CHICAGO — Illinois’ debt manager returns tomorrow from an overseas tour where he sought to whet the appetites of European and Asian institutional buyers for his beleaguered state’s paper ahead of a $900 million taxable Build America Bond sale.

The general obligation issue will boost to more than $8.5 billion the amount of debt sold by the state this year.

Citi is the senior manager on the transaction and led the investor road show that began last week and included European and Asian cities. The finance team will hold meetings in New York next week, according to several market sources.

Illinois debt manager John Sinsheimer confirmed in an interview last week that he was overseas meeting with potential investors, but declined to discuss details of the trip or the meetings.

“We are getting very good reception from people used to investing in sovereign credits around the world. They appreciate the strength and structure of the Illinois general obligation credit,” he said. “These are folks who invest in sovereign risk as a matter of business so they understand how to look at this kind of credit. They understand the state offers bondholders significant protections by statute.”

Repayment of GO debt service from state revenue enjoys a statutory priority. The state holds sovereign powers to raise revenues and reduce expenditures — even if current lawmakers are unwilling to take such action until after the November election.

Proceeds from the sale tentatively scheduled for next Wednesday will fund transportation projects and capital facilities projects. The state will likely use the same structure as past BAB sales, with serial maturities in the first 10 years and one or more term bonds, depending on market demand in the later years.

Morgan Keegan & Co. and PNC Capital Markets LLC are co-senior managers, and four broker-dealers round out the team. Acacia Financial Group Inc. is financial adviser, Drinker Biddle & Reath LLP is bond counsel, and Shanahan & Shanahan LLP is underwriters counsel.

The deal follows two sales last week in which Illinois paid a premium to borrow in light of negative fiscal news. Ahead of a $300 million competitive GO BAB sale, Fitch Ratings and Moody’s Investors Service downgraded the state’s $25.7 billion of GO debt. Fitch lowered the state’s rating to A from A-plus and assigned a negative outlook. Moody’s downgraded the credit to A1 from Aa3 and assigned a stable outlook. Standard & Poor’s affirmed the state’s A-plus, which is on negative watch.

Analysts blamed the action on lawmakers’ refusal to tackle Illinois’ fiscal and liquidity crisis in the fiscal 2011 budget approved last month. The state turned to one-shots to deal with a $13 billion deficit, leaving $6.4 billion in bills unpaid going into the new fiscal year July 1 and a $3.7 billion revenue hole tied to the state’s 2011 pension payment.

Growing interest from foreign institutional investors, as seen in a recent California BAB sale, has helped drive a tightening of the relatively high spreads of BAB coupon rates to comparable corporate and sovereign credits.

Market participants attribute the fresh foreign interest to the perception that U.S. government credits are relatively safe and have value, especially following this year’s European sovereign debt crisis. Also helping is better marketing by broker-dealers with foreign trading desks like Citi and the generally improving view of BABs as an asset class with federal legislation pending to extend the stimulus program.

For Illinois, the need to expand its universe of buyers is all the more urgent as it has asked domestic buyers to digest a steady flow of paper amid an ongoing deluge of negative fiscal news from rating downgrades to columnists raising the specter of insolvency.

Bloomberg LP reported last week that the price of a five-year credit-default swap to insure state debt hit a record high and surpassed California. The state’s CDS spread mid last week was about 60% higher than last month, according to Municipal Market Data.

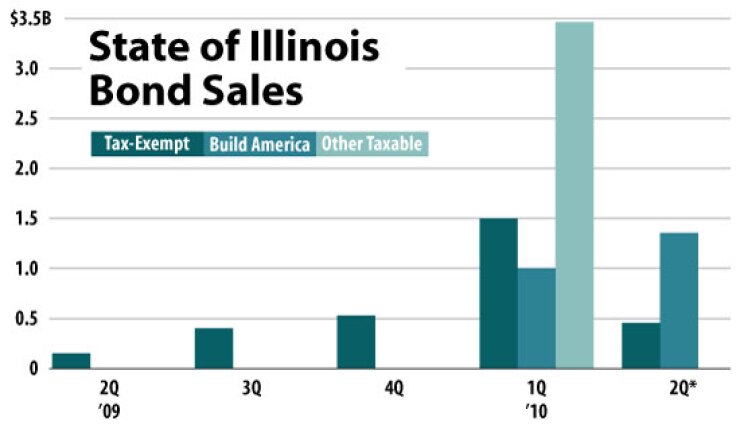

Illinois last week competitively sold $300 million of GO BABs in addition to $455 million of Build Illinois refunding bonds that are backed by state sales taxes. In April, the state sold two BAB transactions, one for $700 million and another for $300 million, as well as $250 million of tax-exempt GO bonds.

