains an open question.

Rating agency actions last year reflected concerns about the need for sustainable revenues, debt-service coverage on a net basis, upcoming capital program needs and anticipated leverage levels. Kroll Bond Rating Agency in January 2019 assigned the authority's workhorse transportation revenue bond credit on negative outlook, while Moody's Investors Service and S&P Global Ratings maintained negative outlooks they placed in 2018.

TRB credit spreads widened in January 2019 as high as 69 basis points to the Municipal Market Data index for long 5% coupon bonds, said Finance Director Patrick McCoy, but stabilized thereafter at 40 to 45 bps primarily due to general market tightening of credit spreads and new revenue sources for the authority. Secondary market trades for long TRBs showed spreads at 40 to 50 bps from August to December.

"We are, obviously, going to be adding a lot of debt based on the new capital program, but of course, the bulk of that will be secured through the new Central Business District tolling lockbox," said McCoy. The lockbox, McCoy added, includes the new tax revenues. "Those revenues will be part of the mix that pays the new debt off."

The MTA's board already authorized two new resolutions which are before the state review panel for consideration. "We expect a good, strong double-A rating" from the payroll mobility tax bond resolution and also a high rating from the sales-tax resolution, McCoy added.

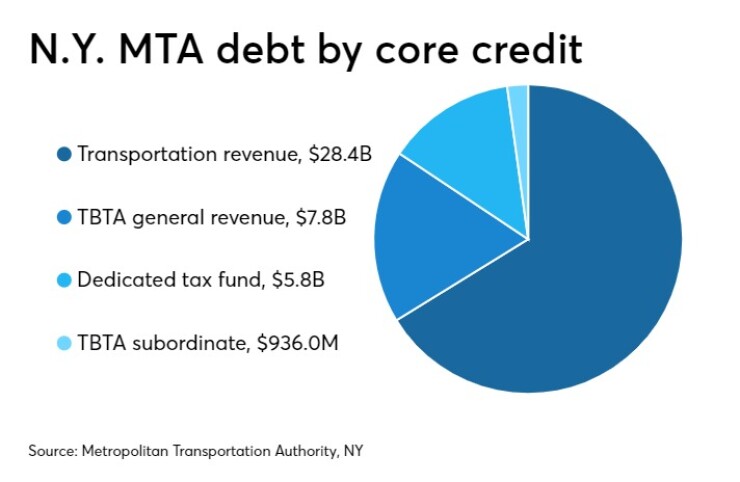

Transportation revenue bonds account for $28.4 billion, or roughly two-thirds of the MTA's core debt, McCoy said in his annual year-end

The MTA operates on a calendar year budget. Core debt does not include roughly $1.1 billion in special obligation bonds and Hudson Rail Yards Trust obligations.

Fixed rate accounts for 70% of MTA's debt, with bond anticipation notes totaling 14.5%. "These will be coming due over the next two to three years, and as those notes come due, we'll issue long-terms bonds to finance that debt out," McCoy said of the latter.

Synthetic and natural fixed-rate BANs toward the state's $7.3 billion commitment to the capital program and term-rate combine for the remainder.

The authority's preliminary financing calendar projects $8.2 billion in debt for 2020, including $2.7 billion in the first quarter.

"We'll have a busy year with a fair amount of activity ahead of us," McCoy said.

This week the MTA expects to remarket $102.1 million of Series 2005A general revenue variable rate bonds, swapping out TD Bank with Barclays Capital. In February it intends to remarket $75 million of transportation revenue variable rate refunding bonds as floating rate notes, indexed to the Securities Industry and Financial Markets Association.