CHICAGO — In a sign of Illinois’ ongoing fiscal challenges, its net assets deteriorated by $8.4 billion in fiscal 2010, pushing its deficit in that category of financial reporting up to a negative $37.9 billion, according to a new report from state auditor general William Holland.

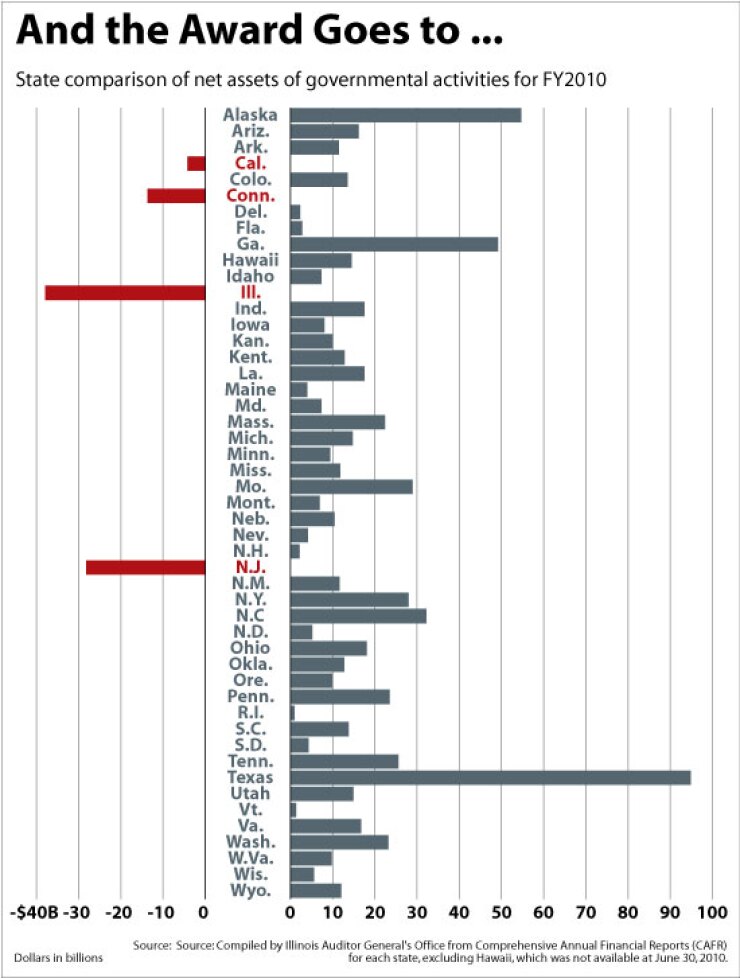

The deficit tops all other states in the nation, according to Holland’s opinion released late last week on the state’s fiscal 2010 financial results, which are prepared by the state comptroller’s office.

The state’s asset deficit has steadily grown. Looking back to fiscal 2003, the deficit stood at $12.8 billion, rising to $20.8 billion in fiscal 2007 and $29.5 billion in fiscal 2009.

The deficit in the statement of net assets reflects the difference between Illinois’ liabilities and assets on an accrual basis. The figure takes into account the state’s accounts payable that were $9.1 billion in fiscal 2010 and $55.1 billion of debt obligations, including outstanding bonds and pension obligations. The figures provide a wider view of a state’s overall long-term fiscal health than the snapshot provided by annual budget numbers.

“Over time, increases and decreases in net assets measure whether the state’s financial position is improving or deteriorating,” the auditor’s report reads.

Illinois fares worse than any other state in an assessment of net assets of governmental activities, even among states facing sizeable general fund deficits. Only California with a $4.2 billion asset deficit, Connecticut with a $13.7 billion deficit, and New Jersey with a $28.2 billion deficit joined Illinois in the red.

Texas enjoys the largest surplus at $94.9 billion. The auditor compiled the information from the fiscal 2010 comprehensive annual financial reports of each state with the exception of Hawaii, which was not then available for review.

Illinois’ general fund deficit at the close of fiscal 2010 rose $1.8 billion to $9.2 billion from a year earlier, according to the report. The state’s cash deficits have ranged from $2.5 billion to $4.2 billion between 2003 to fiscal 2008 before skyrocketing to $7.4 billion in fiscal 2009.

“We are aware of the audit and continue to work with the General Assembly to overcome the financial challenges facing Illinois,” said state budget spokeswoman Kelly Kraft. “The audit does not take into account reforms Governor Quinn has implemented to improve Illinois' finances. Pension, Medicaid, Workers Comp reform, and large reductions in spending, are helping to restore fiscal balance to Illinois. Continued reforms are needed, along with cooperation from the General Assembly to make Illinois fiscally sound.”

The auditor’s numbers show the state’s financial position as of June 30, 2010, so they don’t reflect a significant infusion of an estimated $6.8 billion expected annually over the next four years from an income tax increase enacted in January of this year. The tax was pushed as a means to help stabilize the state’s balance sheet.

Still, the report’s figures underscore the Illinois’ precarious long-term fiscal position that has been highlighted in other recent reports. Comptroller Judy Baar Topinka in her office’s quarterly report warned that the state faces “staggering long-term financial challenges” as it carried $7.4 billion in unpaid obligations — including $3.8 billion owed to schools, transit agencies, health care providers and others — into the new fiscal year July 1.

Treasurer Dan Rutherford issued a report on state debt in May to support his position that Illinois can’t afford any more borrowing. The state owes a total of $45 billion through 2036 when principal and interest are combined. The government owes a combined $140 billion in unfunded pension obligations, retiree health care unfunded liabilities, and debt service on past pension-related bonding, according to the report. Illinois holds the distinction among states of having the lowest funded ratio of its pension funds at 45.4%, with $75.7 billion of unfunded liabilities.

The Commission on Government Forecasting and Accountability reported that Illinois collected an additional $3.4 billion in base revenue during fiscal 2011, which ended June 30, due to the improving economy and the income tax hike, but that it continued to rely on one-shot revenues that won’t be available in future years.

Quinn late last month signed into law a $32.99 billion general fund budget. When all funds are counted, the state’s budget for fiscal 2012 rises to $56.2 billion. After a series of downgrades due to budgetary and liquidity woes, Illinois’ GO bonds are rated A1 by Moody’s Investors Service, A-plus by Standard & Poor’s, and A by Fitch Ratings.