Money market funds continue to waive big chunks of their management fees as yields on cash instruments remain too low to charge the full amount.

A spike in certain short-term interest rates in the second and third quarters allowed money funds to reclaim a few basis points of the fees they had been waiving. It didn’t last. Now that those interest rates have slipped back down, money market fund managers expect to continue reimbursing most of their fees to shareholders.

“We could see a little bit of upward pressure on that in the fourth quarter,” Charles Schwab Corp. chief financial officer Joseph Martinetto said in a conference call last month.

Money funds normally charge annual fees of roughly 0.65% of their assets on average, according to iMoneyNet.

Charging that full amount today would be destructive because money funds typically invest in products the yields on which are now lower than the funds’ listed fees.

The Fidelity Municipal Money Market Fund, which with $22.3 billion in assets is the biggest tax-free money fund, highlights this conundrum.

The fund’s official fees are 0.47% of assets annually.

Like many tax-free money funds, its holdings are mainly municipal variable-rate demand notes. According to the Securities Industry and Financial Markets Association swap index, which measures the yield on these types of instruments, tax-free VRDNs on average yield 0.3%.

Charging annual fees of 0.47% for managing instruments yielding 0.3% would drain money from a fund whose sole purpose is to preserve investors’ cash.

The solution is to reimburse part of the fees to shareholders, to avoid a negative yield.

The fund is currently giving 13 basis points of the listed fee back to shareholders, resulting in a net yield of 0.01% to shareholders.

Most funds are foregoing fees for the same reason.

Returns to shareholders on money market funds have been mostly unchanged at less than 0.1% for a year, despite sometimes volatile interest rates.

Fund families respond to lower yields by waiving more fees, and higher yields by waiving less.

The yield collected by money funds rose four basis points from the first to the quarter this year, but the return to shareholders was unmoved. Funds just charged four basis points more in fees.

The average yield on the industry’s holdings was 0.33% during the third quarter, for an annualized return of 0.05% to shareholders.

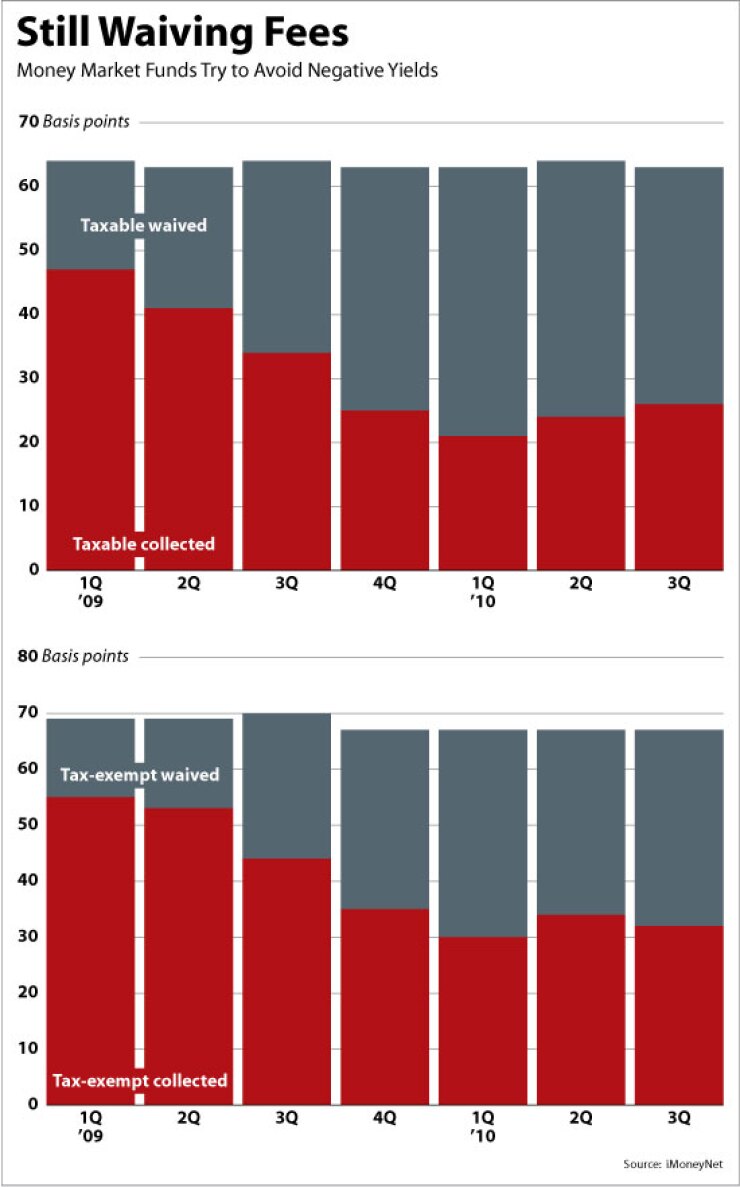

The $2.8 trillion money fund industry charged an aggregate fee of 0.28% during the third quarter, according to iMoneyNet, meaning they waived 36 basis points.

