CHICAGO — After spending the week in a heavy marketing campaign that includes international buyers, Illinois on Thursday or Friday will price nearly $3.5 billion of taxable general obligation bonds with a five-year maturity to help cover its fiscal 2010 pension payments.

The debt matures in equal installments over the next five years, a structure dictated by the legislation approved by lawmakers and signed by Gov. Pat Quinn last year as the state looked for ways to cut a $12 billion deficit.

JPMorgan, Loop Capital Markets LLC, and Goldman, Sachs & Co. are book-runners on the taxable deal and Mesirow Financial Inc. is a senior manager.

Stifel Nicolaus & Co. and Morgan Keegan & Co. are co-senior managers with another four minority or women-owned firms rounding out the underwriting team as co-managers.

Peralta Garcia Solutions is financial adviser. Perkins Coie LLP and Tyson Strong Hill Connor LLP are co-bond counsel and Miller Canfield Paddock and Stone Plc and Sanchez Daniels & Hoffman LLP are co-underwriters counsel.

The state has an Internet roadshow available and the finance team held investor meetings in Chicago Monday and in Boston and Philadelphia yesterday and will be in New York today to attract buyers.

The team also held investors calls with potential Asian and European buyers.

“This is a very large issue, the second largest from Illinois, and market conditions demand that we get out and talk to investors,” said state debt manager John Sinsheimer, adding that for international buyers Illinois is reintroducing itself.

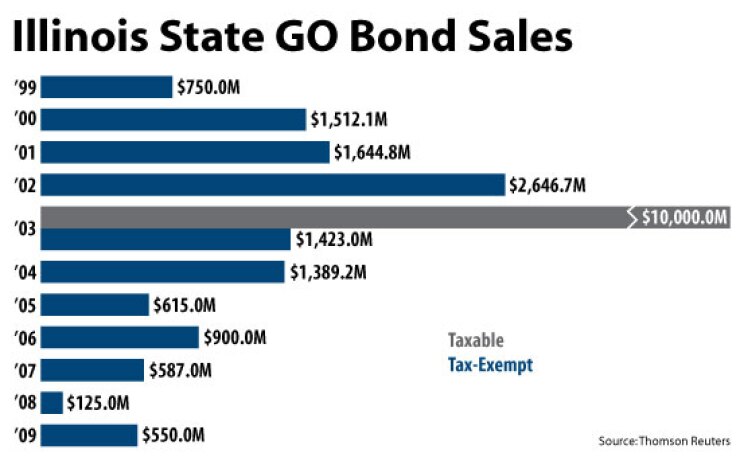

Some 30% to 35% of the state’s $10 billion taxable GO issue in 2003 to raise funds to bring down its unfunded pension liability and to help cover nearly $2 billion in current payments went to international buyers.

The true interest cost on the 30-year bonds, which marked the state’s largest bond sale ever, was 5.0474%.

Ahead of the sale, Fitch Ratings affirmed the state’s A rating on $19.4 billion of outstanding GOs, but placed the credit on negative watch.

Moody’s Investor’s Service affirmed the state’s A2 GO rating and negative outlook. Moody’s downgraded the state by one notch last month. Standard & Poor’s affirmed its A-plus and negative outlook.

The debt sale to cover a portion of the state’s pension payments marked one in a series of one-shot measures lawmakers and Quinn agreed on as they grappled with how to erase $12 billion of combined red ink in fiscal 2009 and 2010 after lawmakers rejected the governor’s proposal to raise income taxes.

The $54 billion budget also included plans to restructure up to $2 billion of GO and sales-tax backed debt for more than $500 million of near-term budgetary savings, although those transactions were put on hold as the state works on structuring issues.

About $3.8 billion of bills were pushed off to fiscal 2010 and more than $500 million was transferred from various non-general fund accounts into the general fund while about $2 billion in spending cuts were made.

Quinn said he would resurrect his planned income tax hike later in 2009, but those tougher decisions over spending and taxes were pushed out with the February primary election looming.

The race pits Quinn against state Comptroller Dan Hynes, who has proposed raising additional revenue by shifting from a flat-rate income tax structure to a progressive tax rate. The general election is in November.

Rating agencies have taken the state to task for the delay, citing it as a factor in negative rating actions because it has exacerbated the government’s growing liquidity problem and poor financial performance.

“We were anticipating some movement towards improving the state’s financial picture by October or November,” said analyst Edward Hampton. “The planned deferral of legislative action to address fiscal 2010 imbalances until at least February or March leaves little time in the fiscal year to take actions to materially reverse the trend of financial weakening.”

California at Baa1 is the only state rated lower by Moody’s.

Fitch analyst Karen Krop wrote: “Now halfway through the fiscal year, the fiscal situation has deteriorated, both due to a decline in economically sensitive revenues as well as the inability of the state to implement important elements of its budget.

The state is facing a growing budget deficit, soaring accounts payables, and a significant structural gap for which solutions have been difficult to identify and implement.”

Fitch’s move to put the state on negative watch reflects the magnitude and persistent nature of the state’s fiscal stress but it gives officials some time to act in the coming legislative session that begins next month. Fitch last downgraded the state by two notches in July.

Standard & Poor’s lowered its rating on the state’s GO by one notch in December “based on what we view as the state’s deteriorating liquidity and financial position,” said analyst Robin Prunty.

The state currently faces an estimated deficit of between $2 billion and $4.3 billion and the backlog of bills owed has risen to $5.1 billion.

“Some bills go back 92 business days,” Hynes spokesman Alan Henry said yesterday.

Quinn last year proposed a $500 million cash-flow issue, but Hynes rejected it as unaffordable. Under state law, the comptroller and state Treasurer Alexi Giannoulias must sign off on short-term borrowings.

Meanwhile, Illinois must repay about $2.25 billion of cash-flow certificates in the coming months that Fitch warned would leave the state with nearly $6 billion of accounts payable at the end of fiscal 2010 on June 30.

The state’s mammoth unfunded pension liability is another negative burden putting pressure on Quinn and lawmakers to take up reforms this year.

The liability rose to an estimated $79 billion at the end of fiscal 2009. The funded ratio was at just 54% at the close of fiscal 2008, down from 63% a year earlier. Additional investment losses of 20% in fiscal 2009 are expected to again drive the funded ratio further down. The state also faces a $24 billion unfunded actuarial accrued liability for its other post-employment benefits.

Illinois’ strengths include its deep and diverse economy, above-average wealth levels, the strength of the Chicago metropolitan-area economy, its sovereign powers to raise taxes and revenue, the absence of constitutional revenue-raising limits, and the ability with legislative approval to dip into non-general fund surpluses

The state has at least two other deals planned over the next two months, including a qualified school construction bond issue.

It received allocations of $244 million in 2009 and 2010 from the federal government, which would be doled out to local schools districts that apply to the state. William Blair & Co. would serve as the lead manager and Scott Balice Strategies is acting as financial adviser.

The state plans to sell $750 million of new-money GO debt by early February with Barclays Capital as the senior manager, issuing taxable bonds and seeking a direct-pay interest rate subsidy under the federal stimulus’ Build America Bond program for the first time.