The state refunded $1.5 billion of GO bonds in February. In January, it sold $3.5 billion of five-year taxable GOs for its fiscal 2010 pension payment. Later that month it sold $1 billion of GO BABs.

Illinois sold just $1 billion of debt in four issues last year, $125 million in 2008, and $637 million in 2007, according to Thomson Reuters.

Sinsheimer said he remains comfortable — based on investor and banker discussions — with the market’s ability to absorb both the $900 million sale and planned deals that include a possible $1.3 billion short-term certificate issue and a $1.4 billion tobacco securitization. But he acknowledges the effect of the negative news, underscoring the importance of expanding the universe of buyers who understand Illinois’ debt protections.

“I have not seen any weariness,” Sinsheimer said. “We’ve had two downgrades in the last two weeks so there is a lot of noise” over the credit.

Buy-side and independent market participants say the market is clearly saturated, and the negative news and the bounty of paper boosts the power of institutional investors to drive up yields in order for Illinois to place all of its bonds.

“It’s unceasing on both the BAB and tax-exempt sides. Every week there’s another deal. Everybody is up to their eyeballs in it,” said Thomas Spalding, portfolio manager at Nuveen Investments. Nuveen placed an order on the state’s sales tax-backed refunding last week.

Nearing the end of the quarter, some funds have hit their limit on controversial credits. “It will get cheaper and cheaper to place debt in the new-issue market. The state has to find new buyers,” Spalding said.

“There has been so much by way of paper coming. It’s going to take a while for the paper to get through the system,” a Chicago trader said. “There has been a ton of Illinois stuff happening. Also, it has a lot to do with what’s going on in the Treasury market … so the spreads are getting wider. There is a combination of what’s happening in the Treasury market and lots of Illinois issuance.”

“A lot of our buy-side customers are reporting fatigue. It’s a saturation issue,” said Matt Fabian, managing director at Municipal Market Advisors. “You have unsophisticated buyers who don’t understand the pledge and sophisticated buyers who understand it but are getting fatigued fighting for it” as they have to answer to risk managers and board members who see the negative news.

Because liquidity is a paramount concern for BAB buyers, some investors also might worry about headline risks and the effect on their ability to trade their holdings, Fabian said.

Citi, with Morgan Keegan as a co-manager, won the $300 million BAB sale last week with a true interest cost of 4.39%. The taxable bonds mature from 2011 through 2019, with term bonds in 2021, 2025, and 2035. Yields ranged from 3.40% priced at par in 2013, or 2.12% after the 35% federal subsidy, to 7.10% priced at par in 2035, or 4.62% after the subsidy. The 7.10% rate was 297 basis points over Treasuries, more than 80 basis points higher than the spread on the state’s April competitive BAB sale.

In his weekly outlook, Fabian said the sale results on the long end more closely resembled levels of a year ago. The long bonds traded steadily at 103, but he said otherwise secondary market prices of Illinois bonds have struggled and dragged down prices of comparable credits.

A wide margin separated the remaining bids, with JPMorgan at 4.71%.

Citi is lead manager on the upcoming $900 million sale. Morgan Keegan is a co-senior manager. “It was in Citi’s interest to place a better bid to protect the scales on the upcoming deal,” one market source said.

The $455 million of tax-exempt Build Illinois bonds priced by Cabrera Capital Markets matured from 2011 through 2021, with yields ranging from 0.64% with a 3% coupon in 2011 to 4.13% with a 4% coupon in 2021. A $33 million bond maturing in 2020 offered a 4.02% yield with a 5% coupon.

The pricing underscored the penalty Illinois has paid for the negative news pouring out of the state. Top-rated, 10-year GOs last week captured yields around 3.14%.

The Build Illinois bonds are rated AAA by Standard & Poor’s. The refunding should generate $30 million of near-term savings and another $27 million of net present-value savings over the life of the bonds, Sinsheimer said.

The deal comes as Gov. Pat Quinn is hoping to bring lawmakers back to work soon to pass a GO pension borrowing to cover a $3.7 billion pension payment in fiscal 2011. Lawmakers adjourned after the House passed the plan, but Senate Democratic leaders could not muster the votes needed.

Without the borrowing, it is unclear how the state will cover the payment. The bond offering statement notes that if the Senate doesn’t pass the pension issue, the governor’s options include vetoing the budget and calling a special session.

Michael Scarchilli contributed to this story.