Each basis point of waived fees represents $280 million of lost revenue to money fund managers.

The waivers imply the industry relinquished $2.52 billion in fees during the quarter, and collected $2 billion. The industry’s worst quarter was the first three months of this year, in which money funds waived $3 billion in fees and collected just $1.8 billion.

“Libor hasn’t changed that much, and a lot of the product is Libor-based,” said Tony Era, vice president of money markets at USAA. “I’m hoping the extending waivers industry-wide is not going to increase at this point.”

Waivers the past two quarters ebbed from their peak of 40 basis points in the first quarter, in part because short-term yields ticked up a few basis points.

Many products in which taxable money funds invest carry yields tied to the London Interbank Offered Rate, which measures how much it costs high-quality banks outside the U.S. to borrow dollars.

European banks’ funding costs swelled during the sovereign debt crisis, helping push one-month Libor to an average of 0.29% in the third quarter, compared with 0.23% in the first quarter.

The higher returns on these instruments enabled money funds to increase the fees they collected while ensuring that returns to shareholders stayed above zero.

Charles Schwab waived 17% of its fees, or $93 million, during the third quarter, down from $113 million in the second quarter and $125 million in the first.

But looking forward, one-month Libor has edged back down to 0.25%, so waivers are likely to move higher again.

“That number was definitely helped some by the tick up in Libor that we saw with the European debt crisis, and we’ll probably be negatively impacted as we’ve seen that rate come back down here in the third quarter,” Martinetto said.

The industry is on pace to collect about $7.5 billion in fees this year, about half what it collected last year.

Not all funds are waiving fees — some are closing down altogether.

There were more than 2,000 money funds at the end of 2008, according to the Investment Company Institute. Today, there are 1,775.

If money fund complexes wanted to blame someone, it would be Ben Bernanke. The Federal Reserve chairman has pinned his target for short-term interest rates to zero since late 2008, and has repeatedly pledged to keep it there indefinitely. The Fed’s overnight lending rate is officially in a range between 0% and 0.25%

With one-month Libor at 0.25% and the SIFMA swap yield at 0.3%, money fund managers expect to continue waiving fees until money-fund-eligible products start to return more than the listed fees.

“We do not expect the impacts from waivers to change materially from this level until the Fed begins to increase interest rates,” Thomas Donahue, chief financial officer of Federated Investors, said in the company’s third-quarter earnings conference call Friday.

Federated, which manages 8% of all money fund assets, expects to lose about $11 million or $12 million in income to fee waivers in the fourth quarter, a similar amount to what it lost in the third quarter.

Donahue in the conference call said a 10 basis point increase in interest rates would reduce waivers by a third, and a 25 basis point increase would reduce waivers by two-thirds.

Most of the reduction in waivers in the latest quarter were made by taxable money funds. The roughly $2.5 trillion taxable money fund industry waived 37 basis points of fees in the third quarter, down three basis points from the second quarter and five from the first.

In fact, taxable funds in general charge less and waive more than tax-free funds. iMoneyNet data show taxable funds have waived more of their fees than tax-free funds every quarter since funds began surrendering fees.

The average expense ratio for the 10 biggest tax-free money funds is 0.32%, according to Crane Data, compared with 0.22% for the biggest taxable funds.

Peter Crane, founder of the firm, cited two reasons tax-free funds charge higher fees.

The most important is that taxable funds are used principally by institutional investors, while tax-free funds are a retail phenomenon.

That means taxable funds are executing more big-block transactions, while tax-free funds are dealing with smaller shareholders with smaller transactions.

Furthermore, because of the nature of tax-free and taxable cash instruments, taxable money funds often put their cash in a handful of big deals, while tax-free funds have to put smaller amounts of cash in a lot of smaller deals.

Vanguard’s biggest taxable and tax-free money funds are a perfect illustration.

The Valley Forge, Pa.-based money manager’s taxable Prime Money Market Fund has $108.3 billion in assets. Its 325 holdings took up nine pages in its latest annual report.

Vanguard’s Tax-Exempt Money Market Fund is far smaller, at $18.4 billion. Yet this fund lists more than 1,100 holdings, and its portfolio in its latest report ran for 18 pages.